TripAdvisor 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

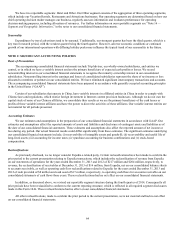

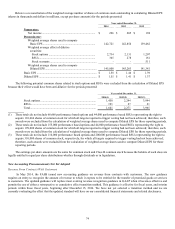

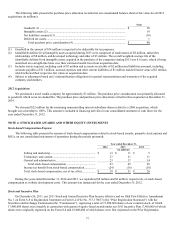

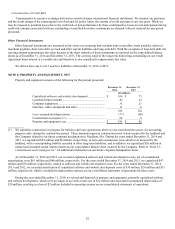

Below is a reconciliation of the weighted average number of shares of common stock outstanding in calculating Diluted EPS

(shares in thousands and dollars in millions, except per share amounts) for the periods presented:

Year ended December 31,

2014 2013 2012

Numerator:

Net income ........................................................................ $ 226 $ 205 $ 194

Denominator:

Weighted average shares used to compute

Basic EPS ....................................................................... 142,721 142,854 139,462

Weighted average effect of dilutive

securities:

Stock options ............................................................... 2,734 2,131 1,207

RSUs ............................................................................ 345 278 161

Stock warrants ............................................................... - - 511

Weighted average shares used to compute

Diluted EPS ...................................................................... 145,800 145,263 141,341

Basic EPS ................................................................................. $ 1.58 $ 1.44 $ 1.39

Diluted EPS .............................................................................. $ 1.55 $ 1.41 $ 1.37

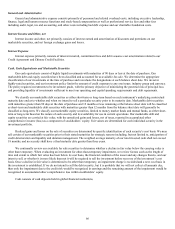

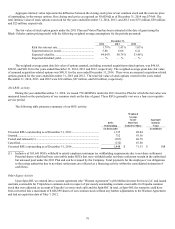

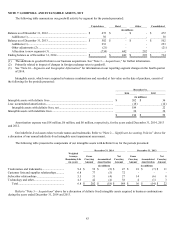

The following potential common shares related to stock options and RSUs were excluded from the calculation of Diluted EPS

because their effect would have been anti-dilutive for the periods presented:

Year ended December 31,

2014(1) 2013(2) 2012(3)

Stock options ........................................................................... 1,450 2,244 3,944

RSUs ........................................................................................ 191 27 21

Total ......................................................................................... 1,641 2,271 3,965

(1) These totals do not include 66,666 performance based options and 44,000 performance based RSUs representing the right to

acquire 110,666 shares of common stock for which all targets required to trigger vesting had not been achieved; therefore, such

awards were excluded from the calculation of weighted average shares used to compute Diluted EPS for those reporting periods.

(2) These totals do not include 155,000 performance based options and 44,000 performance based RSUs representing the right to

acquire 199,000 shares of common stock for which all targets required to trigger vesting had not been achieved; therefore, such

awards were excluded from the calculation of weighted average shares used to compute Diluted EPS for those reporting periods.

(3) These totals do not include 110,000 performance based options and 200,000 performance based RSUs representing the right to

acquire 310,000 shares of common stock, respectively, for which all targets required to trigger vesting had not been achieved;

therefore, such awards were excluded from the calculation of weighted average shares used to compute Diluted EPS for those

reporting periods.

The earnings per share amounts are the same for common stock and Class B common stock because the holders of each class are

legally entitled to equal per share distributions whether through dividends or in liquidation.

New Accounting Pronouncements Not Yet Adopted

Revenue From Contracts With Customers

In May 2014, the FASB issued new accounting guidance on revenue from contracts with customers. The new guidance

requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services

to customers. The updated guidance will replace most existing revenue recognition guidance in GAAP when it becomes effective and

permits the use of either a retrospective or cumulative effect transition method. This guidance is effective for fiscal years, and interim

periods within those fiscal years, beginning after December 15, 2016. We have not yet selected a transition method and we are

currently evaluating the effect that the updated standard will have on our consolidated financial statements and related disclosures.