Time Warner Cable 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

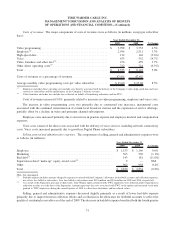

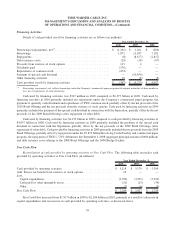

and full year 2009. Casualty insurance expense in 2009 and 2008 included benefits of approximately $11 million and

$16 million, respectively, due to changes in estimates of previously established casualty insurance accruals. Employee

costs in 2009 remained essentially flat as an increase in pension expense was primarily offset by a decrease in employee

headcount.

Restructuring costs. The results for 2009 and 2008 included restructuring costs of $81 million and $15 million,

respectively. The Company eliminated approximately 1,300 positions during 2009.

Impairment of cable franchise rights. During the fourth quarter of 2008, the Company recorded a noncash

impairment charge of $14.822 billion to reduce the carrying value of its cable franchise rights as a result of its

annual impairment testing of goodwill and indefinite-lived intangible assets. There was no such impairment charge in

2009.

Loss on sale of cable systems. During 2008, the Company recorded a loss of $58 million as a result of the sale of

certain non-core cable systems, which closed in December 2008.

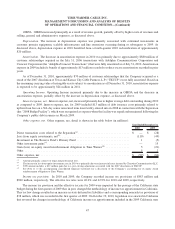

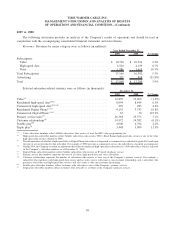

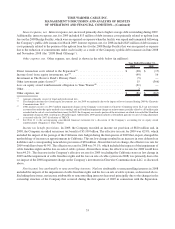

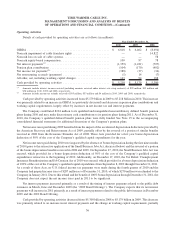

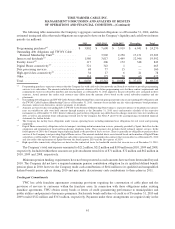

Reconciliation of OIBDA to Operating Income (Loss). The following table reconciles OIBDA to Operating Income

(Loss). In addition, the table provides the components from Operating Income (Loss) to net income (loss) attributable to

TWC shareholders for purposes of the discussions that follow (in millions):

2009 2008 % Change

Year Ended December 31,

OIBDA ..................................................... $ 6,402 $ (8,694) NM

Depreciation ................................................ (2,836) (2,826) 0.4%

Amortization ............................................... (249) (262) (5.0%)

Operating Income (Loss) ........................................ 3,317 (11,782) NM

Interest expense, net ........................................ (1,319) (923) 42.9%

Other expense, net.......................................... (86) (367) (76.6%)

Income (loss) before income taxes................................ 1,912 (13,072) NM

Income tax benefit (provision) ................................. (820) 5,109 NM

Net income (loss) .............................................. 1,092 (7,963) NM

Less: Net (income) loss attributable to noncontrolling interests ........... (22) 619 NM

Net income (loss) attributable to TWC shareholders .................... $ 1,070 $ (7,344) NM

NM—Not meaningful.

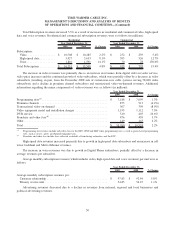

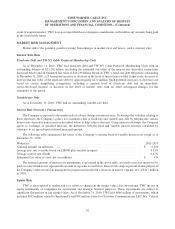

OIBDA. As discussed above, in 2008, OIBDAwas impacted by the impairment of cable franchise rights and the loss

on sale of cable systems. Excluding these items, OIBDA increased principally as a result of revenue growth, partially

offset by higher costs of revenues and restructuring costs, each as discussed above. Additionally, OIBDA in 2008 was

negatively impacted by $14 million of costs resulting from the impact of Hurricane Ike on certain of the Company’s cable

systems in southeast Texas and Ohio.

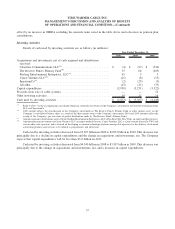

Depreciation expense. The slight increase in depreciation expense was primarily associated with continued

purchases of customer premise equipment, scalable infrastructure and line extensions occurring during or subsequent

to 2008, partially offset primarily by certain property, plant and equipment acquired in the Adelphia/Comcast

Transactions that was fully depreciated as of July 31, 2008.

Amortization expense. Amortization expense in 2009 benefited from an approximate $13 million adjustment to

reduce excess amortization recorded in prior years.

Operating Income (Loss). As discussed above, in 2008, Operating Loss was impacted by the impairment of cable

franchise rights and the loss on sale of cable systems. Excluding these items, Operating Income increased primarily due to

the increase in OIBDA, as discussed above.

52

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)