Time Warner Cable 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

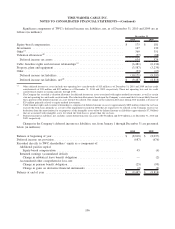

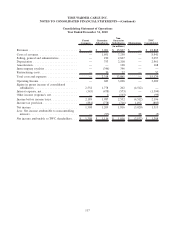

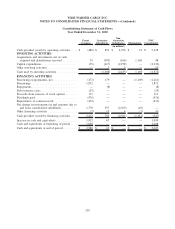

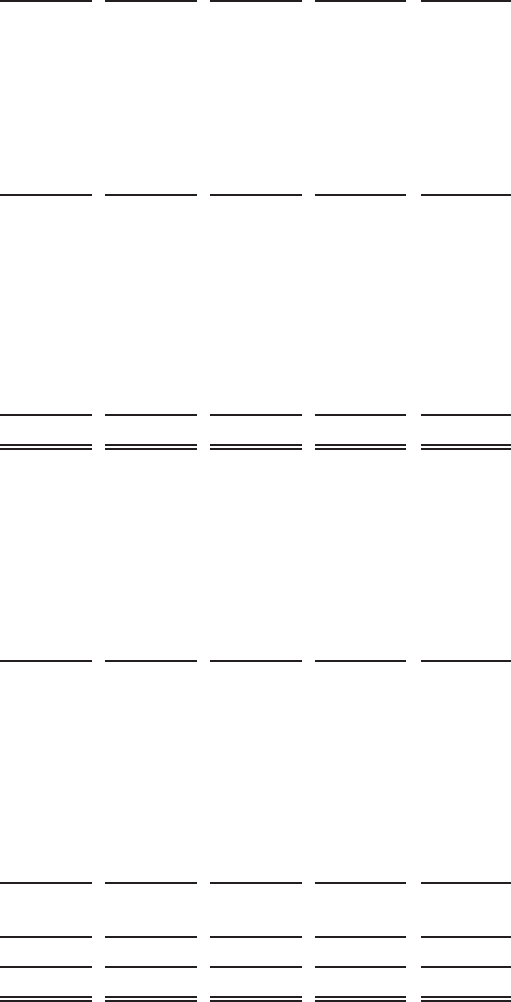

Consolidating Balance Sheet

December 31, 2010

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

ASSETS

Current assets:

Cash and equivalents ...................... $ 2,980 $ 67 $ — $ — $ 3,047

Receivables, net .......................... 44 179 495 — 718

Receivables from affiliated parties ............ 31 25 43 (99) —

Deferred income tax assets.................. 150 93 78 (171) 150

Other current assets ....................... 303 47 75 — 425

Total current assets ......................... 3,508 411 691 (270) 4,340

Investments in and amounts due from consolidated

subsidiaries ............................. 41,628 23,033 11,613 (76,274) —

Investments ............................... 18 6 842 — 866

Property, plant and equipment, net .............. 51 3,800 10,022 — 13,873

Intangible assets subject to amortization, net ...... — 10 122 — 132

Intangible assets not subject to amortization ....... — 6,216 17,875 — 24,091

Goodwill................................. 4 3 2,084 — 2,091

Other assets............................... 381 20 28 — 429

Total assets ............................... $ 45,590 $ 33,499 $ 43,277 $ (76,544) $ 45,822

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable......................... $ — $ 222 $ 307 $ — $ 529

Deferred revenue and subscriber-related

liabilities ............................. — 65 98 — 163

Payables to affiliated parties ................. 25 43 31 (99) —

Accrued programming expense............... — 727 38 — 765

Other current liabilities .................... 555 512 562 — 1,629

Total current liabilities ....................... 580 1,569 1,036 (99) 3,086

Long-term debt ............................ 20,418 2,703 — — 23,121

Mandatorily redeemable preferred equity . . ....... — 1,928 300 (1,928) 300

Deferred income tax liabilities, net.............. 9,634 4,944 4,840 (9,781) 9,637

Long-term payables to affiliated parties . . . ....... 5,630 691 8,704 (15,025) —

Other liabilities ............................ 118 119 224 — 461

TWC shareholders’ equity:

Due to (from) TWC and subsidiaries . . . ....... — 7 (1,568) 1,561 —

Other TWC shareholders’ equity ............. 9,210 17,517 29,741 (47,258) 9,210

Total TWC shareholders’ equity................ 9,210 17,524 28,173 (45,697) 9,210

Noncontrolling interests ...................... — 4,021 — (4,014) 7

Total equity ............................... 9,210 21,545 28,173 (49,711) 9,217

Total liabilities and equity .................... $ 45,590 $ 33,499 $ 43,277 $ (76,544) $ 45,822

115

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)