TripAdvisor 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

NOTE 14: STOCKHOLDERS’ EQUITY

Preferred Stock

In addition to common stock, we are authorized to issue up to 100 million preferred shares, with $ 0.001 par value per share,

with terms determined by our Board of Directors, without further action by our stockholders. At December 31, 2014, no preferred

shares had been issued.

Common Stock and Class B Common Stock

Our authorized common stock consists of 1.6 billion shares of common stock with par value of $0.001 per share, and

400 million shares of Class B common stock with par value of $0.001 per share. Both classes of common stock qualify for and share

equally in dividends, if declared by our Board of Directors. Common stock is entitled to one vote per share and Class B common stock

is entitled to 10 votes per share on most matters. Holders of TripAdvisor common stock, acting as a single class, are entitled to elect a

number of directors equal to 25% percent of the total number of directors, rounded up to the next whole number, which was three

directors as of December 31, 2014. Class B common stockholders may, at any time, convert their shares into common stock, on a one

for one share basis. Upon conversion, the Class B common stock is retired and is not available for reissue. In the event of liquidation,

dissolution, distribution of assets or winding-up of TripAdvisor the holders of both classes of common stock have equal rights to

receive all the assets of TripAdvisor after the rights of the holders of the preferred stock have been satisfied. There were 132,315,465

and 130,121,292 shares of common stock issued and outstanding, respectively, at December 31, 2014 and 12,799,999 shares of Class

B common stock issued and outstanding at December 31, 2014.

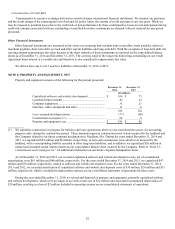

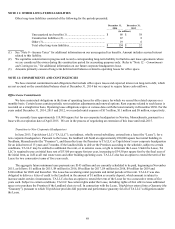

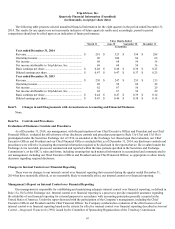

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive loss is primarily comprised of accumulated foreign currency translation adjustments, as

follows for the periods presented:

December 31,

2014

December 31,

2013

(In millions)

Cumulative foreign currency translation adjustments (1) ........... $ (31 ) $ —

Total accumulated other comprehensive loss ............................. $ (31 ) $ —

(1) We consider our foreign subsidiary earnings indefinitely reinvested; therefore; deferred taxes are not provided on foreign

currency translation adjustments.

Treasury Stock

On February 15, 2013, our Board of Directors authorized the repurchase of $250 million of our shares of common stock under a

share repurchase program. We intend to use available cash and future cash from operations to fund repurchases under the share

repurchase program. The repurchase program has no expiration date but may be suspended or terminated by the Board of Directors at

any time. Our Board of Directors will determine the price, timing, amount and method of such repurchases based on its evaluation of

market conditions and other factors, and any shares repurchased will be in compliance with applicable legal requirements, at prices

determined to be attractive and in the best interests of both the Company and its stockholders.

As of December 31, 2014, we have repurchased 2,120,709 shares of outstanding common stock under the share repurchase

program at an aggregate cost of $145 million. We did not repurchase any shares under this share repurchase program during the year

ended December 31, 2014. As of December 31, 2014, from the authorized share repurchase program granted by the Board of

Directors we have $105 million remaining to repurchase shares of our common stock.

Dividends

During the years ended December 31, 2014, 2013 and 2012, our Board of Directors did not declare any dividends on our

outstanding common stock and do not expect to pay any dividends for the foreseeable future.