Time Warner Cable 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

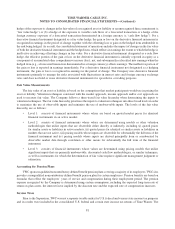

performed as of December 31, 2008, did not result in any goodwill impairments, but did result in a noncash pretax

impairment charge on cable franchise rights of $14.822 billion.

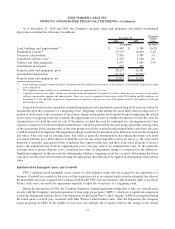

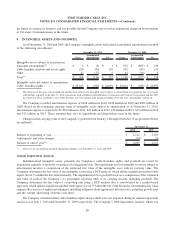

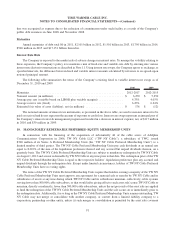

The carrying value of cable franchise rights and goodwill by unit of accounting as of December 31, 2010 and 2009

was as follows (in millions):

Cable

Franchise

Rights Goodwill

Cable

Franchise

Rights Goodwill

December 31, 2010 December 31, 2009

Carrying Value as of

Midwest .................................... $ 5,934 $ 562 $ 5,028 $ 505

Northeast ................................... 5,645 466 5,645 466

Carolinas ................................... 3,969 231 3,908 224

West....................................... 3,498 484 3,350 489

New York City . .............................. 3,345 204 3,345 204

Texas...................................... 1,700 144 1,700 143

National

(a)

................................... — — 722 80

Kansas City

(a)

................................ — — 394 —

Total....................................... $ 24,091 $ 2,091 $ 24,092 $ 2,111

(a)

In connection with certain operational reorganizations during 2010, the Company combined its Kansas City and Midwest reporting units. In

addition, the Company dissolved its National reporting unit and allocated the systems contained therein to its West, Midwest and Carolinas

reporting units. The Company tested the cable franchise rights and goodwill held by the aforementioned units of accounting for impairment

immediately prior to the reorganizations and determined that no impairments existed.

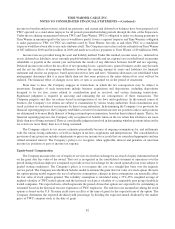

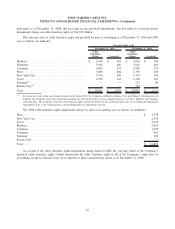

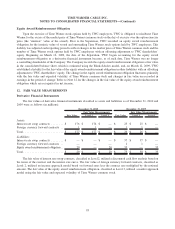

The 2008 cable franchise rights impairment charge by unit of accounting was as follows (in millions):

West......................................................................... $ 3,558

New York City ................................................................. 2,156

Texas ........................................................................ 3,270

Midwest ...................................................................... 2,835

Carolinas ...................................................................... 1,659

Northeast...................................................................... 962

National ...................................................................... 382

Kansas City .................................................................... —

Total ......................................................................... $ 14,822

As a result of the cable franchise rights impairment charge taken in 2008, the carrying values of the Company’s

impaired cable franchise rights (which represented the cable franchise rights in all of the Company’s eight units of

accounting except for Kansas City) were adjusted to their estimated fair values as of December 31, 2008.

87

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)