TripAdvisor 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Letters of Credit

As of December 31, 2014, we have issued unused letters of credit totaling $1 million, related to our property leases.

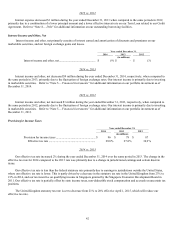

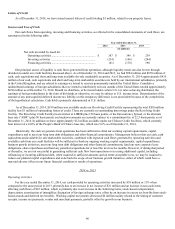

Sources and Uses of Cash

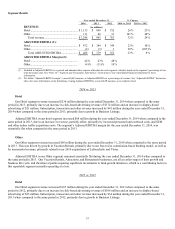

Our cash flows from operating, investing and financing activities, as reflected in the consolidated statements of cash flows, are

summarized in the following table:

Year ended December 31,

2014 2013 2013

(in millions)

N

et cash provided by (used in):

Operating activities ........................................................... $ 387 $ 349 $ 239

Investing activities ............................................................ (234) (196 ) (244)

Financing activities ........................................................... (41) (170 ) 190

Our principal source of liquidity is cash flows generated from operations, although liquidity needs can also be met through

drawdowns under our credit facilities discussed above. As of December 31, 2014 and 2013, we had $594 million and $670 million of

cash, cash equivalents and short and long-term available-for-sale marketable securities. As of December 31, 2014 approximately $435

million of our cash, cash equivalents and short and long-term marketable securities are held by our international subsidiaries, primarily

in the United Kingdom, and are related to earnings we intend to reinvest permanently outside the United States. Cumulative

undistributed earnings of foreign subsidiaries that we intend to indefinitely reinvest outside of the United States totaled approximately

$630 million as of December 31, 2014. Should we distribute, or be treated under certain U.S. tax rules as having distributed, the

earnings of foreign subsidiaries in the form of dividends or otherwise, we may be subject to U.S. income taxes. Determination of the

amount of any unrecognized deferred income tax liability on this temporary difference is not practicable because of the complexities

of the hypothetical calculation. Cash held is primarily denominated in U.S. dollars.

As of December 31, 2014, $199 million was available under our Revolving Credit Facility representing the total $200 million

facility less $1 million of outstanding letters of credit. There are currently no outstanding borrowings under the Revolving Credit

Facility. The Revolving Credit Facility bears interest at LIBOR plus 150 basis points, or the Eurocurrency Spread, or the alternate

base rate (“ABR”) plus 50 basis points, and undrawn amounts are currently subject to a commitment fee of 22.5 basis points, as of

December 31, 2014. In addition we have approximately $12 million available under our Chinese Credit Facilities, which currently

bear interest at a 100% of the People’s Bank of China’s base rate, which was 5.6% as of December 31, 2014.

Historically, the cash we generate from operations has been sufficient to fund our working capital requirements, capital

expenditures and to meet our long term debt obligations and other financial commitments. Management believes that our cash, cash

equivalents and available for sale marketable securities, combined with expected cash flows generated by operating activities and

available cash from our credit facilities will be sufficient to fund our ongoing working capital requirements, capital expenditures,

business growth initiatives, meet our long term debt obligations and other financial commitments, fund our new corporate lease

obligations, share repurchases and fund any potential acquisitions for at least the next twelve months. However, if during that period

or thereafter, we are not successful in generating sufficient cash flow from operations or in raising additional capital, including

refinancing or incurring additional debt, when required in sufficient amounts and on terms acceptable to us, we may be required to

reduce our planned capital expenditures and scale back the scope of our business growth initiatives, either of which could have a

material adverse effect on our future financial condition or results of operations.

2014 vs. 2013

Operating Activities

For the year ended December 31, 2014, net cash provided by operating activities increased by $38 million or 11% when

compared to the same period in 2013, primarily due to an increase in net income of $21 million and an increase in non-cash items

affecting cash flows of $23 million, which is primarily due to an increase in the following items; stock-based compensation;

depreciation; amortization of intangibles; fluctuation of foreign exchange rates, offset by an increase in excess tax benefits from stock-

based awards and deferred tax benefits. Working capital movements decreased $6 million mainly related to the timing of customer

receipts, income tax payments, vendor and merchant payments, partially offset by growth in our business.