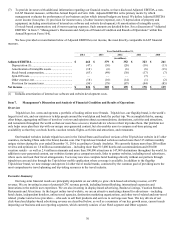

TripAdvisor 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

Holders of Record

As of February 6, 2015, there were 130,126,683 outstanding shares of our common stock held by 2,944 stockholders of record,

and 12,799,999 outstanding shares of our Class B common stock held by one stockholder of record: LTRIP.

Dividends

We have never declared or paid dividends and do not expect to pay any dividends for the foreseeable future. Our ability to pay

dividends is limited by the terms of a credit agreement, dated as of December 20, 2011, that provides for a revolving credit facility and

a term loan. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Term Loan Facility Due

2016 and Revolving Credit Facility” for additional information regarding our revolving credit facility and term loan. Any future

determination as to the declaration and payment of dividends, if any, will be at the discretion of our Board of Directors and will

depend on then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements,

business prospects and other factors our Board of Directors may deem relevant.

Unregistered Sales of Equity Securities

During the year ended December 31, 2014, we did not issue or sell any shares of our common stock, Class B common stock or

other equity securities pursuant to unregistered transactions in reliance upon an exemption from the registration requirements of the

Securities Act of 1933, as amended.

Issuer Purchases of Equity Securities

We did not repurchase any shares of our common stock during the year ended December 31, 2014.

In February 2013, we announced that our Board of Directors authorized the repurchase of $250 million of our shares of

common stock under a share repurchase program. We have in the past, and intend to use in the future, available cash from operations

to fund repurchases under the share repurchase program. The repurchase program has no expiration date but may be suspended or

terminated by the Board of Directors at any time. The Executive Committee of our Board of Directors will determine the price, timing,

amount and method of such repurchases based on its evaluation of market conditions and other factors, and any shares repurchased

will be in compliance with applicable legal requirements, at prices determined to be attractive and in the best interests of both the

Company and its stockholders. As of December 31, 2014, we have $105 million remaining to repurchase shares of our common

stock under this share repurchase program.

Equity Compensation Plan Information

Our equity plan information required by this item is incorporated by reference to the information in Part III, Item 12. of this

Annual Report on Form 10-K.