TripAdvisor 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

The percentage of votes for all classes of TripAdvisor’s capital stock is based on one vote for each share of common stock and

ten votes for each share of Class B common stock. There were 130,707,574 shares of common stock and 12,799,999 shares of Class B

common stock outstanding on April 20, 2015.

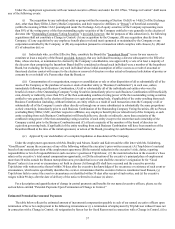

Common Stock Class B Common Stock

Percent (%)

of Votes

Beneficial Owner Shares % Shares % (All Classes)

5% Beneficial Owners

Liberty TripAdvisor Holdings, Inc. .......................... 30,959,751 (1) 21.6 12,799,999 (1) 100 56.5

12300 Liberty Boulevard Englewood, CO 80112

BlackRock, Inc. ......................................................... 10,752,245 (2) 7.5 0 0 4.2

55 East 52nd Street New York, NY 10022

Baillie Gifford & Co ................................................. 9,414,188 (3) 6.6 0 0 3.6

Calton Square 1 Greenside Row Edinburgh EH1

3AN Scotland, UK

Fidelity Management & Research Company ............ 9,150,544 (4) 6.4 0 0 3.5

245 Summer Street Boston, MA 02210

The Vanguard Group ................................................ 8,233,726 (5) 5.7 0 0 3.2

100 Vanguard Blvd Malvern, PA 19355

Prudential Financial, Inc. .......................................... 7,466,042 (6) 5.2 0 0 2.9

751 Broad Street Newark, NJ 07102-3777

N

amed Executive Officers and Directors

Gregory B. Maffei ..................................................... 9,235 (7) * 0 0 *

Stephen Kaufer .......................................................... 906,504 (8) * 0 0 *

Jonathan F. Miller ..................................................... 11,133 * 0 0 *

Dipchand (Deep) Nishar ........................................... 6,318 * 0 0 *

Jeremy Philips ........................................................... 11,133 * 0 0 *

Spencer M. Rascoff ................................................... 5,928 * 0 0 *

Christopher W. Shean ............................................... 7,297 * 0 0 *

Sukhinder Singh Cassidy .......................................... 11,133 * 0 0 *

Robert S. Wiesenthal................................................. 11,133 * 0 0 *

Julie M.B. Bradley .................................................... 148,989 (9) * 0 0 *

Seth J. Kalvert ........................................................... 100,997 (10) * 0 0 *

Dermot M. Halpin ..................................................... 62,617 (11) * 0 0 *

Barrie Seidenberg ...................................................... 21,721 (12) * 0 0 *

All executive officers, directors and director

nominees as a group (13 persons) .......................... 1,314,138 (13) * 0 0 *

* The percentage of shares beneficially owned does not exceed 1% of the class.

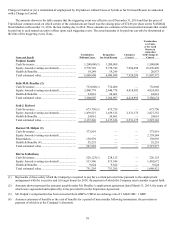

(1) Based on information contained in a Schedule 13D/A filed with the SEC on August 29, 2014 by Liberty TripAdvisor Holdings,

Inc. (“LTRIP”). Consists of 18,159,752 shares of Common Stock and 12,799,999 shares of Class B Common Stock owned by

LTRIP. Excludes shares beneficially owned by the executive officers and directors of LTRIP, as to which LTRIP disclaims

beneficial ownership.

(2) Based solely on information contained in a Schedule 13G filed with the SEC on February 6, 2015 by BlackRock, Inc. According

to the Schedule 13G, BlackRock beneficially owns and has sole dispositive power with respect to 10,752,245 shares but only

has sole voting power with respect to 8,699,082 shares.

(3) Based solely on information contained in a Schedule 13G/A filed with the SEC on February 10, 2015 by Ballie Gifford & Co.

(“BG&C”). According to the Schedule 13G/A, BG&C beneficially owns and has sole dispositive power with respect to

9,414,188 shares but only has sole voting power with respect to 6,657,342 shares.

(4) Based solely on information contained in a Schedule 13G/A filed with the SEC on February 13, 2015 by FMR LLC, the parent

holding company of Fidelity Management & Research Company (“Fidelity”). According to the Schedule 13G/A, Edward C.

Johnson 3d and FMR LLC, through its control of Fidelity, and the Fidelity funds (“Funds”), each beneficially owns and has sole

power to dispose of 9,150,544 shares owned by the Funds. Neither FMR LLC nor Edward C. Johnson 3d, Chairman of FMR

LLC, has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides