Time Warner Cable 2010 Annual Report Download - page 52

Download and view the complete annual report

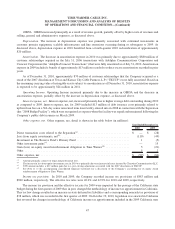

Please find page 52 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The $4.0 billion Revolving Credit Facility contains conditions, covenants, representations and warranties and events

of default (with customary grace periods, as applicable) substantially similar to the conditions, covenants, representations

and warranties and events of default that were contained in the Company’s $5.875 billion Revolving Credit Facility,

including a maximum leverage ratio covenant of 5.0 times TWC’s consolidated EBITDA. The terms and related financial

metrics associated with the leverage ratio are defined in the agreement. The $4.0 billion Revolving Credit Facility does

not contain any: credit ratings-based defaults or covenants; ongoing covenants or representations specifically relating to a

material adverse change in TWC’s financial condition or results of operations; or borrowing restrictions due to material

adverse changes in the Company’s business or market disruption. Borrowings under the $4.0 billion Revolving Credit

Facility may be used for general corporate purposes, and unused credit is available to support borrowings under the

Company’s unsecured commercial paper program, which was reduced from $6.0 billion to $4.0 billion in connection with

the entry into the $4.0 billion Revolving Credit Facility.

FINANCIAL STATEMENT PRESENTATION

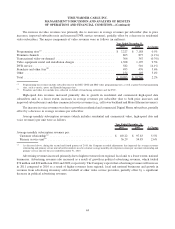

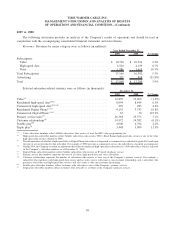

Revenues

The Company’s revenues consist of Subscription and Advertising revenues. Subscription revenues consist of

revenues from video, high-speed data and voice services.

Video revenues include residential and commercial subscriber fees for the Company’s three main levels or “tiers” of

video programming service—Basic Service Tier (“BST”), Expanded Basic Service Tier (or Cable Programming Service

Tier) (“CPST”) and Digital Basic Service Tier (“DBT”), as well as fees for genre-based programming tiers, such as movie,

sports and Spanish-language tiers. Video revenues also include related equipment rental charges, installation charges and

fees collected on behalf of local franchising authorities and the Federal Communications Commission (the “FCC”).

Additionally, video revenues include revenues from premium channels, transactional video-on-demand (e.g., events and

movies) and DVR service. Several ancillary items are also included within video revenues, such as commissions earned on

the sale of merchandise by home shopping networks and revenues from home security services.

High-speed data revenues primarily include residential and commercial subscriber fees for the Company’s high-

speed data and wireless mobile broadband services, along with related high-speed data home networking fees and

installation charges. High-speed data revenues also include fees paid to TWC by (a) the Advance/Newhouse Partnership

for the ability to distribute TWC’s Road Runner@high-speed data service (“Road Runner”) and TWC’s management of

certain functions for the Advance/Newhouse Partnership, including, among others, programming and engineering, and

(b) other distributors of TWC’s Road Runner high-speed data service, which together totaled $131 million, $127 million

and $139 million in 2010, 2009 and 2008, respectively. In addition, high-speed data revenues include fees received from

third-party internet service providers (e.g., Earthlink) whose on-line services are provided to some of TWC’s customers.

Commercial high-speed data revenues include amounts generated by the sale of commercial networking and transport

services. These services include point-to-point transport services offered to wireless telephone providers (i.e., cell tower

backhaul), Internet service providers and competitive carriers on a wholesale basis, as well as Metro Ethernet service.

Voice revenues include subscriber fees from residential and commercial Digital Phone subscribers, along with

related installation charges.

Advertising revenues include the fees charged to local, regional and national advertising customers for advertising

placed on the Company’s video and high-speed data services, as well as revenues from advertising inventory sold on

behalf of other video service providers. Nearly all Advertising revenues are derived from advertising placed on video

services.

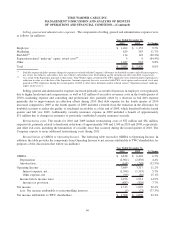

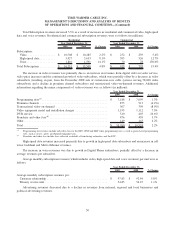

Costs and Expenses

Costs of revenues include the following costs directly associated with the delivery of services to subscribers or the

maintenance of the Company’s delivery systems: video programming costs; high-speed data connectivity costs; voice

40

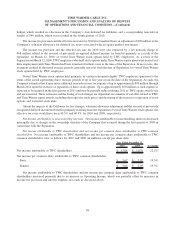

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)