Time Warner Cable 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

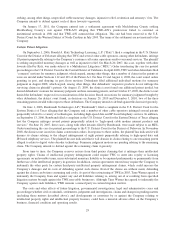

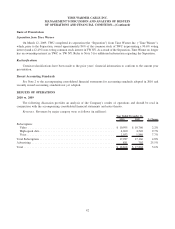

Equity Compensation Plan Information

The following table summarizes information as of December 31, 2010, about the Company’s outstanding equity

compensation awards and shares of common stock reserved for future issuance under the Company’s equity compensation

plans.

Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

(b)

Weighted-average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b)

Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(excluding securities

reflected in

column (i))

(c)

(i) (ii) (iii)

Equity compensation plans approved by security

holders

(a)

............................. 16,798,014 $ 36.03 17,691,764

Equity compensation plans not approved by

security holders ........................ — — —

Total .................................. 16,798,014 $ 36.03 17,691,764

(a)

Equity compensation plans approved by security holders covers the Time Warner Cable Inc. 2006 Stock Incentive Plan (the “2006 Stock Plan”),

which was originally approved by the Company’s stockholders in May 2007 and is currently the Company’s only compensation plan pursuant to

which the Company’s equity is awarded.

(b)

Column (i) includes 5,313,175 shares of TWC Common Stock underlying outstanding restricted stock units. Because there is no exercise price

associated with restricted stock units, such equity awards are not included in the weighted-average exercise price calculation in column (ii).

(c)

A total of 51,299,660 shares of TWC Common Stock have been authorized for issuance pursuant to the terms of the 2006 Stock Plan. Any shares of

TWC Common Stock issued in connection with stock options or stock appreciation rights are counted against the 2006 Stock Plan available share

reserve as one share for every share issued. Any shares of TWC Common Stock issued in connection with “Full Value Awards” (restricted stock or

restricted stock units) are counted against the available share reserve under the 2006 Stock Plan as (i) one share for every share issued multiplied by

(ii) a ratio. The ratio (the “Ratio”) is the quotient resulting from dividing (a) the grant date fair value of such Full Value Award, as determined for

financial reporting purposes, by (b) the grant date fair value of a stock option granted under the 2006 Stock Plan. As a result, based on the Ratio

determined on December 31, 2010, of the shares of TWC Common Stock available for future issuance under the 2006 Stock Plan listed in column

(iii), as of December 31, 2010, a maximum of 4,820,958.80 shares may be issued in connection with Full Value Awards.

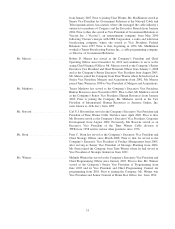

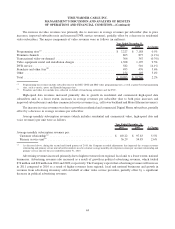

Stock options granted under the 2006 Plan have exercise prices equal to the fair market value of TWC Common

Stock at the date of grant. Generally, the stock options vest ratably over a four-year vesting period and expire ten years

from the date of grant. Certain stock option awards provide for accelerated vesting upon the grantee’s termination of

employment after reaching a specified age and years of service. In connection with the Company’s payment of the special

cash dividend on March 12, 2009 and its 1-for-3 reverse stock split, adjustments were made to the number of underlying

shares and exercise prices of outstanding TWC stock options to maintain the fair value of those awards.

PART IV

Item 15. Exhibits and Financial Statements Schedules.

(a)(1)-(2) Financial Statements and Schedules:

(i) The list of consolidated financial statements and schedules set forth in the accompanying Index to

Consolidated Financial Statements and Other Financial Information at page 36 herein is incorporated herein by

reference. Such consolidated financial statements and schedules are filed as part of this Annual Report.

(ii) All other financial statement schedules are omitted because the required information is not applicable, or

because the information required is included in the consolidated financial statements and notes thereto.

(3) Exhibits:

The exhibits listed on the accompanying Exhibit Index are filed or incorporated by reference as part of this Annual

Report and such Exhibit Index is incorporated herein by reference. Exhibits 10.25 through 10.43 and 10.46 through 10.60

listed on the accompanying Exhibit Index identify management contracts or compensatory plans or arrangements

required to be filed as exhibits to this Annual Report, and such listing is incorporated herein by reference.

34