Time Warner Cable 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

offset by an increase in OIBDA excluding the noncash items noted in the table above and a decrease in pension plan

contributions.

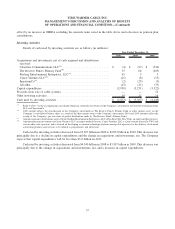

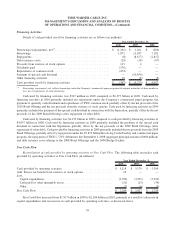

Investing Activities

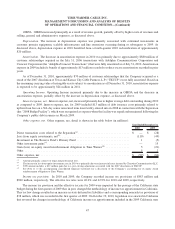

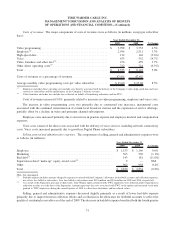

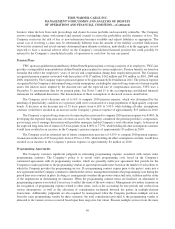

Details of cash used by investing activities are as follows (in millions):

2010 2009 2008

Year Ended December 31,

Acquisitions and investments, net of cash acquired and distributions

received:

Clearwire Communications LLC

(a)

............................. $ (4) $ (97) $ (536)

The Reserve Fund’s Primary Fund

(b)

............................ 35 64 (103)

Sterling Entertainment Enterprises, LLC

(c)

........................ 65 3 3

Canoe Ventures LLC

(d)

...................................... (21) (8) (13)

SpectrumCo

(a)

............................................. (2) (29) (3)

All other................................................. (25) (21) (33)

Capital expenditures .......................................... (2,930) (3,231) (3,522)

Proceeds from sale of cable systems .............................. — — 51

Other investing activities....................................... 10 12 16

Cash used by investing activities ................................. $ (2,872) $ (3,307) $ (4,140)

(a)

Refer to Note 7 to the accompanying consolidated financial statements for details on the Company’s investments in Clearwire Communications

LLC and SpectrumCo.

(b)

2008 amount reflects the classification of the Company’s investment in The Reserve Fund’s Primary Fund as other current assets on the

Company’s consolidated balance sheet as a result of the then current status of the Company’s investment. 2010 and 2009 amounts reflect the

receipt of the Company’s pro rata share of partial distributions made by The Reserve Fund’s Primary Fund.

(c)

Amount represents distributions received from Sterling Entertainment Enterprises, LLC (d/b/a SportsNet New York), an equity-method investee.

(d)

Amount represents investments in Canoe Ventures LLC, an equity-method investee. Canoe Ventures LLC is a joint venture formed by TWC and

certain other cable operators and is focused on developing a common technology platform among cable operators for the delivery of advanced

advertising products and services to be offered to programmers and advertisers.

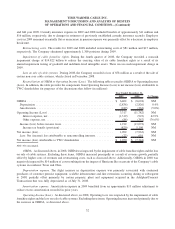

Cash used by investing activities decreased from $3.307 billion in 2009 to $2.872 billion in 2010. This decrease was

principally due to a decline in capital expenditures and the change in acquisitions and investments, net. The Company

expects that capital expenditures will be less than $3.0 billion in 2011.

Cash used by investing activities decreased from $4.140 billion in 2008 to $3.307 billion in 2009. This decrease was

principally due to the change in acquisitions and investments, net, and a decrease in capital expenditures.

57

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)