Travelers 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

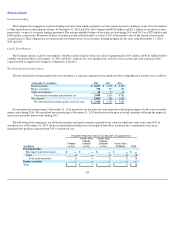

Table of Contents

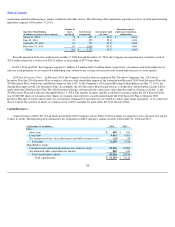

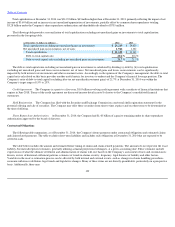

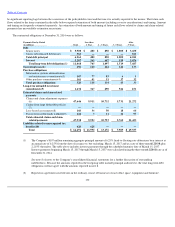

adjustment expense reserves, as the Company retains the contingent liability to the claimant. If it is expected that the life insurance company is not

able to pay, the Company would recognize an impairment of the related reinsurance recoverable if, and to the extent, the purchased annuities are

not covered by state guaranty associations. In the event that the life insurance company fails to make the required annuity payments, the Company

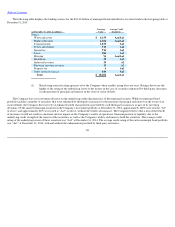

would be required to make such payments. The following table presents the Company's top five groups by structured settlements at December 31,

2014 (in millions). Also included is the A.M. Best rating of the Company's predominant insurer from each insurer group at February 12, 2015:

The Company considers the ratings and related outlook assigned to reinsurance companies and life insurance companies by various

independent ratings agencies in assessing the adequacy of its allowance for uncollectible amounts.

OUTLOOK

The following discussion provides outlook information for certain key drivers of the Company's results of operations and capital position.

Premiums.

The Company's earned premiums are a function of net written premium volume. Net written premiums comprise both renewal

business and new business and are recognized as earned premium over the life of the underlying policies. When business renews, the amount of

net written premiums associated with that business may increase or decrease (renewal premium change) as a result of increases or decreases in rate

and/or insured exposures, which the Company considers as a measure of units of exposure (such as the number and value of vehicles or properties

insured). Net written premiums from both renewal and new business, and therefore earned premiums, are impacted by competitive market

conditions as well as general economic conditions, which, particularly in the case of the Business and International Insurance segment, affect audit

premium adjustments, policy endorsements and mid

-

term cancellations. Net written premiums are also impacted by the structure of reinsurance

programs and related costs.

Overall, the Company expects retention levels (the amount of expiring premium that renews, before the impact of renewal premium changes) will

remain strong. In the Business and International Insurance segment, the Company expects that renewal premium changes during 2015 will remain

positive, driven by both positive renewal rate changes and, subject to the economic uncertainties discussed below, growth in insured exposures,

but will be lower than the levels attained in 2014. In the Bond & Specialty Insurance segment, the Company expects that renewal premium changes

during 2015 will be broadly consistent with 2014. With respect to surety, the Company expects net written premium volume in 2015 that is broadly

consistent with the levels attained in 2014. In the Personal Insurance segment, the Company expects both Agency Automobile and Agency

Homeowners and Other renewal premium changes during 2015 will remain positive, driven by both positive renewal rate changes (based on the

Company's actions to file for rate increases) and, subject to the economic uncertainties discussed below, growth in insured exposures, but will be

lower than the levels attained in 2014. The

121

Group

Structured

Settlements

A.M. Best Rating of Group's Predominant Insurer

Fidelity & Guaranty Life Group

$

938

B++

fifth highest of 16 ratings

MetLife Group

439

A+

second highest of 16 ratings

Genworth Financial Group(1)

414

A

third highest of 16 ratings

John Hancock Group

259

A+

second highest of 16 ratings

Symetra Financial Corporation

238

A

third highest of 16 ratings

(1)

A.M. Best has placed the ratings of Genworth Financial Group under review with negative implications.