Travelers 2014 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

Table of Contents

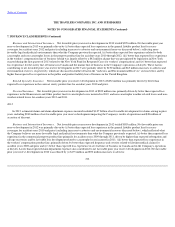

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

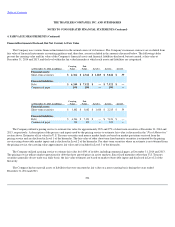

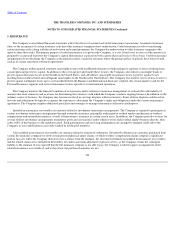

5. REINSURANCE

The Company's consolidated financial statements reflect the effects of assumed and ceded reinsurance transactions. Assumed reinsurance

refers to the acceptance of certain insurance risks that other insurance companies have underwritten. Ceded reinsurance involves transferring

certain insurance risks (along with the related written and earned premiums) the Company has underwritten to other insurance companies who

agree to share these risks. The primary purpose of ceded reinsurance is to protect the Company, at a cost, from losses in excess of the amount it is

prepared to accept and to protect the Company's capital. Reinsurance is placed on both a quota

-

share and excess

-

of

-

loss basis. Ceded reinsurance

arrangements do not discharge the Company as the primary insurer, except for instances where the primary policy or policies have been novated,

such as in certain structured settlement agreements.

The Company utilizes general corporate catastrophe treaties with unaffiliated reinsurers to help manage its exposure to losses resulting from

catastrophes and protect its capital. In addition to the coverage provided under these treaties, the Company also utilizes catastrophe bonds to

protect against hurricane losses in the Northeastern United States, and a Northeast catastrophe reinsurance treaty to protect against losses

resulting from weather

-

related and earthquake catastrophes in the Northeastern United States. The Company also utilizes excess

-

of

-

loss treaties to

protect against earthquake losses up to a certain threshold in the Business and International Insurance segment (for certain markets) and for the

Personal Insurance segment, and several reinsurance treaties specific to its international operations.

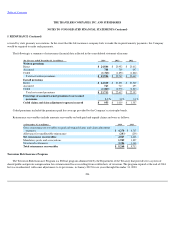

The Company monitors the financial condition of its reinsurers under voluntary reinsurance arrangements to evaluate the collectability of

amounts due from reinsurers and as a basis for determining the reinsurers with which the Company conducts ongoing business. In addition, in the

ordinary course of business, the Company may become involved in coverage disputes with its reinsurers. Some of these disputes could result in

lawsuits and arbitrations brought by or against the reinsurers to determine the Company's rights and obligations under the various reinsurance

agreements. The Company employs dedicated specialists and strategies to manage reinsurance collections and disputes.

Included in reinsurance recoverables are amounts related to involuntary reinsurance arrangements. The Company is required to participate in

various involuntary reinsurance arrangements through assumed reinsurance, principally with regard to residual market mechanisms in workers'

compensation and automobile insurance, as well as homeowners' insurance in certain coastal areas. In addition, the Company provides services for

several of these involuntary arrangements (mandatory pools and associations) under which it writes such residual market business directly, then

cedes 100% of this business to the mandatory pool. Such participations and servicing arrangements are arranged to mitigate credit risk to the

Company, as any ceded balances are jointly backed by all the pool members.

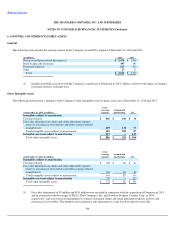

Also included in reinsurance recoverables are amounts related to structured settlements. Structured settlements are annuities purchased from

various life insurance companies to settle certain personal physical injury claims, of which workers' compensation claims comprise a significant

portion. In cases where the Company did not receive a release from the claimant, the structured settlement is included in reinsurance recoverables

and the related claim cost is included in the liability for claims and claim adjustment expense reserves, as the Company retains the contingent

liability to the claimant. If it is expected that the life insurance company is not able to pay, the Company would recognize an impairment of the

related reinsurance recoverable if, and to the extent, the purchased annuities are not

205