TripAdvisor 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

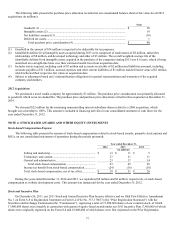

Business Combination Valuations and Recoverability of Goodwill and Indefinite-Lived Intangible Assets

Goodwill

We account for acquired businesses using the purchase method of accounting which requires that the assets acquired and

liabilities assumed be recorded at the date of acquisition at their respective fair values. Any excess of the purchase price over the

estimated fair values of the net assets acquired is recorded as goodwill. We assess goodwill, which is not amortized, for impairment

annually as of October 1, or more frequently, if events and circumstances indicate impairment may have occurred. We test goodwill

for impairment at the reporting unit level (operating segment or one level below an operating segment). Goodwill is allocated to our

reporting units at the date the goodwill is initially recorded. Once goodwill has been allocated to the reporting units, it no longer

retains its identification with a particular acquisition and becomes identified with the reporting unit in its entirety. Accordingly, the

fair value of the reporting unit as a whole is available to support the recoverability of its goodwill.

In the evaluation of goodwill for impairment, we generally first perform a qualitative assessment to determine whether it is more

likely than not (i.e., a likelihood of more than 50%) that the implied fair value of the reporting unit is less than the carrying amount. If

we determine that it is not more likely than not that the implied fair value of the goodwill is less than its carrying amount, no further

testing is necessary. If, however, we determine that it is more likely than not that the implied fair value of the goodwill is less than its

carrying amount, we then perform a quantitative assessment and compare the implied fair value of the reporting unit to the carrying

value. If the carrying value of a reporting unit exceeds its implied fair value, the goodwill of that reporting unit is potentially impaired

and we proceed to step two of the impairment analysis. In step two of the analysis, we will record an impairment loss equal to the

excess of the carrying value of the reporting unit’s goodwill over its implied fair value should such a circumstance arise.

In determining the estimated fair value of assets acquired and liabilities assumed in business combinations and for

determining implied fair values of reporting units in a quantitative goodwill impairment test, we use one of the following recognized

valuation methods: the income approach (including discounted cash flows), the market approach or the cost approach. Our significant

estimates in those fair value measurements include identifying business factors such as size, growth, profitability, risk and return on

investment and assessing comparable revenue and operating income multiples. Further, when measuring fair value based on

discounted cash flows, we make assumptions about risk-adjusted discount rates, future price levels, rates of increase in revenue, cost

of revenue, and operating expenses, weighted average cost of capital, rates of long-term growth, and income tax rates. Valuations are

performed by management or third party valuation specialists under management's supervision, where appropriate. We believe that the

fair values assigned to the assets acquired and liabilities assumed in business combinations and impairment tests are based on

reasonable assumptions that marketplace participants would use. However, such assumptions are inherently uncertain and actual

results could differ from those estimates.

As part of our qualitative assessment for our 2014 goodwill impairment analysis on October 1, the factors that we considered

included, but were not limited to: (a) changes in macroeconomic conditions in the overall economy and the specific markets in which

we operate, (b) our ability to access capital, (c) changes in the online travel industry, (d) changes in the level of competition,

(e) comparison of our current financial performance to historical and budgeted results, and (f) changes in excess market capitalization

over book value based on our current common stock price and latest unaudited consolidated balance sheet. After considering these

factors and the impact that changes in such factors would have on the inputs used in our previous quantitative assessment, we

determined that it was more likely than not that goodwill was not impaired.

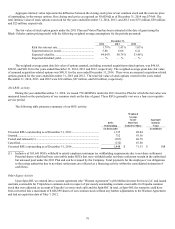

Subsequent to the annual impairment test on October 1, 2014, as discussed in “Note 16—Segment and Geographic

Information," the composition of our operating segments and our reporting units, has been revised. As a result of this revision, we

performed an updated goodwill impairment analysis as of December 31, 2014, for each of our four reporting units which we have

identified: Hotels, Vacation Rentals, Restaurants and Attractions. As part of our qualitative assessment for our Hotel reporting unit,

we considered the same factors used above in our October 1 qualitative assessment. As part of our process for our Vacation Rentals,

Restaurants and Attractions reporting units, we began our qualitative analysis leveraging quantitative valuations for recent acquisitions

in these reporting units, prepared by third party appraisers or management, which were used by management for initial purchase

accounting required under GAAP. We then considered many of the same qualitative factors used in our October 1, 2014 qualitative

assessment and the impact that changes in such factors would have on the inputs previously used in those recent quantitative

valuations. After considering this information, we determined that, regarding all reporting units, it was more likely than not that these

assets were not impaired at December 31, 2014.