TripAdvisor 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

We have concluded we are the deemed owner (for accounting purposes only) of the Premises during the construction period

under build to suit lease accounting. Building construction began in the fourth quarter of 2013. Since construction began, we have

recorded estimated project construction costs incurred by the landlord as a construction in progress asset and a corresponding long

term liability in “Property and equipment, net” and “Other long-term liabilities,” respectively, on our consolidated balance sheets. We

will continue to increase the asset and corresponding long term liability as additional building costs are incurred by the landlord during

the construction period. In addition, the amounts that the Company has paid or incurred for normal tenant improvements and

structural improvements have also been recorded to the construction-in-progress asset.

Once the landlord completes the construction of the Premises (estimated to be mid 2015), we will evaluate the Lease in order to

determine whether or not the Lease meets the criteria for “sale-leaseback” treatment under GAAP. If the Lease meets the “sale-

leaseback” criteria, we will remove the asset and the related liability from our consolidated balance sheet and treat the Lease as either

an operating or capital lease based on the our assessment of the accounting guidance. However, we currently expect that upon

completion of construction of the Premises that the Lease will not meet the "sale-leaseback" criteria.

If the Lease does not meet “sale-leaseback” criteria, we will treat the Lease as a financing obligation and lease payments will be

attributed to (1) a reduction of the principal financing obligation; (2) imputed interest expense; and (3) land lease expense (which is

considered an operating lease) representing an imputed cost to lease the underlying land of the facility. In addition, the underlying

building asset will be depreciated over the initial term of the lease. And at the conclusion of the lease term, we would de-recognize

both the net book values of the asset and financing obligation. Although we will not begin making lease payments pursuant to the

Lease until November 2015, the portion of the lease obligations allocated to the land is treated for accounting purposes as an operating

lease that commenced in 2013.

Additional United States and International Locations

We also lease an aggregate of approximately 470,000 square feet at approximately 40 other locations across North America,

Europe and Asia Pacific, in cities such as, New York, Boston, London, and Beijing, primarily for our sales offices, subsidiary

headquarters, and international management teams, pursuant to leases with expiration dates through November 2024.

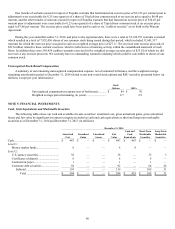

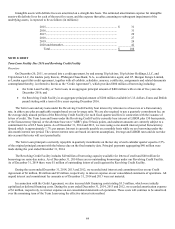

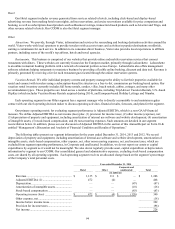

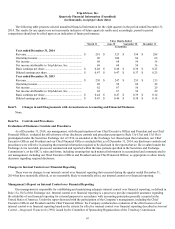

The following table summarizes our material commitments and obligations as of December 31, 2014 and excludes amounts

already recorded on the consolidated balance sheet:

By Period

Total

Less than

1 year 1 to 3 years 3 to 5 years

More than

5 years

(in millions)

Operating leases (1) ....................................................................... $114 $ 19 $ 27 $ 26 $42

Build to suit lease obligation (2) .................................................... 143 1 18 18 106

Expected interest payments on Term Loan (3) .............................. 9 5 4 — —

Total (4)(5)(6)(7) ............................................................................ $266 $ 25 $ 49 $ 44 $148

(1) Estimated future minimum rental payments under operating leases with non-cancelable lease terms.

(2) Estimated future minimum rental payments for our future corporate headquarters in Needham, MA.

(3) The amounts included as expected interest payments on the Term Loan in this table are based on the current effective interest

rate and payment terms as of December 31, 2014, but, could change significantly in the future. Amounts assume that our

existing debt is repaid at maturity and do not assume additional borrowings or refinancings of existing debt. Refer to “Note 8—

Debt” for additional information, including principal payments expected to be paid over the next two years, on our Term Loan.

(4) Excluded from the table was $68 million of unrecognized tax benefits, including accrued interest, that we have recorded in other

long-term liabilities for which we cannot make a reasonably reliable estimate of the amount and period of payment. We estimate

that approximately $1 million will be paid within the next twelve months.

(5) Excluded from the table is our obligation to fund a charitable foundation. The Board of Directors of the charitable foundation is

currently comprised of Stephen Kaufer- President and Chief Executive Officer, Julie M.B. Bradley-Chief Financial Officer and

Seth J. Kalvert- Senior Vice President, General Counsel and Secretary. Our obligation was calculated at 2.0% of OIBA in 2014.

For a discussion regarding OIBA see “Note 16— Segment and Geographic Information” in the notes to the consolidated

financial statements. This future commitment has been excluded from the table above.

(6) Excludes spending on anticipated leasehold improvements on our Needham, Massachusetts lease, including design,

development, construction costs, and the purchase and installation of equipment, net of related landlord incentives, which we

estimate will be in the range of $25-$30 million primarily incurred during the first six months of 2015.

(7) Excludes current liabilities already recorded on the consolidated balance sheet at December 31, 2014, as these liabilities are

expected to be paid within one year.