TripAdvisor 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

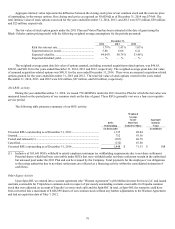

Our stock options generally have a term of ten years from the date of grant and generally vest equitably over a four-year

requisite service period. We amortize the grant-date fair value of our stock option grants, net of estimated forfeitures, as stock-based

compensation expense over the vesting term on a straight-line basis, with the amount of compensation expense recognized at any date

at least equaling the portion of the grant-date fair value of the award that is vested at that date.

As the Company now has three years of post-Spin-Off equity award activity, beginning in February 2015, we will change our

method of estimating our expected term from the simplified method and use historical exercise behavior and expected post-vest

termination data. Simultaneously, we will also begin estimating our expected volatility by equally weighting the historical volatility

and implied volatility on our own stock. Historical volatility will be determined using actual daily price observations of our stock

price over a period equivalent to or approximate to the expected term of our stock option grants to date. Implied volatility represents

the volatility of our actively traded options on our stock, with remaining maturities in excess of twelve months and market prices

approximate to the exercise prices of the stock option grant. These changes are not expected to materially affect our future

consolidated financial statements.

Restricted Stock Units. RSUs are stock awards that are granted to employees entitling the holder to shares of our common stock

as the award vests. RSUs are measured at fair value based on the number of shares granted and the quoted price of our common stock

at the date of grant. We amortize the fair value of RSUs, net of estimated forfeitures, as stock-based compensation expense over the

vesting term of generally four years on a straight-line basis, with the amount of compensation expense recognized at any date at least

equaling the portion of the grant-date fair value of the award that is vested at that date.

Performance-based stock options and RSUs vest upon achievement of certain company-based performance conditions and a

requisite service period. On the date of grant, the fair value of performance-based award is determined based on the fair value, which

is calculated using the same method as our service based stock options and RSUs described above. We then assess whether it is

probable that the individual performance targets would be achieved. If assessed as probable, compensation expense will be recorded

for these awards over the estimated performance period. At each reporting period, we will reassess the probability of achieving the

performance targets and the performance period required to meet those targets. The estimation of whether the performance targets will

be achieved and of the performance period required to achieve the targets requires judgment, and to the extent actual results or

updated estimates differ from our current estimates, the cumulative effect on current and prior periods of those changes will be

recorded in the period estimates are revised, or the change in estimate will be applied prospectively depending on whether the change

affects the estimate of total compensation cost to be recognized or merely affects the period over which compensation cost is to be

recognized. The ultimate number of shares issued and the related compensation expense recognized will be based on a comparison of

the final performance metrics to the specified targets.

Estimates of fair value are not intended to predict actual future events or the value ultimately realized by employees who receive

these awards, and subsequent events are not indicative of the reasonableness of our original estimates of fair value. We use historical

data to estimate pre-vesting stock option and RSU forfeitures and record share-based compensation expense only for those awards that

are expected to vest. Changes in estimated forfeitures are recognized through a cumulative catch-up adjustment in the period of

change which also impacts the amount of stock compensation expense to be recognized in future periods.

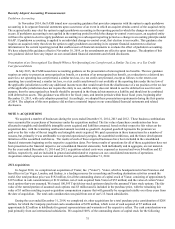

Deferred Merchant Payables

We receive cash from travelers at the time of booking related to our vacation rental, attractions and transaction-based businesses

and we record these amounts, net of commissions, on our consolidated balance sheets as deferred merchant payables. We pay the

hotel, destination activity operators or vacation rental owners after the travelers’ use and subsequent billing from the hotel, attraction

provider or vacation rental owners. Therefore, we receive cash from the traveler prior to paying the hotel, destination activity operator

or vacation rental owners, and this operating cycle represents a working capital source or use of cash to us. As long as these businesses

grow, we expect that changes in working capital related to these transactions, depending on timing of payments and seasonality, will

continue to impact operating cash flows. Our deferred merchant payables balance was $93 million and $30 million for the years ended

December 31, 2014 and 2013, respectively. A payable balance of $76 million was acquired during the year ended December 31, 2014,

primarily related to our Viator acquisition (see “Note 3— Acquisitions”) and therefore is included within investing activities in our

consolidated statement of cash flows.

Credit Risk and Concentrations

Financial instruments, which potentially subject us to concentration of credit risk, consist primarily of cash and cash equivalents,

corporate debt securities, foreign exchange contracts, accounts receivable and customer concentrations. We maintain some cash and

cash equivalents balances with financial institutions that are in excess of Federal Deposit Insurance Corporation insurance limits. Our

cash and cash equivalents are primarily composed of prime institutional money market funds as well as bank account balances

primarily denominated in U.S. dollars, Euros, British pound sterling, Chinese renminbi, Australian dollars and Singapore dollars. We