TripAdvisor 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

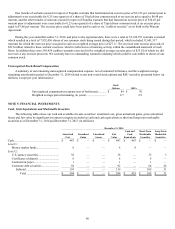

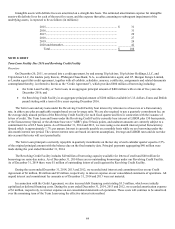

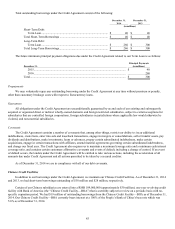

Concentration of Credit Risk

Counterparties to currency exchange derivatives consist of major international financial institutions. We monitor our positions

and the credit ratings of the counterparties involved and, by policy limits, the amount of credit exposure to any one party. While we

may be exposed to potential losses due to the credit risk of non-performance by these counterparties, losses are not anticipated and any

credit risk amounts associated with our outstanding or unsettled derivative instruments are deemed to be not material for any period

presented.

Other Financial Instruments

Other financial instruments not measured at fair value on a recurring basis include trade receivables, trade payables, deferred

merchant payables, short-term debt, accrued and other current liabilities and long-term debt. With the exception of long-term debt, the

carrying amount approximates fair value because of the short maturity of these instruments as reported on the consolidated balance

sheets as of December 31, 2014 and December 31, 2013. The carrying value of the long-term borrowings outstanding on our Credit

Agreement bears interest at a variable rate and therefore is also considered to approximate fair value.

We did not have any Level 3 assets or liabilities at December 31, 2014 or 2013.

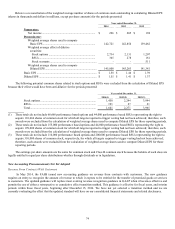

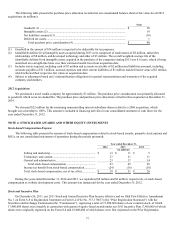

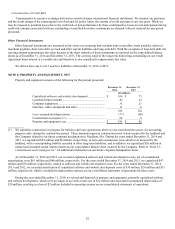

NOTE 6: PROPERTY AND EQUIPMENT, NET

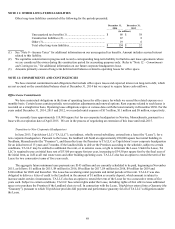

Property and equipment consists of the following for the periods presented:

December 31,

2014

December 31,

2013

(in millions)

Capitalized software and website development ....................... $104 $ 73

Leasehold improvements ......................................................... 40 22

Computer equipment ................................................................ 31 21

Furniture, office equipment and other ...................................... 11 6

186 122

Less: accumulated depreciation ............................................... (77) (48 )

Construction in progress (1) ..................................................... 86 8

Property and equipment, net .................................................... $195 $ 82

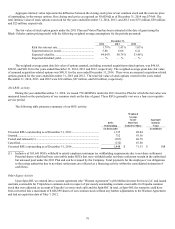

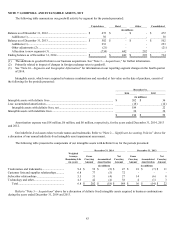

(1) We capitalize construction in progress for build-to-suit lease agreements where we are considered the owner, for accounting

purposes only, during the construction period. These amounts represent construction costs to date incurred by the landlord and

the Company related to our future corporate headquarters in Needham, MA. During the years ended December 31, 2014 and

2013, we capitalized $52 million and $8 million, respectively, in non-cash construction costs which were incurred by the

landlord, with a corresponding liability recorded in other long-term liabilities, and in addition, we capitalized $26 million in

normal and structural tenant improvements on our consolidated balance sheet incurred by the Company. Refer to “Note 12 –

Commitments and Contingencies,” for additional information on our future corporate headquarters lease.

As of December 31, 2014 and 2013, our recorded capitalized software and website development costs, net of accumulated

amortization, were $61 million and $46 million, respectively. For the years ended December 31, 2014 and 2013, we capitalized $47

million and $38 million, respectively, related to software and website development costs. For the years ended December 31, 2014,

2013 and 2012, we recorded amortization of capitalized software and website development costs of $30 million, $20 million and $13

million, respectively, which is included in depreciation expense on our consolidated statements of operations for those years.

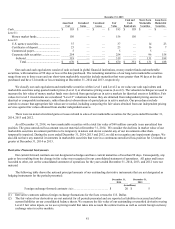

During the year ended December 31, 2014, we retired and disposed of property and equipment, primarily capitalized software

and website development, which were no longer in use with a total cost of $22 million and associated accumulated depreciation of

$20 million, resulting in a loss of $2 million included in operating income on our consolidated statements of operations.