TripAdvisor 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

2013 vs. 2012

Interest expense decreased $1 million during the year ended December 31, 2013 when compared to the same periods in 2012,

primarily due to a combination of a lower principal amount and a lower effective interest rate on our Term Loan related to our Credit

Agreement. Refer to “Note 8— Debt” for additional information on our outstanding borrowing facilities.

Interest Income and Other, Net

Interest income and other, net primarily consists of interest earned and amortization of discounts and premiums on our

marketable securities, and net foreign exchange gains and losses.

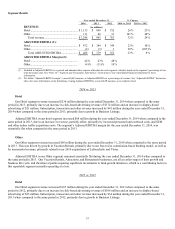

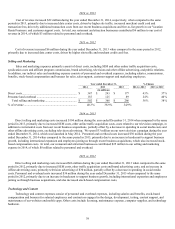

Year ended December 31,

2014 2013 2012

(in millions)

Interest income and other, net ................................................. $ (9) $ - $ (3)

2014 vs. 2013

Interest income and other, net decreased $9 million during the year ended December 31, 2014, respectively, when compared to

the same periods in 2013, primarily due to the fluctuation of foreign exchange rates. Our interest income is primarily due to investing

in marketable securities. Refer to “Note 5— Financial Instruments” for additional information on our portfolio investment as of

December 31, 2014.

2013 vs. 2012

Interest income and other, net increased $3 million during the year ended December 31, 2013, respectively, when compared to

the same periods in 2012, primarily due to the fluctuation of foreign exchange rates. Our interest income is primarily due to investing

in marketable securities. Refer to “Note 5— Financial Instruments” for additional information on our portfolio investment as of

December 31, 2013.

Provision for Income Taxes

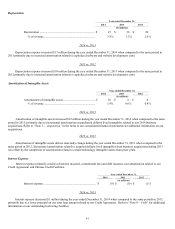

Year ended December 31,

2014 2013 2012

(in millions)

Provision for income taxes ..................................................... $96 $79 $ 87

Effective tax rate ............................................................... 29.8% 27.8 % 30.9%

2014 vs. 2013

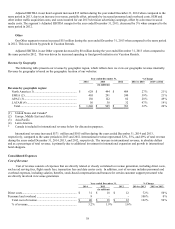

Our effective tax rate increased 2% during the year ended December 31, 2014 over the same period in 2013. The change in the

effective tax rate for 2014 compared to the 2013 rate was primarily due to a change in jurisdictional earnings and certain discrete

items.

Our effective tax rate is less than the federal statutory rate primarily due to earnings in jurisdictions outside the United States,

where our effective tax rate is lower. This is partly driven by a decrease in the statutory tax rate in the United Kingdom from 23% to

21% in 2014, and our tax incentive on qualifying income in Singapore granted by the Singapore Economic Development Board in

2011. Our effective tax rate is partially offset by state income taxes, non-deductible stock compensation and accruals on uncertain tax

positions.

The United Kingdom statutory tax rate is set to decrease from 21% to 20% effective April 1, 2015, which will reduce our

effective tax rate.