TripAdvisor 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

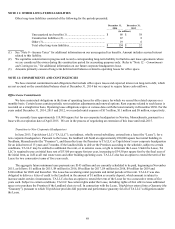

81

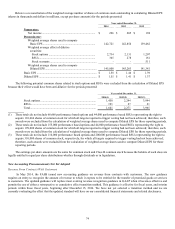

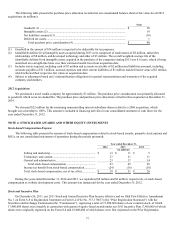

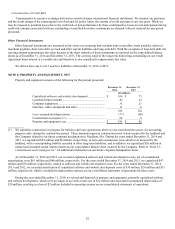

December 31, 2013

Cash and Short-Term Long-Term

Amortized Unrealized Unrealized Fair Cash Marketable Marketable

Cost Gains Losses Value Equivalents Securities Securities

Cash .............................................................. $ 195 $ — $ — $ 195 $ 195 $ — $ —

Level 1:

Money market funds ............................... 156 — — 156 156 — —

Level 2:

U.S. agency securities ............................. 37 — — 37 — 14 23

Certificates of deposit ............................. 23 — — 23 — 16 7

Commercial paper ................................... 5 — — 5 — 5 —

Corporate debt securities ........................ 254 — — 254 — 96 158

Subtotal ............................................. 319 — — 319 — 131 188

Total ............................................. $ 670 $

—

$

—

$670 $ 351 $ 131 $188

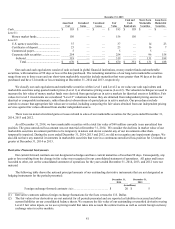

Our cash and cash equivalents consist of cash on hand in global financial institutions, money market funds and marketable

securities, with maturities of 90 days or less at the date purchased. The remaining maturities of our long-term marketable securities

range from one to three years and our short-term marketable securities include maturities that were greater than 90 days at the date

purchased and have 12 months or less remaining at December 31, 2014 and 2013, respectively.

We classify our cash equivalents and marketable securities within Level 1 and Level 2 as we value our cash equivalents and

marketable securities using quoted market prices (Level 1) or alternative pricing sources (Level 2). The valuation technique we used to

measure the fair value of money market funds were derived from quoted prices in active markets for identical assets or liabilities. Fair

values for Level 2 investments are considered “Level 2” valuations because they are obtained from independent pricing sources for

identical or comparable instruments, rather than direct observations of quoted prices in active markets. Our procedures include

controls to ensure that appropriate fair values are recorded, including comparing the fair values obtained from our independent pricing

services against fair values obtained from another independent source.

There were no material realized gains or losses related to sales of our marketable securities for the years ended December 31,

2014, 2013 and 2012.

As of December 31, 2014, we have marketable securities with a total fair value of $68 million currently in an unrealized loss

position. The gross unrealized loss amount was not material at December 31, 2014. We consider the declines in market value of our

marketable securities investment portfolio to be temporary in nature and do not consider any of our investments other-than-

temporarily impaired. During the years ended December 31, 2014, 2013 and 2012, we did not recognize any impairment charges. We

also did not have any material investments in marketable securities that were in a continuous unrealized loss position for 12 months or

greater at December 31, 2014 or 2013.

Derivative Financial Instruments

Our current forward contracts are not designated as hedges and have current maturities of less than 90 days. Consequently, any

gain or loss resulting from the change in fair value was recognized in our consolidated statement of operations. All gains and losses

recorded to other, net on the consolidated statement of operations for the years ended December 31, 2014, 2013, and 2012 were not

material.

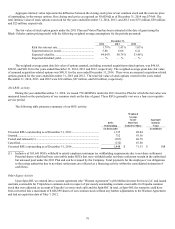

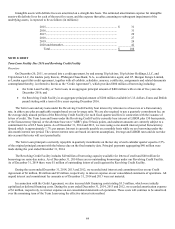

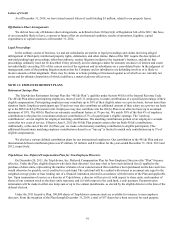

The following table shows the notional principal amounts of our outstanding derivative instruments that are not designated as

hedging instruments for the periods presented:

December 31,

2014 December 31,

2013

(in millions)

Foreign exchange-forward contracts (1)(2) ........................................................... $ 20 $ 5

(1) Derivative contracts address foreign exchange fluctuations for the Euro versus the U.S. Dollar.

(2) The fair value of our derivatives are not material for all periods presented and are reported as liabilities in accrued and other

current liabilities on our consolidated balance sheets. We measure the fair value of our outstanding or unsettled derivatives using

Level 2 fair value inputs, as we use a pricing model that takes into account the contract terms as well as current foreign currency

exchange rates in active markets.