TripAdvisor 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Change in Control or (iv) a termination of employment by TripAdvisor without Cause or by him or her for Good Reason in connection

with a Change in Control.

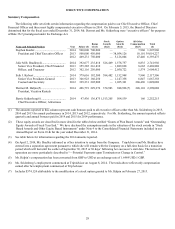

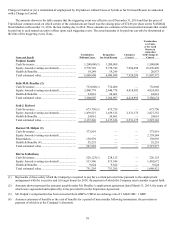

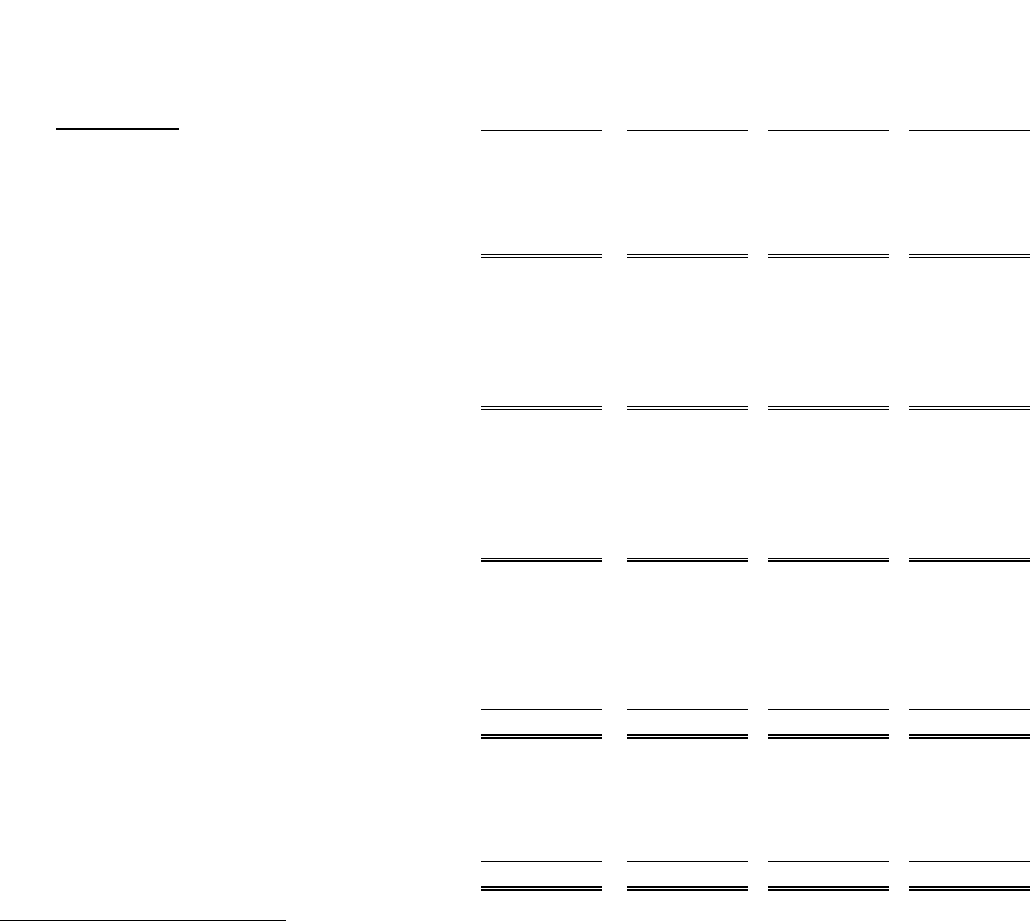

The amounts shown in the table assume that the triggering event was effective as of December 31, 2014 and that the price of

TripAdvisor common stock on which certain of the calculations are based was the closing price of $74.66 per share on the NASDAQ

Stock Market on December 31, 2014, the last trading day in 2014. These amounts are estimates of the incremental amounts that would

be paid out to each named executive officer upon such triggering event. The actual amounts to be paid out can only be determined at

the time of the triggering event, if any.

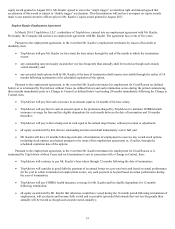

Name and Benefit

Termination

Without Cause

Resignation

for Good Reason

Change in

Control

Termination

w/o Cause

or for Good

Reason in

connection

with Change in

Control

Stephen Kaufer

Cash Severance ....................................................... 1,200,000(1) 1,200,000 — 1,500,000

Equity Awards (vesting accelerated) ....................... 5,770,749 5,770,749 7,924,299 10,278,499

Health & Benefits .................................................... 19,249 19,249 — 28,873

Total estimated value............................................... 6,989,998 6,989,998 7,924,299 11,807,372

Julie M.B. Bradley (2)

Cash Severance ....................................................... 732,068(1) 732,068 — 732,068

Equity Awards (vesting accelerated) ....................... 2,448,778 2,448,778 4,418,992 4,824,545

Health & Benefits .................................................... 24,061 24,061 — 24,061

Total estimated value............................................... 3,204,907 3,204,907 4,418,992 5,580,674

Seth J. Kalvert

Cash Severance ....................................................... 673,750(1) 673,750 — 673,750

Equity Awards (vesting accelerated) ....................... 1,439,515 1,439,515 2,531,175 2,827,352

Health & Benefits .................................................... 24,061 24,061 — 24,061

Total estimated value............................................... 2,137,326 2,137,326 2,531,175 3,525,163

Dermot M. Halpin (3)

Cash Severance ....................................................... 373,819 — — 373,819

Equity Awards (vesting accelerated) ....................... — — — 2,159,584

Repatriation ............................................................. 138,939 — — 138,939

Health & Benefits (4) .............................................. 55,235 — — 55,235

Total estimated value............................................... 567,993 — — 2,727,577

Barrie Seidenberg

Cash Severance ....................................................... 228,125(1) 228,125 — 228,125

Equity Awards (vesting accelerated) ....................... 513,546 513,546 — 1,402,672

Health & Benefits .................................................... 9,624 9,624 — 9,624

Total estimated value............................................... 751,295 751,295 — 1,640,421

(1) Represents (i) base salary which the Company is required to pay for a certain period of time pursuant to the employment

arrangement with the executive and (ii) target bonus for 2014, the payment of which the Company must consider in good faith.

(2) Amounts shown represent the amounts payable under Ms. Bradley’s employment agreement dated March 31, 2014, the terms of

which were superseded and replaced by terms provided for in the Separation Agreement.

(3) Mr. Halpin’s compensation has been converted from GBP to USD at an exchange rate of 1.6484 USD : 1 GBP.

(4) Assumes extension of benefits or the cost of benefits for a period of nine months following termination, the provision or

payment of which is at the Company’s discretion.