Travelers 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

Table of Contents

(7)

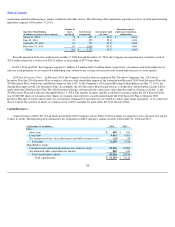

Workers' compensation large deductible policies provide third party coverage in which the Company typically is responsible for paying the

entire loss under such policies and then seeks reimbursement from the insured for the deductible amount. "Claims from large deductible

policies" represent the estimated future payment for claims and claim related expenses below the deductible amount, net of the estimated

recovery of the deductible. The liability and the related deductible receivable for unpaid claims are presented in the consolidated balance

sheet as "contractholder payables" and "contractholder receivables," respectively. Most deductibles for such policies are paid directly

from the policyholder's escrow which is periodically replenished by the policyholder. The payment of the loss amounts above the

deductible are reported within "Claims and claim adjustment expenses" in the above table. Because the timing of the collection of the

deductible (contractholder receivables) occurs shortly after the payment of the deductible to a claimant (contractholder payables), these

cash flows offset each other in the table.

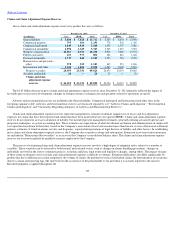

The estimated timing of the payment of the contractholder payables and the collection of contractholder receivables for workers'

compensation policies is presented below:

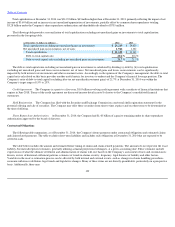

(8)

The amounts in "Loss

-

based assessments" relate to estimated future payments of second

-

injury fund assessments which would result from

payment of current claim liabilities. Second injury funds cover the cost of any additional benefits for aggravation of a pre

-

existing condition.

For loss

-

based assessments, the cost is shared by the insurance industry and self

-

insureds, funded through assessments to insurance

companies and self

-

insureds based on losses. Amounts relating to second

-

injury fund assessments are included in "other liabilities" in the

consolidated balance sheet.

(9)

The amounts in "Payout from ceded funds withheld" represent estimated payments for losses and return of funds held related to certain

reinsurance arrangements whereby the Company holds a portion of the premium due to the reinsurer and is allowed to pay claims from the

amounts held.

(10)

The Company's current liabilities related to unrecognized tax benefits from uncertain tax positions are $628 million. Offsetting these liabilities

are deferred tax assets of $588 million associated with the temporary differences that would exist if these positions become realized.

The above table does not include an analysis of liabilities reported for structured settlements for which the Company has purchased annuities

and remains contingently liable in the event of default by the company issuing the annuity. The Company is not reasonably likely to incur material

future payment obligations under such agreements. In addition, the Company is not currently subject to any minimum funding requirements for its

qualified pension plan. Accordingly, future contributions are not included in the foregoing table.

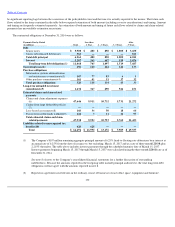

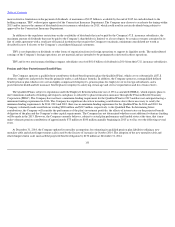

Dividend Availability

The Company's principal insurance subsidiaries are domiciled in the state of Connecticut. The insurance holding company laws of Connecticut

applicable to the Company's subsidiaries requires notice to, and approval by, the state insurance commissioner for the declaration or payment of

any dividend that, together with other distributions made within the preceding twelve months, exceeds the greater of 10% of the insurer's statutory

capital and surplus as of the preceding December 31, or the insurer's net income for the twelve

-

month period ending the preceding December 31, in

each case determined in accordance with statutory accounting practices and by state regulation. This declaration or payment is further limited by

adjusted unassigned surplus, as determined in accordance with statutory accounting practices. The insurance holding company laws of other

states in which the Company's subsidiaries are domiciled generally contain similar, although in some instances somewhat

132

(in millions)

Total

Less than

1 Year

1

-

3 Years

3

-

5 Years

After

5 Years

Contractholder payables/receivables

$

4,362

$

1,089

$

1,211

$

657

$

1,405