TripAdvisor 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Statement) and 100,000 shares were issuable under our Deferred Compensation Plan for Non-Employee Directors (refer to “Note

13— Employee Benefit Plans” below for information on our Deferred Compensation Plan for Non-Employee Directors).

At our annual meeting of stockholders held on June 28, 2013 (the “Annual Meeting”), our stockholders approved an amendment

to our 2011 Stock and Annual Incentive Plan to, among other things, increase the aggregate number of shares of common stock

authorized for issuance thereunder by 15,000,000 shares. We refer to our 2011 Stock and Annual Incentive Plan, as amended by the

amendment as the “2011 Incentive Plan.” A summary of the material terms of the 2011 Incentive Plan can be found in “Proposal 3:

Approval of the 2011 Stock and Annual Incentive Plan, as amended” in our Proxy Statement for the Annual Meeting.

On September 12, 2014, we filed a Registration Statement on Form S-8 with respect to up to 100,595 shares of our common

stock for issuance under the Viator, Inc. 2010 Stock Incentive Plan, as amended (the “Viator Plan”). Pursuant to the Amended and

Restated Agreement and Plan of Merger among TripAdvisor LLC; Vineyard Acquisition Corporation and Viator, Inc., dated as of

July 24, 2014 (the “Merger Agreement”), Vineyard Acquisition Corporation merged with and into Viator, Inc. with Viator, Inc.

surviving as a wholly-owned subsidiary of the Company. In accordance with the Merger Agreement, we assumed certain outstanding

options to purchase shares of common stock of Viator granted under the Viator Plan (the “Assumed Options”). As a result of this

assumption, the Assumed Options were converted into options to purchase shares of our common stock. We do not intend to grant

new equity or equity-based awards under the Viator Plan.

Pursuant to the 2011 Annual Incentive Plan, we may, among other things, grant RSUs, restricted stock, stock options and other

stock-based awards to our directors, officers, employees and consultants. The summary of the material terms of the 2011 Incentive

Plan is qualified in its entirety by the full text of the 2011 Incentive Plan previously filed.

As of December 31, 2014, the total number of shares available for issuance under the 2011 Incentive Plan is 17,691,977 shares.

All shares of common stock issued in respect of the exercise of options or other equity awards since Spin-Off have been issued from

authorized, but unissued common stock.

Stock Based Award Activity and Valuation

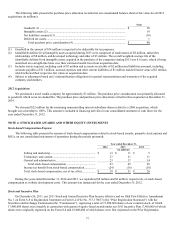

2014 Stock Option Activity

During the year ended December 31, 2014, we have issued 679,568 of primarily service based non-qualified stock options

primarily from the 2011 Incentive Plan. These stock options generally have a term of ten years from the date of grant and generally

vest equitably over a four-year requisite service period.

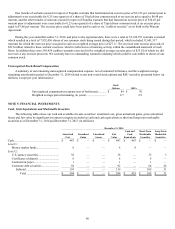

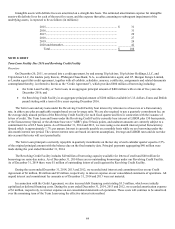

A summary of our stock option activity is presented below:

Weighted Weighted

Average Average

Exercise Remaining Aggregate

Options Price Per Contractual Intrinsic

Outstanding Share Life Value

(in thousands) (in years) (in millions)

Options outstanding at December 31, 2013 ........................... 9,470 40.18

Assumed options from acquisition ........................................ 101 16.36

Granted .................................................................................. 579 95.87

Exercised (1) ......................................................................... (1,202) 32.87

Cancelled or expired .............................................................. (297) 45.40

Options outstanding at December 31, 2014 ........................... 8,651 $ 44.47 5.0 $ 273

Exercisable as of December 31, 2014 ................................... 4,080 $ 32.05 2.7 $ 174

Vested and ex

p

ected to vest after December 31

,

2014.......... 8

,

445 $44.11 4.9 $ 269

(1) Inclusive of 628,010 options, which were not converted into shares due to net share settlement in order to cover the aggregate

exercise price and the minimum amount of required employee withholding taxes. Potential shares which had been convertible

under stock options that were withheld under net share settlement remain in the authorized but unissued pool under the 2011

Incentive Plan and can be reissued by the Company. We began net-share settling the majority of our stock option exercises

during the third quarter of 2013. Total payments for the employees’ tax obligations to the taxing authorities due to net share

settlements are reflected as a financing activity within the consolidated statements of cash flows.