TripAdvisor 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

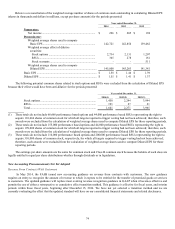

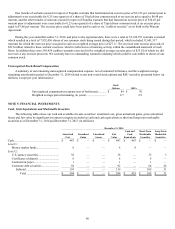

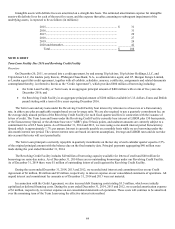

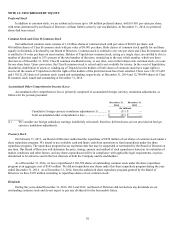

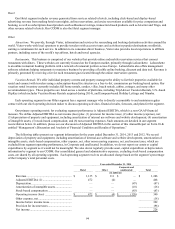

Intangible assets with definite lives are amortized on a straight-line basis. The estimated amortization expense for intangible

assets with definite lives for each of the next five years, and the expense thereafter, assuming no subsequent impairment of the

underlying assets, is expected to be as follows (in millions):

2015 ................................................................................................ $ 31

2016 ................................................................................................ 31

2017 ................................................................................................ 29

2018 ................................................................................................ 27

2019 ................................................................................................ 24

2020 and thereafter ......................................................................... 42

Total .......................................................................................... $ 184

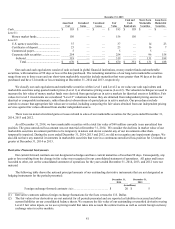

NOTE 8: DEBT

Term Loan Facility Due 2016 and Revolving Credit Facility

Overview

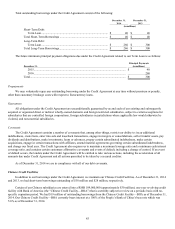

On December 20, 2011, we entered into a credit agreement, by and among TripAdvisor, TripAdvisor Holdings, LLC, and

TripAdvisor LLC, the lenders party thereto, JPMorgan Chase Bank, N.A., as administrative agent, and J.P. Morgan Europe Limited,

as London agent (this credit agreement, together with all exhibits, schedules, annexes, certificates, assignments and related documents

contemplated thereby, is referred to herein as the “Credit Agreement”), which provides $600 million of borrowing including:

x the Term Loan Facility, or Term Loan, in an aggregate principal amount of $400 million with a term of five years due

December 2016; and

x the Revolving Credit Facility in an aggregate principal amount of $200 million available in U.S. dollars, Euros and British

pound sterling with a term of five years expiring December 2016.

The Term Loan and any loans under the Revolving Credit Facility bear interest by reference to a base rate or a Eurocurrency

rate, in either case plus an applicable margin based on our leverage ratio. We are also required to pay a quarterly commitment fee, on

the average daily unused portion of the Revolving Credit Facility for each fiscal quarter and fees in connection with the issuance of

letters of credit. The Term Loan and loans under the Revolving Credit Facility currently bear interest at LIBOR plus 150 basis points,

or the Eurocurrency Spread, or the alternate base rate (“ABR”) plus 50 basis points, and undrawn amounts are currently subject to a

commitment fee of 22.5 basis points. As of December 31, 2014 and 2013, we were using a one-month interest period Eurocurrency

Spread which is approximately 1.7% per annum. Interest is currently payable on a monthly basis while we are borrowing under the

one-month interest rate period. The current interest rates are based on current assumptions, leverage and LIBOR rates and do not take

into account that rates will reset periodically.

The Term Loan principal is currently repayable in quarterly installments on the last day of each calendar quarter equal to 2.5%

of the original principal amount with the balance due on the final maturity date. Principal payments aggregating $40 million were

made during the year ended December 31, 2014.

The Revolving Credit Facility includes $40 million of borrowing capacity available for letters of credit and $40 million for

borrowings on same-day notice. As of December 31, 2014 there are no outstanding borrowings under our Revolving Credit Facility.

As of December 31, 2014 there were $1 million of outstanding letters of credit against the Revolving Credit Facility.

During the years ended December 31, 2014, 2013 and 2012, we recorded total interest and commitment fees on our Credit

Agreement of $6 million, $8 million and $9 million, respectively, to interest expense on our consolidated statements of operations. All

unpaid interest and commitment fee amounts as of December 31, 2014 and 2013 were not material.

In connection with the Credit Agreement, we also incurred debt financing costs totaling $3.5 million, which were initially

capitalized as deferred financing costs. During the years ended December 31, 2014, 2013 and 2012, we recorded amortization expense

of $1 million, respectively, to interest expense on our consolidated statements of operations. These costs will continue to be amortized

over the remaining term of the Term Loan using the effective interest rate method.