TripAdvisor 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

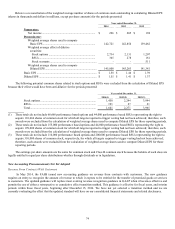

We have two reportable segments: Hotel and Other. Our Other segment consists of the aggregation of three operating segments,

which include our Vacation Rentals, Restaurants and Attractions businesses. Our operating segments are determined based on how our

chief operating decision maker manages our business, regularly assesses information and evaluates performance for operating

decision-making purposes, including allocation of resources. For further information on our reportable segments see “Note 16 —

Segment and Geographic Information,” in the notes to our consolidated financial statements.

Seasonality

Expenditures by travel advertisers tend to be seasonal. Traditionally, our strongest quarter has been the third quarter, which is a

key travel research period, with the weakest quarter being the fourth quarter. However, adverse economic conditions or continued

growth of our international operations with differing holiday peaks may influence the typical trend of our seasonality in the future.

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

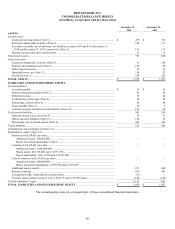

The accompanying consolidated financial statements include TripAdvisor, our wholly-owned subsidiaries, and entities we

control, or in which we have a variable interest and are the primary beneficiary of expected cash profits or losses. We record

noncontrolling interest in our consolidated financial statements to recognize the minority ownership interest in our consolidated

subsidiaries. Noncontrolling interest in the earnings and losses of consolidated subsidiaries represent the share of net income or loss

allocated to members or partners in our consolidated entities. We have eliminated significant intercompany transactions and accounts.

The accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles

in the United States (“GAAP”).

Certain of our subsidiaries that operate in China, have variable interests in affiliated entities in China in order to comply with

Chinese laws and regulations, which restrict foreign investment in Internet content provision businesses. Although we do not own the

capital stock of some of our Chinese affiliates, we consolidate their results as we are the primary beneficiary of the cash losses or

profits of these variable interest affiliates and have the power to direct the activities of these affiliates. Our variable interest entities are

not material for all periods presented.

Accounting Estimates

We use estimates and assumptions in the preparation of our consolidated financial statements in accordance with GAAP. Our

estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of

the date of our consolidated financial statements. These estimates and assumptions also affect the reported amount of net income or

loss during any period. Our actual financial results could differ significantly from these estimates. The significant estimates underlying

our consolidated financial statements include; (i) recoverability of intangible assets and goodwill; (ii) recoverability and useful life of

long-lived assets; (iii) accounting for income taxes; (iv) purchase accounting for business combinations and (v) stock-based

compensation.

Reclassifications

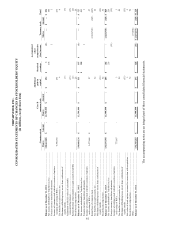

As previously disclosed, we no longer consider Expedia a related party. Certain reclassifications have been made to conform the

prior period to the current presentation relating to Expedia transactions, which includes the reclassification of revenue from Expedia

on our statements of operations for the years ended December 31, 2013 and 2012 of $217 million and $204 million, respectively, to

revenue, the reclassification of receivables at December 31, 2013 of $16 million, from Expedia, net on our consolidated balance sheets

to accounts receivable, as well as operating cash flow reclassifications related to Expedia for the years ended December 31, 2013 and

2012 of cash provided of $8 million and cash used of $17 million, respectively, to operating cash flows for accounts receivable on our

consolidated statements of cash flows those years. These reclassifications had no net effect on our consolidated financial statements.

In addition, as discussed above, we revised our reportable segment structure during the fourth quarter of 2014. Consequently all

prior periods have been reclassified to conform to the current reporting structure, which is reflected in all required segment disclosures

made in this Form 10-K. These reclassifications had no effect on our consolidated financial statements.

All other reclassifications, made to conform the prior period to the current presentation, were not material and had no net effect

on our consolidated financial statements.