Time Warner Cable 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

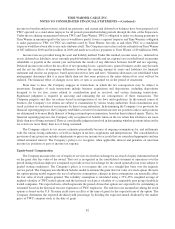

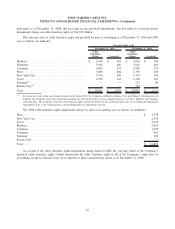

9. DEBT

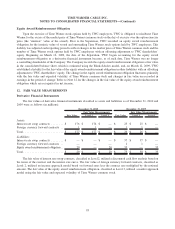

TWC’s debt as of December 31, 2010 and 2009 was as follows:

Maturity 2010 2009

Outstanding Balance as of

December 31,

(in millions)

Revolving credit facility ........................................ 2013 $ — $ —

Commercial paper program

(a)

.................................... 2013 — 1,261

Senior notes and debentures

(b)

................................... 2012-2040 23,118 21,059

Capital leases and other ........................................ 3 11

Total ...................................................... $ 23,121 $ 22,331

(a)

Outstanding balance amount as of December 31, 2009 excludes an unamortized discount on commercial paper of $1 million.

(b)

The weighted-average effective interest rate for senior notes and debentures as of December 31, 2010 is 6.231% and includes the effects of interest

rate swap contracts.

Revolving Credit Facility and Commercial Paper Program

On November 3, 2010, the Company entered into a credit agreement for a $4.0 billion senior unsecured three-year

revolving credit facility maturing in November 2013 (the “$4.0 billion Revolving Credit Facility”), and the Company’s

$5.875 billion senior unsecured five-year revolving credit facility (the “$5.875 billion Revolving Credit Facility”),

scheduled to mature in February 2011, was terminated.

The Company’s obligations under the $4.0 billion Revolving Credit Facility are guaranteed by its subsidiaries, TWE

and TW NY. Borrowings under the $4.0 billion Revolving Credit Facility bear interest at a rate based on the credit rating

of TWC, which rate was LIBOR plus 1.25% per annum at December 31, 2010. In addition, TWC is required to pay a

facility fee on the aggregate commitments under the $4.0 billion Revolving Credit Facility at a rate determined by the

credit rating of TWC, which rate was 0.25% per annum at December 31, 2010. TWC may also incur an additional usage

fee of 0.25% per annum on the outstanding loans and other extensions of credit under the $4.0 billion Revolving Credit

Facility if and when such amounts exceed 25% of the aggregate commitments thereunder. The $4.0 billion Revolving

Credit Facility provides same-day funding capability, and a portion of the aggregate commitments, not to exceed

$500 million at any time, may be used for the issuance of letters of credit.

The $4.0 billion Revolving Credit Facility contains conditions, covenants, representations and warranties and events

of default (with customary grace periods, as applicable) substantially similar to the conditions, covenants, representations

and warranties and events of default that were contained in the Company’s $5.875 billion Revolving Credit Facility,

including a maximum leverage ratio covenant of 5.0 times TWC’s consolidated EBITDA. The terms and related financial

metrics associated with the leverage ratio are defined in the agreement. At December 31, 2010, TWC was in compliance

with the leverage ratio covenant, calculated in accordance with the agreement, with a ratio of approximately 2.9 times.

The $4.0 billion Revolving Credit Facility does not contain any: credit ratings-based defaults or covenants; ongoing

covenants or representations specifically relating to a material adverse change in TWC’s financial condition or results of

operations; or borrowing restrictions due to material adverse changes in the Company’s business or market disruption.

Borrowings under the $4.0 billion Revolving Credit Facility may be used for general corporate purposes, and unused

credit is available to support borrowings under the CP Program (as defined below).

In connection with the entry into the $4.0 billion Revolving Credit Facility, the Company’s unsecured commercial

paper program (the “CP Program”) was reduced from $6.0 billion to $4.0 billion. The CP Program is also guaranteed by

TW NYand TWE. Commercial paper issued under the CP Program is supported by unused committed capacity under the

$4.0 billion Revolving Credit Facility and ranks pari passu with other unsecured senior indebtedness of TWC, TWE and

TW NY.

88

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)