Time Warner Cable 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

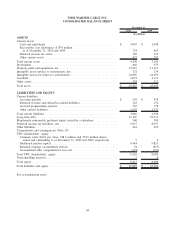

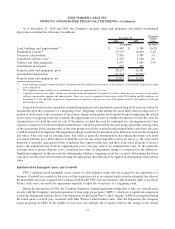

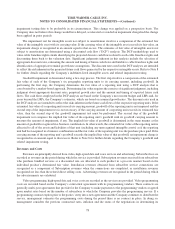

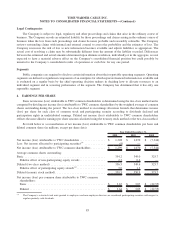

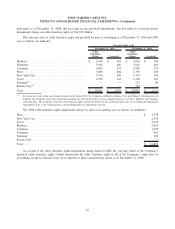

As of December 31, 2010 and 2009, the Company’s property, plant and equipment and related accumulated

depreciation included the following (in millions):

2010 2009

Estimated

Useful

Lives

December 31,

(in years)(in millions)

Land, buildings and improvements

(a)

........................... $ 1,462 $ 1,384 10-20

Distribution systems

(b)

...................................... 17,515 16,060 3-25

Converters and modems ..................................... 5,506 5,389 3-5

Capitalized software costs

(c)

.................................. 1,338 1,140 3-5

Vehicles and other equipment................................. 1,977 1,851 3-10

Construction in progress .................................... 419 457

Property, plant and equipment, gross ........................... 28,217 26,281

Accumulated depreciation ................................... (14,344) (12,362)

Property, plant and equipment, net ............................. $ 13,873 $ 13,919

(a)

Land, buildings and improvements includes $152 million and $151 million related to land as of December 31, 2010 and 2009, respectively, which

is not depreciated.

(b)

The weighted-average useful lives for distribution systems are approximately 12 years.

(c)

Capitalized software costs reflect certain costs incurred for the development of internal use software, including costs associated with coding,

software configuration, upgrades and enhancements. These costs, net of accumulated depreciation, totaled $581 million and $514 million as of

December 31, 2010 and 2009, respectively. Depreciation of capitalized software costs was $185 million in 2010, $174 million in 2009 and

$157 million in 2008.

Long-lived assets do not require that an annual impairment test be performed; instead, long-lived assets are tested for

impairment upon the occurrence of a triggering event. Triggering events include the more likely than not disposal of a

portion of such assets or the occurrence of an adverse change in the market involving the business employing the related

assets. Once a triggering event has occurred, the impairment test is based on whether the intent is to hold the asset for

continued use or to hold the asset for sale. If the intent is to hold the asset for continued use, the impairment test first

requires a comparison of estimated undiscounted future cash flows generated by the asset group against the carrying value

of the asset group. If the carrying value of the asset group exceeds the estimated undiscounted future cash flows, the asset

would be deemed to be impaired. The impairment charge would then be measured as the difference between the estimated

fair value of the asset and its carrying value. Fair value is generally determined by discounting the future cash flows

associated with that asset. If the intent is to hold the asset for sale and certain other criteria are met (e.g., the asset can be

disposed of currently, appropriate levels of authority have approved the sale, and there is an active program to locate a

buyer), the impairment test involves comparing the asset’s carrying value to its estimated fair value. To the extent the

carrying value is greater than the asset’s estimated fair value, an impairment charge is recognized for the difference.

Significant judgments in this area involve determining whether a triggering event has occurred, determining the future

cash flows for the assets involved and selecting the appropriate discount rate to be applied in determining estimated fair

value.

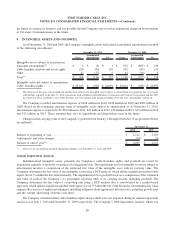

Indefinite-lived Intangible Assets and Goodwill

TWC’s indefinite-lived intangible assets consist of cable franchise rights that are acquired in an acquisition of a

business. Goodwill is recorded for the excess of the acquisition cost of an acquired entity over the estimated fair value of

the identifiable net assets acquired. In accordance with GAAP, TWC does not amortize cable franchise rights or goodwill.

Rather, such assets are tested for impairment annually or upon the occurrence of a triggering event.

During the first quarter of 2010, the Company changed its annual impairment testing date to July 1 to coincide more

closely with the Company’s annual preparation of long range projections (“LRPs”), which are a significant component

used in the impairment analysis. Prior to the Separation (as defined in Note 5), the Company’s LRPs were prepared during

the fourth quarter of each year, consistent with Time Warner’s other business units. After the Separation, the Company

began preparing its LRPs in the middle of each year. Accordingly, the Company believes the change in the annual

77

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)