TripAdvisor 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

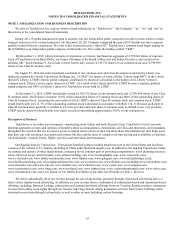

Indefinite-Lived Intangible Assets

Intangible assets that have indefinite lives are not amortized and are tested for impairment annually on October 1, or whenever

events or changes in circumstances indicate that the carrying value may not be recoverable. Similar to the qualitative assessment for

goodwill, we may assess qualitative factors to determine if it is more likely than not that the implied fair value of the indefinite-lived

intangible asset is less than its carrying amount. If we determine that it is not more likely than not that the implied fair value of the

indefinite-lived intangible asset is less than its carrying amount, no further testing is necessary. If, however, we determine that it is

more likely than not that the implied fair value of the indefinite-lived intangible asset is less than its carrying amount, we compare the

implied fair value of the indefinite-lived asset with its carrying amount. If the carrying value of an individual indefinite-lived

intangible asset exceeds its implied fair value, the individual asset is written down by an amount equal to such excess. The assessment

of qualitative factors is optional and at our discretion. We may bypass the qualitative assessment for any indefinite-lived intangible

asset in any period and resume performing the qualitative assessment in any subsequent period.

As part of our qualitative assessment for our 2014 impairment analysis on October 1, the factors that we considered for our

indefinite-lived intangible assets included, but were not limited to: (a) changes in macroeconomic conditions in the overall economy

and the specific markets in which we operate, (b) our ability to access capital, (c) changes in the online travel industry, (d) changes in

the level of competition, (e) comparison of our current financial performance to historical and budgeted results, (f) changes in excess

market capitalization over book value based on our current common stock price and latest unaudited consolidated balance sheet, and

(g) comparison of the excess of the fair value of our trade names and trademarks to the carrying value of those same assets, using the

results of our most recent quantitative assessment. After considering these factors and the impact that changes in such factors would

have on the inputs used in our previous quantitative assessment, we determined that it was more likely than not that these assets were

not impaired.

Since the annual impairment test on October 1, 2014, there have been no events or changes in circumstances to indicate any

potential impairment to our indefinite lived intangible assets. In the event that future circumstances indicate that our indefinite-lived

intangibles are impaired, an impairment charge would be recorded.

There were no impairment charges recognized to our consolidated statement of operations during the years ended December 31,

2014, 2013 and 2012 related to our goodwill or indefinite-lived intangible assets.

Recoverability of Intangible Assets with Definite Lives and Other Long-Lived Assets

Intangible assets with definite lives and other long-lived assets are carried at cost and are amortized on a straight-line basis over

their estimated useful lives of two to twelve years. The straight-line method of amortization is currently used for our definite-lived

intangible assets as it approximates, or is our best estimate, of the distribution of the economic use of our identifiable intangible assets.

We review the carrying value of long-lived assets or asset groups, including property and equipment, to be used in operations

whenever events or changes in circumstances indicate that the carrying amount of the assets might not be recoverable.

Factors that would necessitate an impairment assessment include a significant adverse change in the extent or manner in which

an asset is used, a significant adverse change in legal factors or the business climate that could affect the value of the asset, or a

significant decline in the observable market value of an asset, among others. If such facts indicate a potential impairment, we assess

the recoverability of the asset by determining if the carrying value of the asset exceeds the sum of the projected undiscounted cash

flows expected to result from the use and eventual disposition of the asset over the remaining economic life of the asset. If the

recoverability test indicates that the carrying value of the asset is not recoverable, we will estimate the fair value of the asset using

appropriate valuation methodologies which would typically include an estimate of discounted cash flows. Any impairment would be

measured by the amount that the carrying value of such assets exceeds their fair value and would be included in operating income on

the consolidated statement of operations. We have not identified any circumstances that would warrant an impairment assessment of

any recorded assets in our consolidated balance sheet at December 31, 2014.

Income Taxes

We record income taxes under the asset and liability method. Deferred tax assets and liabilities reflect our estimation of the

future tax consequences of temporary differences between the carrying amounts of assets and liabilities for book and tax purposes. We

determine deferred income taxes based on the differences in accounting methods and timing between financial statement and income

tax reporting. Accordingly, we determine the deferred tax asset or liability for each temporary difference based on the enacted tax

rates expected to be in effect when we realize the underlying items of income and expense. We consider all relevant factors when

assessing the likelihood of future realization of our deferred tax assets, including our recent earnings experience by jurisdiction,

expectations of future taxable income, and the carryforward periods available to us for tax reporting purposes, as well as assessing

available tax planning strategies. We may establish a valuation allowance to reduce deferred tax assets to the amount we believe is