Time Warner Cable 2010 Annual Report Download - page 76

Download and view the complete annual report

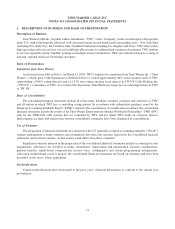

Please find page 76 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.asset exceeds its fair value, an impairment charge is recognized in an amount equal to that excess. The estimates of fair

value of intangible assets not subject to amortization are determined using a discounted cash flow (“DCF”) analysis. The

DCF methodology used to value cable franchise rights entails identifying the projected discrete cash flows related to such

cable franchise rights and discounting them back to the valuation date. Significant judgments inherent in this analysis

include the selection of appropriate discount rates, estimating the amount and timing of future cash flows attributable to

cable franchise rights and identification of appropriate terminal growth rate assumptions. The discount rates used in the

DCF analyses are intended to reflect the risk inherent in the projected future cash flows generated by the respective

intangible assets.

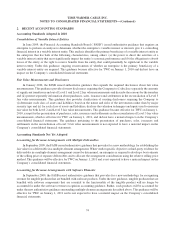

Goodwill is tested for impairment annually or upon the occurrence of a triggering event. Goodwill impairment is

determined using a two-step process. The first step involves a comparison of the estimated fair value of each of the

Company’s six geographic reporting units to its carrying amount, including goodwill. In performing the first step, the

Company determines the fair value of a reporting unit using a DCF analysis that is corroborated by a market-based

approach. Determining fair value requires the exercise of significant judgment, including judgment about appropriate

discount rates, perpetual growth rates and the amount and timing of expected future cash flows. The cash flows employed

in the DCF analyses are based on the Company’s most recent budget and LRPs and, for years beyond the LRPs, the

Company’s estimates, which are based on assumed growth rates. The discount rates used in the DCF analyses are intended

to reflect the risks inherent in the future cash flows of the respective reporting units. If the estimated fair value of a

reporting unit exceeds its carrying amount, goodwill of the reporting unit is not impaired and the second step of the

impairment test is not necessary. If the carrying amount of a reporting unit exceeds its estimated fair value, then the second

step of the goodwill impairment test must be performed. The second step of the goodwill impairment test compares the

implied fair value of the reporting unit’s goodwill with its goodwill carrying amount to measure the amount of

impairment, if any. The implied fair value of goodwill is determined in the same manner as the amount of goodwill

recognized in a business combination. In other words, the estimated fair value of the reporting unit is allocated to all of the

assets and liabilities of that unit (including any unrecognized intangible assets) as if the reporting unit had been acquired

in a business combination and the fair value of the reporting unit was the purchase price paid. If the carrying amount of the

reporting unit’s goodwill exceeds the implied fair value of that goodwill, an impairment charge is recognized in an amount

equal to that excess.

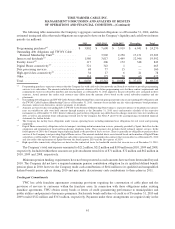

As discussed further in Note 8 to the accompanying consolidated financial statements, the Company determined that

cable franchise rights and goodwill were not impaired during its annual impairment analysis performed as of July 1, 2010.

To illustrate the extent that the fair value of the cable franchise rights exceeded their carrying value as of July 1, 2010, had

the fair values of each of the cable franchise rights been lower by 20%, the Company still would not have recorded an

impairment charge. Similarly, a decline in the fair values of the reporting units by up to 30% would not have resulted in

any goodwill impairment charges.

Investments

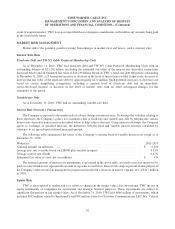

TWC’s investments are primarily accounted for using the equity method of accounting. A subjective aspect of

accounting for investments involves determining whether an other-than-temporary decline in value of the investment has

been sustained. If it has been determined that an investment has sustained an other-than-temporary decline in its value, the

investment is written down to its fair value by a charge to earnings. This evaluation is dependent on the specific facts and

circumstances. TWC evaluates available information (e.g., budgets, business plans, financial statements, etc.) in addition

to quoted market prices, if any, in determining whether an other-than-temporary decline in value exists. Factors indicative

of an other-than-temporary decline include recurring operating losses, credit defaults and subsequent rounds of financing

at an amount below the cost basis of the Company’s investment. This list is not all-inclusive and the Company weighs all

known quantitative and qualitative factors in determining if an other-than-temporary decline in the value of an investment

has occurred. In 2010, there were no significant investment impairment charges.

TWC holds a 4.7% equity interest in Clearwire Communications LLC, the operating subsidiary of Clearwire

Corporation (“Clearwire”). In its Quarterly Report on Form 10-Q for the quarter ended September 30, 2010, Clearwire

64

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)