TripAdvisor 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Under the employment agreements with our named executive officers and under the 2011 Plan, “Change in Control” shall mean

any of the following events:

(i) The acquisition by any individual entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange

Act), other than Barry Diller, Liberty Media Corporation, and their respective Affiliates (a “Person”) of beneficial ownership

(within the meaning of Rule 13d-3 promulgated under the Exchange Act) of equity securities of the Company representing more

than 50% of the voting power of the then outstanding equity securities of the Company entitled to vote generally in the election of

directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this subsection (i), the following

acquisitions shall not constitute a Change in Control: (A) any acquisition by the Company, (B) any acquisition directly from the

Company, (C) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any

corporation controlled by the Company, or (D) any acquisition pursuant to a transaction which complies with clauses (A), (B) and

(C) of subsection (iii); or

(ii) Individuals who, as of the Effective Date, constitute the Board (the “Incumbent Board”) cease for any reason to

constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the Effective

Date, whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least a majority of

the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent

Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or

threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or

consents by or on behalf of a Person other than the Board; or

(iii) Consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the

assets of the Company or the purchase of assets or stock of another entity (a “Business Combination”), in each case, unless

immediately following such Business Combination, (A) all or substantially all of the individuals and entities who were the

beneficial owners of the Outstanding Company Voting Securities immediately prior to such Business Combination will beneficially

own, directly or indirectly, more than 50% of the then outstanding combined voting power of the then outstanding voting securities

entitled to vote generally in the election of directors (or equivalent governing body, if applicable) of the entity resulting from such

Business Combination (including, without limitation, an entity which as a result of such transaction owns the Company or all or

substantially all of the Company’s assets either directly or through one or more subsidiaries) in substantially the same proportions

as their ownership, immediately prior to such Business Combination of the Outstanding Company Voting Securities, (B) no Person

(excluding Barry Diller, LMC, and their respective affiliates, any employee benefit plan (or related trust) of the Company or such

entity resulting from such Business Combination) will beneficially own, directly or indirectly, more than a majority of the

combined voting power of the then outstanding voting securities of such entity except to the extent that such ownership of the

Company existed prior to the Business Combination and (C) at least a majority of the members of the board of directors (or

equivalent governing body, if applicable) of the entity resulting from such Business Combination will have been members of the

Incumbent Board at the time of the initial agreement, or action of the Board, providing for such Business Combination; or

(iv) Approval by our stockholders of a complete liquidation or dissolution of the Company.

Under the employment agreements with Ms. Bradley and Messrs. Kaufer and Kalvert and the offer letter with Ms. Seidenberg,

“Good Reason” means the occurrence of any of the following without the executive’s prior written consent: (A) TripAdvisor’s material

breach of any material provision of the employment agreement, (B) the material reduction in the executive’s title, duties, reporting

responsibilities or level of responsibilities in such executive’s position at TripAdvisor, (C) the material reduction in the executive’s base

salary or the executive’s total annual compensation opportunity, or (D) the relocation of the executive’s principal place of employment

more than 50 miles outside the Boston metropolitan area; provided that in no event shall the executive’s resignation be for “Good

Reason” unless (x) an event or circumstance set forth in clauses (A) through (D) shall have occurred and the executive provides

TripAdvisor with written notice thereof within 30 days after the executive has knowledge of the occurrence or existence of such event or

circumstance, which notice specifically identifies the event or circumstance that the executive believes constitutes Good Reason, (y)

TripAdvisor fails to correct the event or circumstance so identified within 30 days after receipt of such notice, and (z) the executive

resigns within 90 days after the date of delivery of the notice referred to in clause (x) above.

For a description and quantification of change in control payments and benefits for our named executive officers, please see the

section below entitled “Potential Payments Upon Termination of Change in Control.”

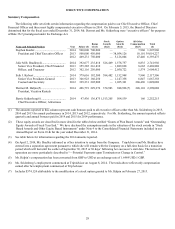

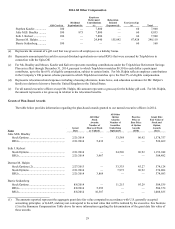

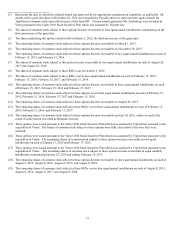

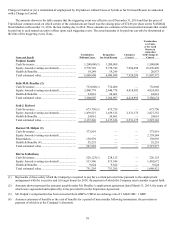

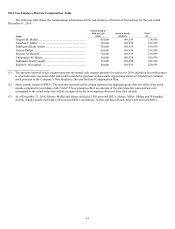

Estimated Potential Incremental Payments

The table below reflects the estimated amount of incremental compensation payable to each of our named executive officers upon

termination of his or her employment in the following circumstances: (i) a termination of employment by TripAdvisor without Cause not

in connection with a Change in Control, (ii) resignation by him or her for Good Reason not in connection with a Change in Control, (iii) a