Travelers 2014 Annual Report Download - page 338

Download and view the complete annual report

Please find page 338 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. Grant of Performance Shares. This performance shares award is granted pursuant to The Travelers Companies, Inc. 2014 Stock Incentive

Plan, as it may be amended from time to time (the “Plan”

),

by The Travelers Companies, Inc. (the “Company”

)

to you (the “Participant”

)

as an

employee of the Company or an affiliate of the Company (together, the “Travelers Group”

).

The Company hereby grants to the Participant as of the

Grant Date an award (“Award”

)

for the initial number of Performance Shares set forth above pursuant to the Plan, as it may be amended from time to

time, and subject to the terms, conditions, and restrictions set forth herein, including, without limitation, the conditions set forth in Section 7.

2.

Terms and Conditions.

The terms, conditions, and restrictions applicable to the Award are specified the Plan and this grant notification

and agreement, including Exhibits A, B and C (the “Award Agreement”

).

The terms, conditions and restrictions in the Plan include, but are not

limited to, provisions relating to amendment, vesting, cancellation and settlement, all of which are hereby incorporated by reference into this Award

Agreement to the extent not otherwise set forth herein.

By accepting this Award, the Participant acknowledges receipt of the prospectus dated February 3, 2015 and any applicable prospectus

supplement thereto (together, the

“Prospectus”

)

and that he or she has read and understands the Prospectus.

The Participant understands that the Award and all other incentive awards are entirely discretionary and that no right to receive an award exists

absent a prior written agreement with the Company to the contrary. The Participant also understands that the value that may be realized, if any,

from the Award is contingent, and depends on the future financial performance of the Company, among other factors. The Participant further

confirms his or her understanding that the Award is intended to promote employee retention and stock ownership and to align participants

’

interests with those of shareholders. Additionally, the Participant understands that the Award is subject to performance conditions and will be

cancelled if the performance or other conditions are not satisfied. Thus, the Participant understands that (a) any monetary value assigned to the

Award in any communication regarding the Award is contingent, hypothetical, or for illustrative purposes only, and does not express or imply any

promise or intent by the Company to deliver, directly or indirectly, any certain or determinable cash value to the Participant; (b) receipt of the

Award or any incentive award in the past is neither an indication nor a guarantee that an incentive award of any type or amount will be made in the

future, and that absent a written agreement to the contrary, the Company is free to change its practices and policies regarding incentive awards at

any time; and (c) performance may be subject to confirmation and final determination by the Company

’

s Board of Directors or its Compensation

Committee (the “

Committee

”

)

that the performance conditions have been satisfied.

The Participant shall have no rights as a stockholder of the Company with respect to any shares covered by the Award unless and until the Award

is vested and settled in shares of Common Stock.

3.

Performance Period.

For purposes of the Award, the Performance Period shall be defined as the three

-

year period commencing XXXXX

XX, 20XX and ending XXXXX XX, 20XX.

4. Vesting. The Award shall vest in full on the last day of the Performance Period, provided the Participant remains continuously employed

within the Travelers Group through such date. If the

1

Participant has a termination of, or leave from active employment prior to the last day of the Performance Period, the Participant

’

s rights are

determined under the Award Rules of Exhibit A.

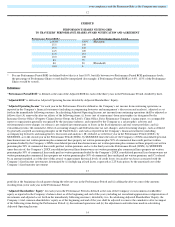

5.

Settlement of Award.

The number of Performance Shares vested (which shall include any additional Performance Shares credited to the

Participant

’

s account pursuant to Section 6) shall be calculated based on the Performance Shares Vesting Grid set forth in Exhibit B. The Company

shall deliver to the Participant, subject to any certification of satisfaction of the performance goal as required by the Plan in order to comply with

Section 162(m) of the Internal Revenue Code a number of shares of Common Stock equal to the number of vested Performance Shares on January 1

of the year following the end of the Performance Period or as soon as administratively practicable thereafter (but no later than March 15 of the year

following the end of the Performance Period, or the date provided pursuant to Exhibit A, if applicable). The number of shares of Common Stock

delivered to the Participant shall be reduced by a number of shares of Common Stock having a Fair Market Value on the date of delivery equal to

the tax withholding obligation.

6.

Dividend Equivalents.

The Participant shall be entitled to receive additional Performance Shares with respect to any cash dividends

declared by the Company. The number of additional Performance Shares shall be determined by multiplying the number of Performance Shares

credited to the Participant

’

s account (which shall include the number of Performance Shares set forth above, plus any Performance Shares credited

in connection with dividend payments under this Section 6), times the dollar amount of the cash dividend per share of Common Stock, and then

dividing by the Fair Market Value of the Common Stock as of the dividend payment date. The Participant

’

s right to any Performance Shares

credited to the Participant

’

s account in connection with dividends shall vest in the same manner described in Section 4. As described in Section 5,

such additional Performance Shares shall be included in the total number of Performance Shares credited to the Participant

’

s account for purposes

of applying the Performance Shares Vesting Grid.

7.

Grant Conditioned on Principles of Employment Agreement.

By entering into this Award Agreement, the Participant shall be deemed to have confirmed his or her agreement to be bound by the Company

’

s

Principles of Employment Agreement in effect on the date immediately preceding the Grant Date (the “POE Agreement”

),

as published on the

Company

’

s intranet site or previously distributed in hard copy to the Participant. Furthermore, by accepting the Award, the Participant agrees that

the POE Agreement shall supersede and replace the form of Principles of Employment Agreement contained or referenced in any Prior Equity

Award (as defined below) made by the Company to the Participant, and, accordingly, such Prior Equity Award shall become subject to the terms

and conditions of the POE Agreement.