Time Warner Cable 2010 Annual Report Download - page 79

Download and view the complete annual report

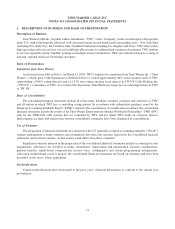

Please find page 79 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.programming vendor may be received over different contractual periods and may have different contractual rates, the

allocation of consideration to the individual services will have an impact on the timing of the Company’s expense recognition.

Significant judgment is also involved when the Company enters into agreements that result in the Company receiving

cash consideration from the programming vendor, usually in the form of advertising sales, channel positioning fees,

launch support or marketing support. In these situations, management must determine based upon facts and circumstances

if such cash consideration should be recorded as revenue, a reduction in programming expense or a reduction in another

expense category (e.g., marketing).

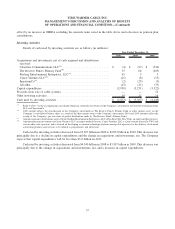

Property, Plant and Equipment

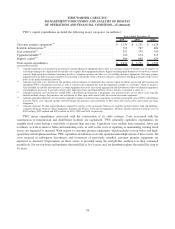

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the

construction of transmission and distribution facilities are capitalized. TWC uses standard capitalization rates to

capitalize installation activities. Significant judgment is involved in the development of these capitalization

standards, including the average time required to perform an installation and the determination of the nature and

amount of indirect costs to be capitalized. The capitalization standards are reviewed at least annually and adjusted, if

necessary, based on comparisons to actual costs incurred.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

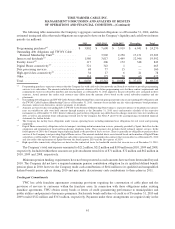

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, particularly statements anticipating future growth in revenues, OIBDA, cash provided by operating

activities and other financial measures. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,”

“believes” and words and terms of similar substance used in connection with any discussion of future operating or

financial performance identify forward-looking statements. These forward-looking statements are included throughout

this report and are based on management’s current expectations and beliefs about future events. As with any projection or

forecast, they are susceptible to uncertainty and changes in circumstances.

The Company operates in a highly competitive, consumer and technology driven and rapidly changing business that

is affected by government regulation and economic, strategic, political and social conditions. Various factors could

adversely affect the operations, business or financial results of TWC in the future and cause TWC’s actual results to differ

materially from those contained in the forward-looking statements, including those factors discussed in detail in Item 1A,

“Risk Factors,” in Part I of this report, as well as:

• increased competition from video, high-speed data and voice providers, particularly direct broadcast satellite

operators, incumbent local telephone companies, companies that deliver programming over broadband Internet

connections, and wireless broadband and phone providers;

• the Company’s ability to deal effectively with the current challenging economic environment or further

deterioration in the economy, which may negatively impact customers’ demand for the Company’s services

and also result in a reduction in the Company’s advertising revenues;

• the Company’s continued ability to exploit new and existing technologies that appeal to residential and

commercial customers;

• changes in the regulatory and tax environments in which the Company operates, including, among others,

regulation of broadband Internet services, “net neutrality” legislation or regulation and federal, state and local

taxation;

• increased difficulty negotiating programming and retransmission agreements on favorable terms, resulting in

increased costs to the Company and/or the loss of popular programming; and

• changes in the Company’s plans, initiatives and strategies.

Any forward-looking statements made by the Company in this document speak only as of the date on which they are

made. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward

looking statements whether as a result of changes in circumstances, new information, subsequent events or otherwise.

67

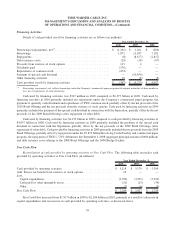

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)