TripAdvisor 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

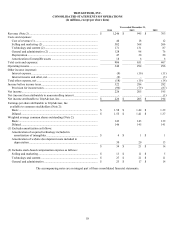

68

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are generally due within 30 days and are recorded net of an allowance for doubtful accounts. We record

accounts receivable at the invoiced amount. Collateral is not required for accounts receivable. We consider accounts outstanding

longer than the contractual payment terms as past due. We determine our allowance by considering a number of factors, including the

length of time trade accounts receivable are past due, previous loss history, a specific customer’s ability to pay its obligations to us,

and the condition of the general economy and industry as a whole.

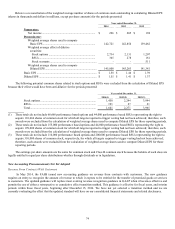

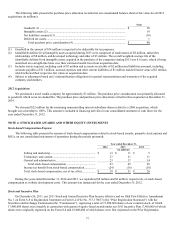

The following table presents the changes in the allowance for doubtful accounts for the periods presented:

December 31,

2014 2013 2012

(in millions)

Allowance for doubtful accounts:

Balance, beginning of period ...................................... $ 3 $3 $ 5

Charges (recoveries) to earnings ................................. 3 1 (1)

Write-offs, net of recoveries and other adjustments .... 1 (1 )

(1)

Balance, end of period ................................................. $ 7 $3 $ 3

Property and Equipment, Including Website and Software Development Costs

We record property and equipment at cost, net of accumulated depreciation. We capitalize certain costs incurred during the

application development stage related to the development of websites and internal use software when it is probable the project will be

completed and the software will be used as intended. Capitalized costs include internal and external costs, if direct and incremental,

and deemed by management to be significant. We expense costs related to the planning and post-implementation phases of software

and website development as these costs are incurred. Maintenance and enhancement costs (including those costs in the post-

implementation stages) are typically expensed as incurred, unless such costs relate to substantial upgrades and enhancements to the

website or software resulting in added functionality, in which case the costs are capitalized.

We compute depreciation using the straight-line method over the estimated useful lives of the assets, which is three to five years

for computer equipment, capitalized software and website development, office furniture and other equipment. We depreciate leasehold

improvements using the straight-line method, over the shorter of the estimated useful life of the improvement or the remaining term of

the lease.

Leases

We lease office space in several countries around the world under non-cancelable lease agreements. We generally lease our

office facilities under operating lease agreements. Office facilities subject to an operating lease and the related lease payments are not

recorded on our balance sheet. The terms of certain lease agreements provide for rental payments on a graduated basis, however, we

recognize rent expense on a straight-line basis over the lease period in accordance with GAAP. Any lease incentives are recognized as

reductions of rental expense on a straight-line basis over the term of the lease. The lease term begins on the date we become legally

obligated for the rent payments or when we take possession of the office space, whichever is earlier.

We establish assets and liabilities for the estimated construction costs incurred under lease arrangements where we are

considered the owner for accounting purposes only, or build-to-suit leases, to the extent we are involved in the construction of

structural improvements or take construction risk prior to commencement of a lease. Upon occupancy of facilities under build-to-suit

leases, we assess whether these arrangements qualify for sales recognition under the sale-leaseback accounting guidance under GAAP.

If we continue to be the deemed owner, for accounting purposes, the facilities are accounted for as financing obligations.

We establish assets and liabilities for the present value of estimated future costs to return certain of our leased facilities to their

original condition for asset retirement obligations. Such assets are depreciated over the lease period into operating expense, and the

recorded liabilities are accreted to the future value of the estimated restoration costs.