Travelers 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

Table of Contents

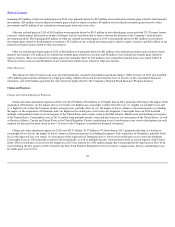

in the U.S. and worldwide may not succeed initially or may later be challenged by third parties. Further, the laws of certain countries outside the

United States may not adequately protect our intellectual property rights. We may incur significant costs in our efforts to protect and enforce our

intellectual property, including the initiation of expensive and protracted litigation, and we may not prevail. Any inability to enforce our intellectual

property rights could have a material adverse effect on our business and our ability to compete.

We may be subject to claims by third parties from time to time that our products, services and technologies infringe on their intellectual

property rights. In recent years, certain entities have acquired patents in order to allege claims of infringement against companies, including in

some cases, us. Any intellectual property infringement claims brought against us could cause us to spend significant time and money to defend

ourselves, regardless of the merits of the claims. If we are found to infringe any third

-

party intellectual property rights, it could result in reputational

harm, payment of significant monetary damages, payment of license fees (if licenses are even available to us, on reasonable terms or otherwise)

and/or substantial time and expense to redesign our products, services or technologies to avoid the infringement. In addition, we use third

-

party

software in some of our products, services and technologies. If any of our software vendors or licensors are faced with infringement claims, we may

lose our ability to use such software until the dispute is resolved. If we cannot successfully redesign an infringing product, service or technology

(or procure a substitute version), this could have a material adverse effect on our business and our ability to compete.

Changes to existing accounting standards may adversely impact our reported results.

As a U.S.

-

based SEC registrant, we are currently

required to prepare our financial statements in accordance with U.S. Generally Accepted Accounting Principles (U.S. GAAP), as promulgated by

the Financial Accounting Standards Board (FASB), subject to the accounting

-

related rules and interpretations of the Securities and Exchange

Commission (SEC). During the last several years, the SEC has been evaluating whether, when and how International Financial Reporting Standards

(IFRS) should be incorporated into the U.S. financial reporting system, including for companies such as us. In December 2014, the SEC indicated

that it plans to explore allowing IFRS financial statements or financial information as supplemental information in SEC filings.

The FASB and the International Accounting Standards Board (IASB) have been working on a long

-

term project to converge U.S. GAAP and

IFRS, which included a project on insurance accounting. While the FASB decided during 2014 to retain current U.S. GAAP for property and

casualty insurance contracts, the IASB is continuing its development of a new model that is significantly different than current U.S. GAAP.

We are not able to predict whether we will choose to, or be required to, adopt IFRS or how the adoption of IFRS (or the convergence of

U.S. GAAP and IFRS, including the project on the accounting for insurance contracts) may impact our financial statements in the future. Changes

in accounting standards, particularly those that specifically apply to insurance company operations, may impact the content and presentation of

our reported financial results and could cause increased volatility in reported earnings, resulting in other adverse impacts on the Company's ratings

and cost of capital, and decrease the understandability of our financial results as well as the comparability of our reported results with other

insurers.

Changes in U.S. tax laws or in the tax laws of other jurisdictions in which we operate could adversely impact us.

Tax laws may change in

ways that adversely impact us. For example, federal tax legislation could be enacted to reduce the existing statutory U.S. federal corporate income

tax rate from 35%, which would, accordingly, reduce any U.S. deferred tax asset. The amount of any net deferred tax asset is volatile and

significantly impacted by changes in unrealized investment gains and losses. The effect of a reduction in a tax rate on net deferred tax assets is

required to be recognized, in full, as a reduction of income from continuing operations in the period when enacted and, along with

74