TripAdvisor 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

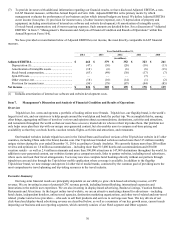

Key Drivers of Click-Based Advertising Revenue

For the years ended December 31, 2014, 2013 and 2012, 70%, 74% and 77%, respectively, of our total revenue came from our

CPC product. All of our CPC revenue is included in our Hotel segment. The key drivers of our CPC revenue include the growth in

monthly unique hotel shoppers and revenue per hotel shopper.

x Hotel shoppers: We believe that total traffic growth, or growth in monthly visits from unique visitors, is reflective of our

overall brand growth. Additionally, we track and analyze sub-segments of our traffic and their correlation to revenue

generation and utilize data regarding hotel shoppers as a key indicator of revenue growth. We use the term “hotel

shoppers” to refer to visitors who view either a listing of hotels in a city or a specific hotel page. The number of hotel

shoppers tends to vary based on seasonality of the travel industry and general economic conditions, as well as other

factors outside of our control. Given these factors, as well as the trend towards increased usage on mobile devices (for

which usage trends continue to evolve) and international growth, quarterly and annual hotel shopper growth is difficult to

forecast. Unique hotel shoppers on TripAdvisor sites increased 17% for the year ended December 31, 2014 over 2013 and

increased 35% for the year ended December 31, 2013 over 2012, according to our log files. The deceleration of hotel

shopper growth for the year ended December 31, 2014 is primarily due to high hotel shopper growth from search engine

optimization (“SEO”) for the year ended December 31, 2013, which provides for a challenging comparative. Increasing

the number of hotel shoppers on our sites remains a top strategic priority.

As our traffic grows and we optimize the hotel shopper experience on our site, the number of pages on which a user can

engage with the TripAdvisor brand also grows. We have captured these additional page views in the data for the year

ended December 31, 2014 regarding hotel shopper growth and have also updated our historical hotel shopper growth

figure for the years ended December 31, 2013 and 2012 for comparative purposes. The impact of this change is

immaterial to hotel shopper growth and revenue per hotel shopper and did not affect our consolidated financial statements

for any period presented.

x Revenue per hotel shopper: Revenue per hotel shopper is designed to measure how effectively we convert hotel shoppers

into revenue. Revenue per hotel shopper is made up of three factors—the number of monthly unique hotel shoppers, the

rate of conversion of a hotel shopper to a paid click and the price per click that we receive.

o Conversion: Conversion of a hotel shopper to a paid click on a TripAdvisor site is driven by three primary factors:

merchandising, commerce coverage and choice. We define merchandising as the number and location of ads that

are available on a page; we define commerce coverage as whether we have a client who can take an online

booking for a particular property; and we define choice as the number of clients available for any given property.

Hotel shoppers visiting via mobile generally convert to a paid click at a lower rate than hotel shoppers visiting via

desktop and tablet.

o Cost per click (CPC): Cost per click is the effective CPC that partners are willing to pay us for a hotel shopper

lead, by participating in a competitive bidding process which determines the CPC price paid. CPCs are generally

lower in emerging international markets as well as on mobile, given the use case and form factor of those devices.

Revenue per hotel shopper increased 7% for the year ended December 31, 2014 in comparison to 2013, and decreased

13% for the year ended December 31, 2013 in comparison to 2012, according to our log files. Revenue per hotel shopper

increased 7% for the year ended December 31, 2014, largely due to our implementation of hotel metasearch completed in

June of 2013, which has resulted in higher CPC pricing paid by our partners, due to higher quality clicks being delivered,

offset by relatively lower rates of hotel shopper conversion. Other factors that can impact revenue per hotel shopper

include the device and IP addresses from which users access TripAdvisor and the IP address of the user. In our

experience, hotel shoppers visiting on mobile devices generally exhibit a lower rate of conversion, monetize at a

significantly lower rate than hotel shoppers visiting via desktop or tablet and emerging international destinations tend to

have lower CPCs associated with them. A growing percentage of our hotel shoppers are using mobile; this trend will

create pressure on the revenue per hotel shopper metric, particularly if we fail to realize the opportunities we anticipate

with the transition to more mobile users.

Key Drivers of Display-Based Advertising Revenue

For the years ended December 31, 2014, 2013 and 2012, 11%, 13% and 12%, respectively, of our total revenue came from our

display-based advertising products. Substantially all of our display-based advertising revenue is included in our Hotel segment. The

key drivers of our display-based advertising revenue include the growth in number of impressions sold, or the number of times an ad

is displayed on our site, and the revenue we received for such impressions, measured in cost per thousand impressions (“CPM”).

According to our logs, number of impressions sold increased 19% for the year ended December 31, 2014 over 2013 and increased

34% for the year ended December 31, 2013 over 2012, which has typically correlated to our hotel shopper growth rates, while pricing

decreased 1% for the year ended December 31, 2014 over 2013 and decreased 5% for the years ended December 31, 2013 over 2012.