TripAdvisor 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

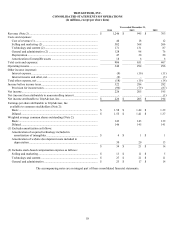

Revenue Recognition

We recognize revenue from our services rendered when the following four revenue recognition criteria are met: persuasive

evidence of an arrangement exists, services have been rendered, the price is fixed or determinable, and collectability is reasonably

assured. Deferred revenue, which primarily relates to our subscription-based and commission based arrangements, is recorded when

payments are received in advance of our performance as required by the underlying agreements.

Click-based Advertising. Revenue is derived primarily from click-through fees charged to our travel partners for traveler leads

sent to the travel partners’ website. We record revenue from click-through fees after the traveler makes the click-through to the travel

partners’ websites.

Instant booking commission revenue is recorded at the time a traveler books a hotel transaction on our site where we do not

assume cancellation risk. In transactions in which we assume cancellation risk, we record revenue when we receive cash from our

travel partners, given the current uncertainty of the traveler’s stay. We have no post-booking service obligations for Instant Booking

transactions.

Display-based Advertising. We recognize display advertising revenue ratably over the advertising period or upon delivery of

advertising impressions, depending on the terms of the advertising contract. Subscription-based revenue is recognized ratably over the

related contractual period over which service is delivered.

Attractions. We receive cash from the consumer at the time of booking of the destination activity and record these amounts, net

of commissions, as deferred merchant payables on our consolidated balance sheet. Commission revenue is recorded as deferred

revenue at the time of booking and later recognized when the consumer has completed the destination activity or as the consumer’s

refund privileges lapse. We pay the destination activity operators after the travelers’ use.

Restaurants. We recognize reservation revenues (or per seated diner fees) on a transaction-by-transaction basis as diners are

seated by our restaurant customers. Subscription-based revenue is recognized ratably over the related contractual period over which

the service is delivered.

Vacation Rentals. We generate revenue from customers for online advertising listing services related to the listing of their

properties for rent on a subscription basis, over a fixed-term, or on a free-to-list option. Payments for term-based paid subscriptions

received in advance of services being rendered are recorded as deferred revenue and recognized ratably on a straight-line basis over

the listing period. We generate commission revenue from our free-to-list bookings option. We receive cash from travelers at the time

of booking, net of commissions, and record as deferred merchant payables on our consolidated balance sheet. Commission revenue is

recorded as deferred revenue at the time of booking and later recognized when the traveler has completed the stay or as the travelers’

refund privileges lapse. We pay the customer or property owner after the travelers’ stay.

Cost of Revenue

Cost of revenue consists of expenses that are directly related or closely correlated to revenue generation, including direct

costs, such as ad serving fees, flight search fees, transaction fees and data center costs. In addition, cost of revenue includes personnel

and overhead expenses, including salaries, benefits, stock-based compensation and bonuses for certain customer support personnel

who are directly involved in revenue generation.

Selling and Marketing

Sales and marketing expenses primarily consist of direct costs, including SEM and other online traffic acquisition costs,

syndication costs and affiliate program commissions, brand advertising, television and other offline advertising, and public relations.

In addition, our indirect sales and marketing expense consists of personnel and overhead expenses, including salaries, commissions,

benefits, stock-based compensation expense and bonuses for sales, sales support, customer support and marketing employees.

Technology and Content

Technology and content expenses consist of personnel and overhead expenses, including salaries and benefits, stock-based

compensation expense and bonuses for salaried employees and contractors engaged in the design, development, testing, content

support, and maintenance of our websites and mobile apps. Other costs include licensing, maintenance expense, computer supplies,

and technology hardware.