TripAdvisor 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

62

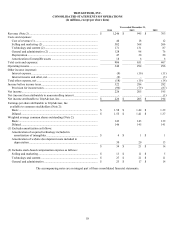

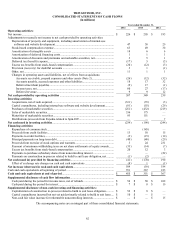

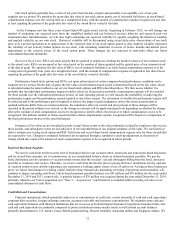

TRIPADVISOR, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

Year ended December 31,

2014 2013 2012

Operating activities:

N

et inco

m

e ............................................................................................................................ $ 226 $ 205 $ 195

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation of property and equipment, including amortization of internal-use

software and website development ............................................................................... 47 30 20

Stock-based compensation expense ................................................................................. 63 49 30

Amortization of intangible assets .................................................................................... 18 6 6

Amortization of deferred financing costs ........................................................................ 1 1 1

Amortization of discounts and premiums on marketable securities, net .......................... 3 5 1

Deferred tax (benefit) expense ......................................................................................... (17 ) 5 (5)

Excess tax benefits from stock-based compensation ....................................................... (20 ) (12) (3)

Provision (recovery) for doubtful accounts ..................................................................... 3 1 (1)

Other, net ......................................................................................................................... 11 1 1

Changes in operating assets and liabilities, net of effects from acquisitions:

Accounts receivable, prepaid expenses and other assets (Note 2) .............................. (26 ) (12) (32)

Accounts payable, accrued expenses and other liabilities .......................................... 18 17 32

Deferred merchant payables ....................................................................................... (9 ) 17 (1)

Income taxes, net ........................................................................................................ 60 27 (17)

Deferred revenue ........................................................................................................ 9 9 12

Net cash provided by operating activities ......................................................................... 387 349 239

Investing activities:

Acquisitions, net of cash acquired ................................................................................... (331 ) (35) (3)

Capital expenditures, including internal-use software and website development ............ (81 ) (55) (29)

Purchases of marketable securities .................................................................................. (251 ) (432) (219)

Sales of marketable securities .......................................................................................... 336 175 —

Maturities of marketable securities .................................................................................. 93 151 —

Distributions proceeds from Expedia related to Spin-Off ............................................... — — 7

Net cash used in investing activities ................................................................................... (234 ) (196) (244)

Financing activities:

Repurchase of common stock .......................................................................................... — (145) —

Proceeds from credit facilities ......................................................................................... 13 10 15

Payments to credit facilities ............................................................................................. (3 ) (15) (10)

Principal payments on long-term debt ............................................................................. (40 ) (40) (20)

Proceeds from exercise of stock options and warrants .................................................... 3 24 231

Payment of minimum withholding taxes on net share settlements of equity awards ....... (33 ) (14) (7)

Excess tax benefits from stock-based compensation ....................................................... 20 12 3

Payments to purchase subsidiary shares from noncontrolling interest ............................ — — (22)

Payments on construction in-process related to build to suit lease obligation, net .......... (1 ) (2) —

Net cash (used in) provided by financing activities .......................................................... (41 ) (170) 190

Effect of exchange rate changes on cash and cash equivalents ....................................... (8 ) 1 (1)

Net increase (decrease) in cash and cash equivalents....................................................... 104 (16) 184

Cash and cash equivalents at beginning of period ................................................................ 351 367 183

Cash and cash equivalents at end of period ...................................................................... $ 455 $ 351 $ 367

Supplemental disclosure of cash flow information...........................................................

Cash paid during the period for income taxes, net of refunds ......................................... $ 54 $ 50 $ 108

Cash paid during the period for interest ........................................................................... $ 7 $ 8 $ 10

Supplemental disclosure of non-cash investing and financing activities:

Capitalization of construction in-process related to build to suit lease obligation ........... $ 52 $ 8 $ —

Capital expenditures incurred but not yet paid primarily related to build to suit lease .... $ 10 $ — $ —

Non-cash fair value increase for redeemable noncontrolling interests ............................ $ — $ — $ 15

The accompanying notes are an integral part of these consolidated financial statements.