TripAdvisor 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.91

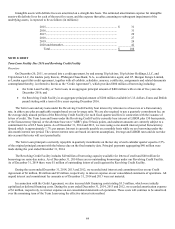

Letters of Credit

As of December 31, 2014, we have issued unused letters of credit totaling $1 million, related to our property leases.

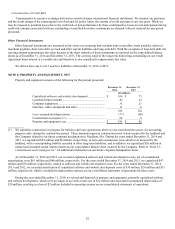

Off-Balance Sheet Arrangements

We did not have any off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of Regulation S-K of the SEC, that have,

or are reasonably likely to have, a current or future effect on our financial condition, results of operations, liquidity, capital

expenditures or capital resources at December 31, 2014.

Legal Proceedings

In the ordinary course of business, we and our subsidiaries are parties to legal proceedings and claims involving alleged

infringement of third-party intellectual property rights, defamation, and other claims. Rules of the SEC require the description of

material pending legal proceedings, other than ordinary, routine litigation incident to the registrant’s business, and advise that

proceedings ordinarily need not be described if they primarily involve damages claims for amounts (exclusive of interest and costs)

not individually exceeding 10% of the current assets of the registrant and its subsidiaries on a consolidated basis. In the judgment of

management, none of the pending litigation matters that the Company and its subsidiaries are defending involves or is likely to

involve amounts of that magnitude. There may be claims or actions pending or threatened against us of which we are currently not

aware and the ultimate disposition of which could have a material adverse effect on us.

NOTE 13: EMPLOYEE BENEFIT PLANS

Retirement Savings Plan

The TripAdvisor Retirement Savings Plan (the “401(k) Plan”), qualifies under Section 401(k) of the Internal Revenue Code.

The 401(k) Plan allows participating employees, most of our U.S. employees, to make contributions of a specified percentage of their

eligible compensation. Participating employees may contribute up to 50% of their eligible salary on a pre-tax basis, but not more than

statutory limits. Employee-participants age 50 and over may also contribute an additional amount of their salary on a pre-tax tax basis

up to the IRS Catch-Up Provision Limit. Employees may also contribute into the 401(k) Plan on an after-tax basis up to an annual

maximum of 10%. The 401(k) Plan has an automatic enrollment feature at 3% pre-tax. We match 50% of the first 6% of employee

contributions to the plan for a maximum employer contribution of 3% of a participant’s eligible earnings. The “catch up

contributions”, are not eligible for employer matching contributions. The matching contributions portion of an employee’s account,

vests after two years of service. Effective June 8, 2012 the 401(k) Plan permits certain after-tax Roth 401(k) contributions.

Additionally, at the end of the 401 (k) Plan year, we make a discretionary matching contribution to eligible participants. This

additional discretionary matching employer contribution referred to as “true up” is limited to match only contributions up to 3% of

eligible compensation.

We also have various defined contribution plans for our international employees. Our contribution to the 401(k) Plan and our

international defined contribution plans was $5 million, $5 million, and $3 million for the years ended December 31, 2014, 2013 and

2012, respectively.

TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

On December 20, 2011, the TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors (the “Plan”) became

effective. Under the Plan, eligible directors who defer their directors’ fees may elect to have such deferred fees (i) applied to the

purchase of share units, representing the number of shares of our common stock that could have been purchased on the date such fees

would otherwise be payable, or (ii) credited to a cash fund. The cash fund will be credited with interest at an annual rate equal to the

weighted average prime or base lending rate of a financial institution selected in accordance with the terms of the Plan and applicable

law. Upon termination of service as a director of TripAdvisor, a director will receive (i) with respect to share units, such number of

shares of our common stock as the share units represent, and (ii) with respect to the cash fund, a cash payment. Payments upon

termination will be made in either one lump sum or up to five annual installments, as elected by the eligible director at the time of the

deferral election.

Under the 2011 Incentive Plan, 100,000 shares of TripAdvisor common stock are available for issuance to non-employee

directors. From the inception of the Plan through December 31, 2014, a total of 557 shares have been reserved for such purpose.