TripAdvisor 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

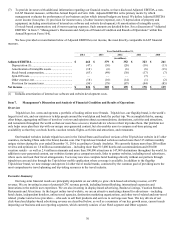

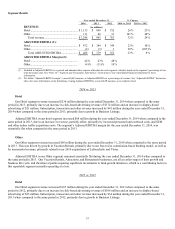

Adjusted EBITDA

To provide investors with additional information regarding our financial results, we also disclose Adjusted EBITDA, which is a

non-GAAP financial measure. We have provided a reconciliation below of Adjusted EBITDA to net income, the most directly

comparable GAAP financial measure. A “non-GAAP financial measure” refers to a numerical measure of a company’s historical or

future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded

from) the most directly comparable measure calculated and presented in accordance with GAAP in such company’s financial

statements.

We define Adjusted EBITDA as net income (loss) plus: (1) provision for income taxes; (2) other income (expense), net;

(3) depreciation of property and equipment, including amortization of internal use software and website development; (4) amortization

of intangible assets; (5) stock-based compensation; and (6) non-recurring expenses. Adjusted EBITDA is the primary metric by which

management evaluates the performance of its business and on which internal budgets are based. In particular, the exclusion of certain

expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis. We believe that

by excluding certain non-cash expenses, such as stock-based compensation and non-recurring expenses, Adjusted EBITDA

corresponds more closely to the cash that operating income generated from our business and allows investors to gain an understanding

of the factors and trends affecting the ongoing cash earnings capabilities of our business, from which capital investments are made and

debt is serviced.

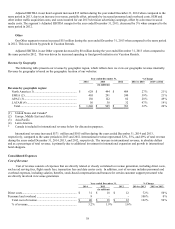

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute

for analysis of our results reported in accordance with GAAP. Some of these limitations are:

x Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual

commitments;

x Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

x Adjusted EBITDA does not reflect the interest expense, or cash requirements necessary to service interest or principal

payments on our debt;

x Adjusted EBITDA does not consider the potentially dilutive impact of stock-based compensation;

x Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be

replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements

or for new capital expenditure requirements;

x Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and

x Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do,

limiting its usefulness as a comparative measure.

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including

cash flows, net income and our other GAAP results.

Refer to “Note 16— Segment and Geographic Information” in the notes to our consolidated financial statements for a

reconciliation of Adjusted EBITDA to net income, the most directly comparable financial measure calculated and presented in

accordance with GAAP, for the periods presented above.

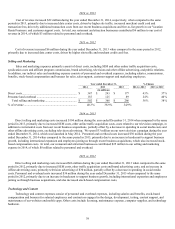

Reclassifications

As previously disclosed, we no longer consider Expedia a related party. Certain reclassifications have been made to conform the

prior period to the current presentation relating to Expedia transactions, which includes the reclassification of revenue from Expedia

on our statements of operations for the years ended December 31, 2013 and 2012 of $217 million and $204 million, respectively, to

revenue, the reclassification of receivables at December 31, 2013 of $16 million, from Expedia, net on our consolidated balance sheets

to accounts receivable, as well as operating cash flow reclassifications related to Expedia for the years ended December 31, 2013 and

2012 of cash provided of $8 million and cash used of $17 million, respectively, to operating cash flows for accounts receivable on our

consolidated statements of cash flows those years. These reclassifications had no net effect on our consolidated financial statements.

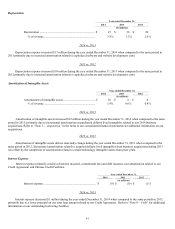

In addition, as discussed above, we revised our reportable segment structure during the fourth quarter of 2014. Consequently all

prior periods have been reclassified to conform to the current reporting structure, which is reflected in all segment disclosures made in

this Form 10-K. These reclassifications had no effect on our consolidated financial statements.