Time Warner Cable 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

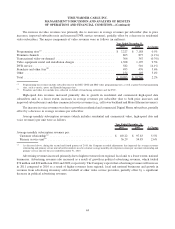

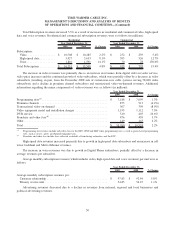

budget, which resulted in a decrease in the Company’s state deferred tax liabilities and a corresponding noncash tax

benefit of $40 million, which was recorded in the fourth quarter of 2010.

The income tax provision and the effective tax rates for 2010 also benefited from an adjustment of $29 million to the

Company’s valuation allowance for deferred tax assets associated with an equity-method investment.

The income tax provision and the effective tax rate for 2010 were also impacted by a net noncash charge of

$68 million related to the reversal of previously recognized deferred income tax benefits primarily as a result of the

expiration, on March 12, 2010, of vested Time Warner stock options held by TWC employees. As a result of the

Separation on March 12, 2009, TWC employees who held stock options under Time Warner equity plans were treated as if

their employment with Time Warner had been terminated without cause at the time of the Separation. In most cases, this

treatment resulted in shortened exercise periods, generally one year from the date of Separation, for vested Time Warner

stock options held by TWC employees.

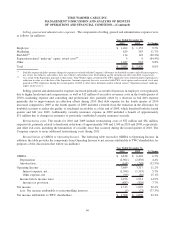

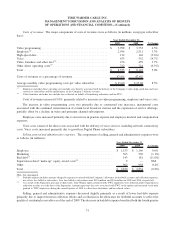

Vested Time Warner stock options held primarily by certain retirement-eligible TWC employees (pursuant to the

terms of the award agreements) have exercise periods of up to five years from the date of the Separation. As such, the

Company estimates that it may incur additional noncash income tax expense of up to approximately $90 million through

March 2014 upon the exercise or expiration of these stock options. Up to approximately $50 million of such expense is

expected to be incurred in the first quarter of 2011 and may be partially reduced during 2011 as TWC equity awards vest

and are exercised. These estimates and the timing of such charges are dependent on a number of variables related to TWC

and Time Warner equity awards, including the respective stock prices and the timing of the exercise or expiration of stock

options and restricted stock units.

Absent the impacts of the California tax law changes, valuation allowance adjustment and the reversal of previously

recognized deferred income tax benefits primarily resulting from the expiration of vested Time Warner stock options, the

effective tax rates would have been 40.3% and 40.9% for 2010 and 2009, respectively.

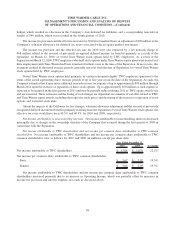

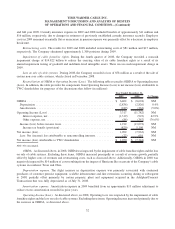

Net income attributable to noncontrolling interests. Net income attributable to noncontrolling interests decreased

principally due to changes in the ownership structure of the Company that occurred during the first quarter of 2009 in

connection with the Separation.

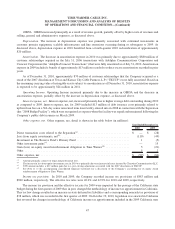

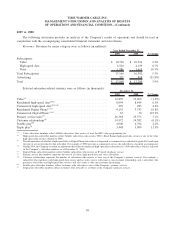

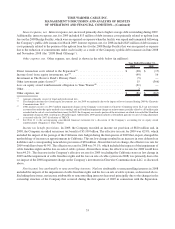

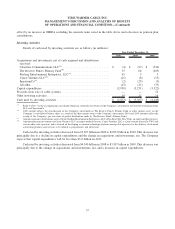

Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders. Net income attributable to TWC shareholders and net income per common share attributable to TWC

common shareholders were as follows for 2010 and 2009 (in millions, except per share data):

2010 2009 % Change

Year Ended December 31,

Net income attributable to TWC shareholders .......................... $ 1,308 $ 1,070 22.2%

Net income per common share attributable to TWC common shareholders:

Basic ...................................................... $ 3.67 $ 3.07 19.5%

Diluted .................................................... $ 3.64 $ 3.05 19.3%

Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders increased primarily due to an increase in Operating Income, which was partially offset by increases in

income tax provision and interest expense, net, each as discussed above.

48

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)