TripAdvisor 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

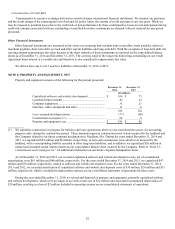

Recently Adopted Accounting Pronouncements

Pushdown Accounting

In November 2014, the FASB issued new accounting guidance that provides companies with the option to apply pushdown

accounting in its separate financial statements upon occurrence of an event in which an acquirer obtains control of the acquired entity.

The acquired entity may elect the option to apply pushdown accounting in the reporting period in which the change-in-control event

occurs. If pushdown accounting is not applied in the reporting period in which the change-in-control event occurs, an acquired entity

will have the option to elect to apply pushdown accounting in a subsequent reporting period as a change in accounting principle under

GAAP. If pushdown accounting is applied to an individual change-in-control event, that election is irrevocable. This guidance also

requires an acquired entity that elects the option to apply pushdown accounting in its separate financial statements to disclose

information in the current reporting period that enables users of financial statements to evaluate the effect of pushdown accounting.

We have adopted this guidance effective November 18, 2014, as the amendments are effective upon issuance. The adoption of this

new guidance did not have any impact on our consolidated financial statements and related disclosures.

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists

In July 2013, the FASB issued new accounting guidance on the presentation of unrecognized tax benefits. The new guidance

requires an entity to present an unrecognized tax benefit, or a portion of an unrecognized tax benefit, as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, except as follows: to the extent a net

operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date under the tax law of

the applicable jurisdiction to settle any additional income taxes that would result from the disallowance of a tax position or the tax law

of the applicable jurisdiction does not require the entity to use, and the entity does not intend to use the deferred tax asset for such

purpose, then the unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined

with deferred tax assets. This guidance was effective for fiscal years, and interim periods within those fiscal years, beginning after

December 15, 2013, with early adoption permitted. Accordingly, we adopted these presentation requirements during the first quarter

of 2014. The adoption of this new guidance did not have a material impact on our consolidated financial statements and related

disclosures.

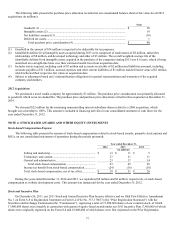

NOTE 3: ACQUISITIONS

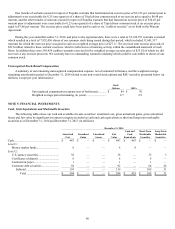

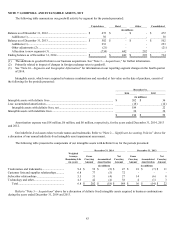

We acquired a number of businesses during the years ended December 31, 2014, 2013 and 2012. These business combinations

were accounted for as purchases of businesses under the acquisition method. The fair value of purchase consideration has been

allocated to tangible and identifiable intangible assets acquired and liabilities assumed, based on their respective fair values on the

acquisition date, with the remaining unallocated amount recorded as goodwill. Acquired goodwill represents the premium we

paid over the fair value of the net tangible and intangible assets acquired. We paid a premium in these transactions for a number of

reasons, but, primarily it was attributable to expected operational synergies, the assembled workforces, and the future development

initiatives of the assembled workforces. The results of each of these acquired businesses have been included in the consolidated

financial statements beginning on the respective acquisition dates. Pro-forma results of operations for all of these acquisitions have not

been presented as the financial impact to our consolidated financial statements, both individually and in aggregate, are not material.

For the years ended December 31, 2014 and 2013, acquisition-related costs were expensed as incurred and were $4 million and $2

million, respectively, and are included in general and administrative expenses on our consolidated statements of operations.

Acquisition-related expenses were not material for the year ended December 31, 2012.

2014 Acquisitions

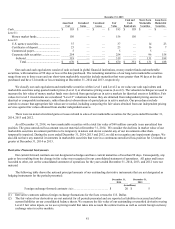

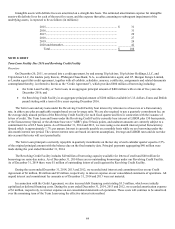

In August 2014, we completed our acquisition of Viator, Inc. (“Viator”). Viator, which is headquartered in San Francisco and

has offices in Las Vegas, London, and Sydney, is a leading resource for researching and booking destination activities around the

world. Our total purchase price was $192 million, for all the outstanding shares of capital stock of Viator, consisting of approximately

$187 million in cash consideration (or $132 million, net of cash acquired from Viator of $55 million) and the value of certain Viator

stock options that were assumed. We issued 100,595 TripAdvisor stock options related to the assumed Viator stock options. The fair

value of the earned portion of assumed stock options was $5 million and is included in the purchase price, with the remaining fair

value of $3 million resulting in post-acquisition compensation expense that will generally be recognized ratably over three years from

the date of acquisition. The total cash consideration was paid from one of our U.S. based subsidiaries.

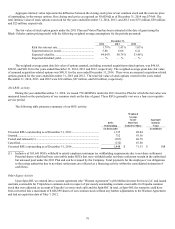

During the year ended December 31, 2014, we completed six other acquisitions for a total purchase price consideration of $208

million, for which the Company paid total cash consideration of $199 million, which is net of cash acquired of $7 million and

approximately $2 million in holdbacks for general representations and warranties of the respective sellers. The cash consideration was

paid primarily from our international subsidiaries. We acquired 100% of the outstanding shares of capital stock for the following