Time Warner Cable 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

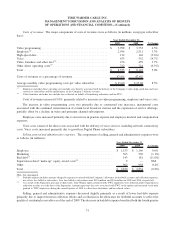

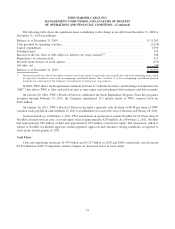

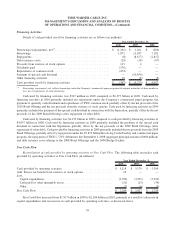

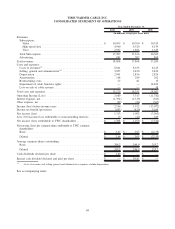

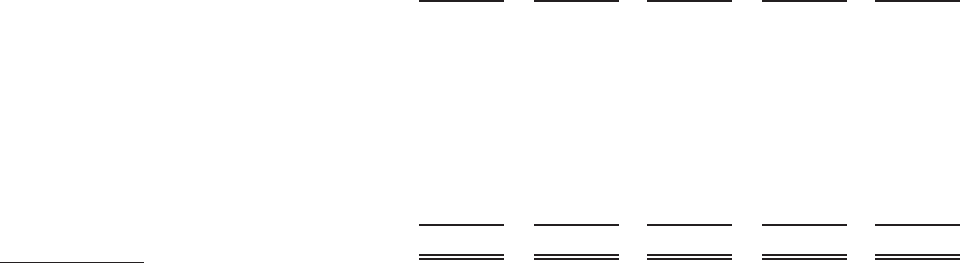

The following table summarizes the Company’s aggregate contractual obligations as of December 31, 2010, and the

estimated timing and effect that such obligations are expected to have on the Company’s liquidity and cash flows in future

periods (in millions):

2011 2012-2013 2014-2015 Thereafter Total

Programming purchases

(a)

................. $ 3,802 $ 7,608 $ 5,919 $ 6,941 $ 24,270

Outstanding debt obligations and TW NY Cable

Preferred Membership Units

(b)

............. — 3,902 2,250 17,151 23,303

Interest and dividends

(c)

.................. 1,580 3,017 2,449 12,946 19,992

Facility leases

(d)

........................ 117 206 172 348 843

Digital Phone connectivity

(e)

............... 321 343 1 — 665

Data processing services .................. 68 77 15 — 160

High-speed data connectivity

(f)

............. 34 17 6 21 78

Other ................................ 114 173 70 65 422

Total................................. $ 6,036 $ 15,343 $ 10,882 $ 37,472 $ 69,733

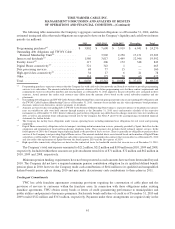

(a)

Programming purchases represent contracts that the Company has with cable television networks and broadcast stations to provide programming

services to its subscribers. The amounts included above represent estimates of the future programming costs for these contract requirements and

commitments based on subscriber numbers and tier placement as of December 31, 2010 applied to the per-subscriber rates contained in these

contracts. Actual amounts due under such contracts may differ from the amounts above based on the actual subscriber numbers and tier

placements.

(b)

Outstanding debt obligations and TW NY Cable Preferred Membership Units represent principal amounts due on outstanding debt obligations and

the TW NY Cable Preferred Membership Units as of December 31, 2010. Amounts do not include any fair value adjustments, bond premiums,

discounts, interest rate derivatives, interest payments or dividends.

(c)

Amounts are based on the outstanding debt or TW NY Cable Preferred Membership Units balances, respective interest or dividend rates (interest

rates on variable-rate debt were held constant through maturity at the December 31, 2010 rates) and maturity schedule of the respective

instruments as of December 31, 2010. Interest ultimately paid on these obligations may differ based on changes in interest rates for variable-rate

debt, as well as any potential future refinancings entered into by the Company. See Notes 9 and 10 to the accompanying consolidated financial

statements for further details.

(d)

The Company has facility lease obligations under various operating leases including minimum lease obligations for real estate and operating

equipment.

(e)

Digital Phone connectivity obligations relate to transport, switching and interconnection services, primarily provided by Sprint, that allow for the

origination and termination of local and long-distance telephony traffic. These expenses also include related technical support services. In the

fourth quarter of 2010, the Company began replacing Sprint as the provider of these services. There is generally no obligation to purchase these

services if the Company is not providing Digital Phone service. The amounts included above are estimated based on the number of Digital Phone

subscribers as of December 31, 2010 and the per-subscriber contractual rates contained in the contracts that were in effect as of December 31, 2010

and also reflect the replacement of Sprint between the fourth quarter 2010 and the first quarter of 2014.

(f)

High-speed data connectivity obligations are based on the contractual terms for bandwidth circuits that were in use as of December 31, 2010.

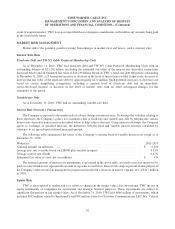

The Company’s total rent expense amounted to $212 million, $212 million and $190 million in 2010, 2009 and 2008,

respectively. Included within these amounts are pole attachment rental fees of $71 million, $72 million and $62 million in

2010, 2009 and 2008, respectively.

Minimum pension funding requirements have not been presented as such amounts have not been determined beyond

2010. The Company did not have a required minimum pension contribution obligation for its qualified defined benefit

pension plans in 2010; however, the Company made cash contributions of $104 million to its qualified and nonqualified

defined benefit pension plans during 2010 and may make discretionary cash contributions to these plans in 2011.

Contingent Commitments

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing

franchise agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and

public utilities and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2010 and

2009 totaled $322 million and $313 million, respectively. Payments under these arrangements are required only in the

61

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)