TripAdvisor 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

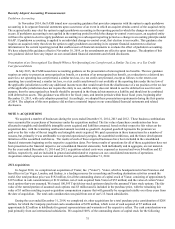

Fair Value Measurements

We apply fair value accounting for all financial assets and liabilities and non-financial assets and liabilities that are recognized

or disclosed at fair value in the financial statements on a recurring basis. We measure assets and liabilities at fair value based on the

expected exit price, which is the amount that would be received on the sale of an asset or amount paid to transfer a liability, as the case

may be, in an orderly transaction between market participants in the principal or most advantageous market in which we would

transact. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability at the

measurement date. The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value

on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level. The

following are the hierarchical levels of inputs to measure fair value:

Level 1—Valuations are based on quoted prices for identical assets and liabilities in active markets.

Level 2—Valuations are based on observable inputs other than quoted prices included in Level 1, such as quoted prices

for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are

not active, or other inputs that are observable or can be corroborated by observable market data.

Level 3—Valuations are based on unobservable inputs reflecting our own assumptions, consistent with reasonably

available assumptions made by other market participants. These valuations require significant judgment.

Derivative Financial Instruments

Our goal in managing our foreign exchange risk is to reduce, to the extent practicable, our potential exposure to the changes that

exchange rates might have on our earnings, cash flows and financial position. We do not use derivatives for trading or speculative

purposes. We account for our derivative instruments as either assets or liabilities and carry them at fair value.

For derivative instruments that hedge the exposure to variability in expected future cash flows that are designated as cash flow

hedges, the effective portion of the gain or loss on the derivative instrument is reported as a component of accumulated other

comprehensive income (loss) in stockholders’ equity and reclassified into income in the same period or periods during which the

hedged transaction affects earnings. The ineffective portion of the gain or loss on the derivative instrument, if any, is recognized in

current income. To receive hedge accounting treatment, cash flow hedges must be highly effective in offsetting changes to expected

future cash flows on hedged transactions. For options designated as cash flow hedges, changes in the time value are excluded from the

assessment of hedge effectiveness and are recognized in income. For derivative instruments that hedge the exposure to changes in the

fair value of an asset or a liability and that are designated as fair value hedges, both the net gain or loss on the derivative instrument as

well as the offsetting gain or loss on the hedged item attributable to the hedged risk are recognized in earnings in the current period.

The net gain or loss on the effective portion of a derivative instrument that is designated as an economic hedge of the foreign currency

translation exposure of the net investment in a foreign operation is reported in the same manner as a foreign currency translation

adjustment. For forward exchange contracts designated as net investment hedges, we exclude changes in fair value relating to changes

in the forward carrying component from its definition of effectiveness. Accordingly, any gains or losses related to this component are

recognized in current income. We have not entered into any cash flow, fair value or net investment hedges to date as of December 31,

2014.

Derivatives that do not qualify for hedge accounting must be adjusted to fair value through current income. In certain

circumstances, we enter into foreign currency forward exchange contracts (“forward contracts”) to reduce the effects of fluctuating

foreign currency exchange rates on our cash flows denominated in foreign currencies. Our derivative instruments or forward contracts

entered into are not designated as hedges as of December 31, 2014 are disclosed below in “Note 5— Financial Instruments” in the

notes to the consolidated financial statements. Monetary assets and liabilities denominated in a currency other than the functional

currency of a given subsidiary are remeasured at spot rates in effect on the balance sheet date with the effects of changes in spot rates

reported in other, net on our consolidated statements of operations. Accordingly, fair value changes in the forward contracts help

mitigate the changes in the value of the remeasured assets and liabilities attributable to changes in foreign currency exchange rates,

except to the extent of the spot-forward differences. These differences are not expected to be significant due to the short-term nature of

the contracts, which to date, have generally had maturities at inception of 90 days or less. The net cash received or paid related to our

derivative instruments are classified as an operating activity in our consolidated statements of cash flow, which is based on the

objective of the derivative instruments. These net cash flows have not been material in any reporting period to date.