Travelers 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

Table of Contents

UNCERTAINTY REGARDING ADEQUACY OF ASBESTOS AND ENVIRONMENTAL RESERVES

As a result of the processes and procedures discussed above, management believes that the reserves carried for asbestos and environmental

claims are appropriately established based upon known facts, current law and management's judgment. However, the uncertainties surrounding the

final resolution of these claims continue, and it is difficult to determine the ultimate exposure for asbestos and environmental claims and related

litigation. As a result, these reserves are subject to revision as new information becomes available and as claims develop. The continuing

uncertainties include, without limitation, the risks and lack of predictability inherent in complex litigation, any impact from the bankruptcy

protection sought by various asbestos producers and other asbestos defendants, a further increase or decrease in the cost to resolve, and/or the

number of, asbestos and environmental claims beyond that which is anticipated, the emergence of a greater number of asbestos claims than

anticipated as a result of extended life expectancies resulting from medical advances and lifestyle improvements, the role of any umbrella or excess

policies the Company has issued, the resolution or adjudication of disputes pertaining to the amount of available coverage for asbestos and

environmental claims in a manner inconsistent with the Company's previous assessment of these claims, the number and outcome of direct actions

against the Company, future developments pertaining to the Company's ability to recover reinsurance for asbestos and environmental claims and

the unavailability of other insurance sources potentially available to policyholders, whether through exhaustion of policy limits or through the

insolvency of other participating insurers. In addition, uncertainties arise from the insolvency or bankruptcy of policyholders and other

defendants. It is also not possible to predict changes in the legal, regulatory and legislative environment and their impact on the future

development of asbestos and environmental claims. This environment could be affected by changes in applicable legislation and future court and

regulatory decisions and interpretations, including the outcome of legal challenges to legislative and/or judicial reforms establishing medical criteria

for the pursuit of asbestos claims. It is also difficult to predict the ultimate outcome of complex coverage disputes until settlement negotiations near

completion and significant legal questions are resolved or, failing settlement, until the dispute is adjudicated. This is particularly the case with

policyholders in bankruptcy where negotiations often involve a large number of claimants and other parties and require court approval to be

effective. As part of its continuing analysis of asbestos and environmental reserves, the Company continues to study the implications of these and

other developments.

Because of the uncertainties set forth above, additional liabilities may arise for amounts in excess of the Company's current reserves. In

addition, the Company's estimate of claims and claim adjustment expenses may change. These additional liabilities or increases in estimates, or a

range of either, cannot now be reasonably estimated and could result in income statement charges that could be material to the Company's

operating results in future periods.

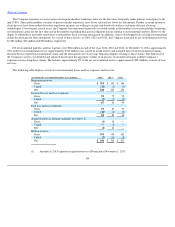

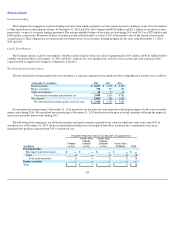

INVESTMENT PORTFOLIO

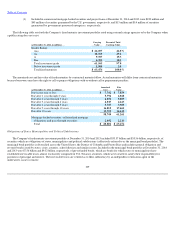

The Company's invested assets at December 31, 2014 were $73.26 billion, of which 93% was invested in fixed maturity and short

-

term

investments, 1% in equity securities, 1% in real estate investments and 5% in other investments. Because the primary purpose of the investment

portfolio is to fund future claims payments, the Company employs a conservative investment philosophy. A significant majority of funds available

for investment are deployed in a widely diversified portfolio of high quality, liquid, taxable U.S. government, tax

-

exempt U.S. municipal and taxable

corporate and U.S. agency mortgage

-

backed bonds.

The carrying value of the Company's fixed maturity portfolio at December 31, 2014 was $63.47 billion. The Company closely monitors the

duration of its fixed maturity investments, and investment purchases and sales are executed with the objective of having adequate funds available

to satisfy the Company's insurance and debt obligations. The weighted average credit quality of the Company's fixed maturity portfolio, both

including and excluding U.S. Treasury securities, was "Aa2" at

107