TripAdvisor 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

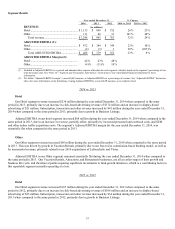

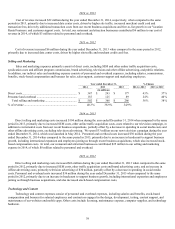

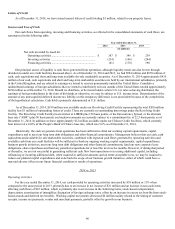

Depreciation

Year ended December 31,

2014 2013 2012

(in millions)

Depreciation .......................................................................... $47 $30 $ 20

% of revenue .................................................................... 3.8% 3.2 % 2.6%

2014 vs. 2013

Depreciation expense increased $17 million during the year ended December 31, 2014 when compared to the same period in

2013 primarily due to increased amortization related to capitalized software and website development costs.

2013 vs. 2012

Depreciation expense increased $10 million during the year ended December 31, 2013 when compared to the same period in

2012 primarily due to increased amortization related to capitalized software and website development costs.

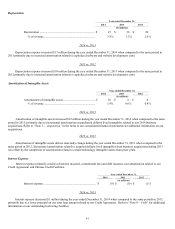

Amortization of Intangible Assets

Year ended December 31,

2014 2013 2012

(in millions)

Amortization of intangible assets ........................................... $18 $6 $ 6

% of revenue ..................................................................... 1.4% 0.6 % 0.8%

2014 vs. 2013

Amortization of intangible assets increased $12 million during the year ended December 31, 2014 when compared to the same

period in 2013, primarily due to incremental amortization on purchased definite lived intangibles related to our 2014 business

acquisitions. Refer to “Note 3— Acquisition” in the notes to our consolidated financial statements for additional information on our

acquisitions.

2013 vs. 2012

Amortization of intangible assets did not materially change during the year ended December 31, 2013 when compared to the

same period in 2012. Incremental amortization related to acquired definite lived intangibles from business acquisitions during 2013

was offset by the completion of amortization related to certain technology intangible assets from prior years.

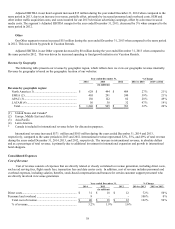

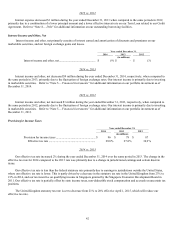

Interest Expense

Interest expense primarily consists of interest incurred, commitment fees and debt issuance cost amortization related to our

Credit Agreement and Chinese Credit Facilities.

Year ended December 31,

2014 2013 2012

(in millions)

Interest expense ...................................................................... $ (9) $ (10 ) $ (11)

2014 vs. 2013

Interest expense decreased $1 million during the year ended December 31, 2014 when compared to the same periods in 2013,

primarily due to a lower principal on our term loan amount related to our Credit Agreement. Refer to “Note 8— Debt” for additional

information on our outstanding borrowing facilities.