TripAdvisor 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

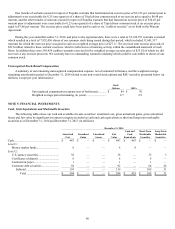

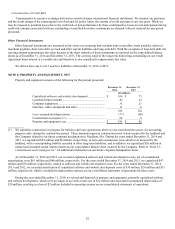

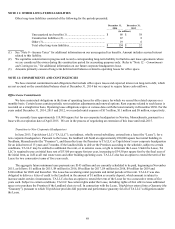

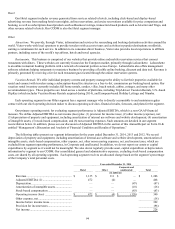

Our deferred tax assets and deferred tax liabilities as of December 31, 2014 and 2013 are as follows:

December 31,

2014 2013

(in millions)

Deferred tax assets:

Stock-based compensation ..............................................................................

$43 $ 30

N

et operating loss carryforwards ..................................................................... 34 18

Provision for accrued expenses .......................................................................

13 7

Deferred rent ....................................................................................................

5 —

Build-to-suit lease ............................................................................................

26 —

Foreign advertising spend ................................................................................

9 —

Other ................................................................................................................ 5 4

Total deferred tax assets ..................................................................................

$135 $ 59

Less: valuation allowance ................................................................................

(19 )

(13)

N

et deferred tax assets .....................................................................................

$116 $ 46

Deferred tax liabilities:

Intangible assets ...............................................................................................

$(88 )

$ (32)

Property and equipment ...................................................................................

(25 )

(18)

Prepaid expenses .............................................................................................

(4 )

(2)

Lease financing obligation ...............................................................................

(26 )

—

Other ................................................................................................................ (1 )

(2)

Total deferred tax liabilities .............................................................................

$(144 )

$ (54)

N

et deferred tax liability ..................................................................................

$(28 )

$ (8)

At December 31, 2014, we had federal, state and foreign net operating loss carryforwards (“NOLs”) of approximately

$42 million, $36 million and $84 million. If not utilized, the federal and state NOLs will expire at various times between 2020 and

2034 and the foreign NOLs will expire at various times between 2015 and 2034.

At December 31, 2014, we had a valuation allowance of $19 million primarily related to foreign net operating loss

carryforwards for which it is more likely than not that the tax benefit will not be realized. This amount represented an overall increase

of $6 million over the amount recorded as of December 31, 2013. The increase is primarily due to additional foreign advertising

spend, offset by expiring foreign net operating losses. Except for certain deferred tax assets, we expect to realize all of our deferred

tax assets based on a strong history of earnings in the US and other jurisdictions, as well as future reversals of taxable temporary

differences.

We have not provided for deferred U.S. income taxes on undistributed earnings of our foreign subsidiaries that we intend to

reinvest permanently outside the United States; the total amount of such earnings as of December 31, 2014 was $630 million. Should

we distribute or be treated under certain U.S. tax rules as having distributed earnings of foreign subsidiaries in the form of dividends

or otherwise, we may be subject to U.S. income taxes. Due to complexities in tax laws and various assumptions that would have to be

made, it is not practicable at this time to estimate the amount of unrecognized deferred U.S. taxes on these earnings.

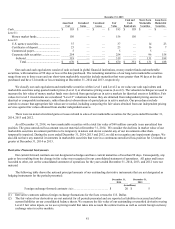

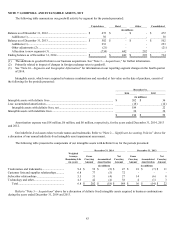

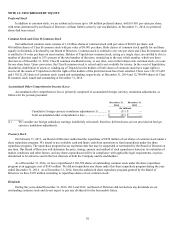

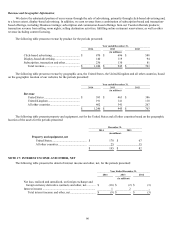

A reconciliation of the provision for income taxes to the amounts computed by applying the statutory federal income tax rate to

income before income taxes is as follows:

Year Ended December 31,

2014 2013 2012

(in millions)

Income tax expense at the federal statutory rate of 35% .. $113 $100 $ 99

Foreign rate differential .................................................... (49) (41 )

(25)

State income taxes, net of effect of federal tax benefit ..... 13 8 5

Unrecognized tax benefits and related interest ................. 14 9 5

N

on-deductible transaction costs ...................................... 1 — —

Change in valuation allowance ......................................... 5 2 2

Other, net .......................................................................... (1) 1 1

Provision for income taxes ............................................... $96 $79 $ 87