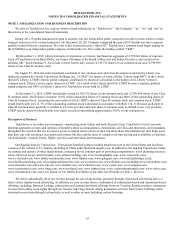

TripAdvisor 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk Management

We are exposed to certain market risks, including changes in interest rates and foreign currency exchange rates that could

adversely affect our results of operations or financial condition. We manage our exposure to these risks through established policies

and procedures and by assessing the anticipated near-term and long-term fluctuations in interest rates and foreign currency exchange

rates. Our objective is to mitigate potential income statement, cash flow and market exposures from changes in interest and foreign

exchange rates.

Interest Rates

Our current exposure to changes in interest rates relate primarily to our investment portfolio and the outstanding principal on our

Term Loan. Our interest income and expense is most sensitive to fluctuations in U.S. interest rates and Libor. Changes in interest rates

affect the interest earned on our cash, cash equivalents and marketable securities and the fair value of those securities, as well as the

amount of interest we pay on our outstanding debt.

We currently invest our excess cash in cash deposits at major global banks, money market mutual funds and marketable

securities. Our investment policy and strategy are focused on preservation of capital and supporting our liquidity requirements. We

invest in highly-rated securities, and our investment policy limits the amount of credit exposure to any one issuer. The policy requires

investments to be investment grade, with the primary objective of minimizing the potential risk of principal loss.

In order to provide a meaningful assessment of the interest rate risk associated with our investment portfolio, we performed a

sensitivity analysis to determine the impact a change in interest rates would have on the value of our current investment portfolio

assuming a 100 basis point parallel shift in the yield curve. Based on our investment positions as of December 31, 2014, a hypothetical

100 basis point increase in interest rates across all maturities would result in an approximate $1 million incremental decline in the fair

market value of the portfolio. Such losses would only be realized if we sold the investments prior to maturity.

As of December 31, 2014, we had $300 million of debt under our Term Loan, which has a variable rate. The variable interest

rate on the Term Loan is based on current assumptions, leverage and LIBOR rates. Based on our current loan balance through

December 31, 2014, a 25 basis point change in our interest rate on the Term Loan would result in an increase or decrease to interest

expense of approximately $1 million per annum. We currently do not hedge our interest rate risk; however, we are continually

evaluating the interest rate market, and if we become increasingly exposed to potentially volatile movements in interest rates, and if

these movements are material, this could cause us to adjust our financing strategy.

We did not experience any significant impact from changes in interest rates for the years ended December 31, 2014, 2013 or

2012.

Foreign Currency Exchange Rates

We conduct business in certain international markets, primarily the European Union, the United Kingdom, Singapore, Australia

and China. Because we operate in international markets, we have exposure to different economic climates, political arenas, tax

systems and regulations that could affect foreign exchange rates.

Some of our foreign subsidiaries maintain their accounting records in their respective local currencies other than the U.S. dollar

(primarily in British pound sterling). Consequently, changes in currency exchange rates may impact the translation of foreign financial

statements into U.S. dollars. As a result, we face exposure to adverse movements in currency exchange rates as the financial results of

our international operations are translated from local currency, or functional currency, into U.S. dollars upon consolidation. If the U.S.

dollar weakens against the local currency, the translation of these foreign-currency-denominated balances will result in increased net

assets, revenue, operating expenses, operating income and net income. Similarly, our net assets, revenue, operating expenses,

operating income and net income will decrease if the U.S. dollar strengthens against local currency. The effect of foreign exchange on

our business historically has varied from quarter to quarter and may continue to do so, potentially materially. A hypothetical 10%

decrease of the foreign exchange rates relative to the U.S. Dollar, or strengthening of the U.S. Dollar, would generate an unrealized

loss of approximately $21 million related to an decrease in our net assets held in functional currencies other than the U.S. Dollar as of

December 31, 2014, which would be recorded to accumulated other comprehensive loss on our consolidated balance sheet.

In addition, foreign exchange rate fluctuations on transactions denominated in currencies other than the functional currency

result in gains and losses. We recognize these transactional gains and losses (primarily Euro currency transactions) in our consolidated