Time Warner Cable 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

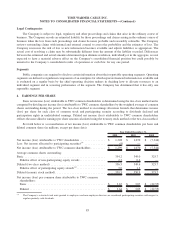

As of December 31, 2010, TWC’s unused committed financial capacity was $6.891 billion, reflecting $3.047 billion

of cash and equivalents and $3.844 billion of available borrowing capacity under the $4.0 billion Revolving Credit

Facility (which reflects a reduction of $156 million for outstanding letters of credit backed by the $4.0 billion Revolving

Credit Facility).

Senior Notes and Debentures

TWC Notes and Debentures

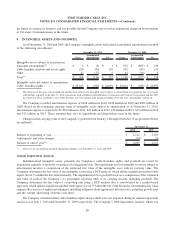

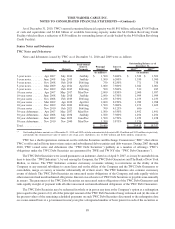

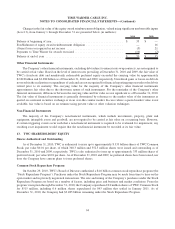

Notes and debentures issued by TWC as of December 31, 2010 and 2009 were as follows:

Issuance Maturity

Semi-annual

Interest

Payments

Principal

Amount

Interest

Rate 2010

(a)

2009

(a)

Outstanding Balance as of

December 31,

Date of

(in millions) (in millions)

5-year notes . . . .... Apr2007 July 2012 Jan/July $ 1,500 5.400% $ 1,529 $ 1,502

5-year notes . . . .... June 2008 July 2013 Jan/July 1,500 6.200% 1,550 1,500

5-year notes . . . .... Nov2008 Feb 2014 Feb/Aug 750 8.250% 771 738

5-year notes . . . .... Mar2009 Apr 2014 Apr/Oct 1,000 7.500% 1,042 1,001

5-year notes . . . .... Dec2009 Feb 2015 Feb/Aug 500 3.500% 512 485

10-year notes . . .... Apr2007 May 2017 May/Nov 2,000 5.850% 2,000 1,997

10-year notes . . .... June 2008 July 2018 Jan/July 2,000 6.750% 1,999 1,999

10-year notes . . .... Nov2008 Feb 2019 Feb/Aug 1,250 8.750% 1,235 1,233

10-year notes . . .... Mar2009 Apr 2019 Apr/Oct 2,000 8.250% 1,989 1,988

10-year notes . . .... Dec2009 Feb 2020 Feb/Aug 1,500 5.000% 1,472 1,469

10-year notes . . .... Nov2010 Feb 2021 Feb/Aug 700 4.125% 696 —

30-year debentures . . Apr 2007 May 2037 May/Nov 1,500 6.550% 1,492 1,491

30-year debentures . . June 2008 July 2038 Jan/July 1,500 7.300% 1,496 1,496

30-year debentures . . June 2009 June 2039 June/Dec 1,500 6.750% 1,459 1,458

30-year debentures . . Nov 2010 Nov 2040 May/Nov 1,200 5.875% 1,176 —

Total . . . ......... $ 20,400 $ 20,418 $ 18,357

(a)

Outstanding balance amounts as of December 31, 2010 and 2009 exclude an unamortized discount of $149 million and $131 million, respectively,

and include the estimated fair value of interest rate swap assets (liabilities), net, of $167 million and $(12) million, respectively.

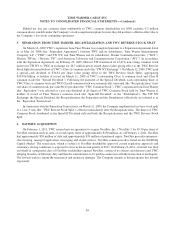

TWC has a shelf registration statement on file with the Securities and Exchange Commission (“SEC”) that allows

TWC to offer and sell from time to time senior and subordinated debt securities and debt warrants. During 2007 through

2010, TWC issued notes and debentures (the “TWC Debt Securities”) publicly in a number of offerings. TWC’s

obligations under the TWC Debt Securities are guaranteed by TWE and TW NY (the “TWC Debt Guarantors”).

The TWC Debt Securities were issued pursuant to an indenture, dated as of April 9, 2007, as it may be amended from

time to time (the “TWC Indenture”), by and among the Company, the TWC Debt Guarantors and The Bank of New York

Mellon, as trustee. The TWC Indenture contains customary covenants relating to restrictions on the ability of the

Company or any material subsidiary to create liens and on the ability of the Company and the TWC Debt Guarantors to

consolidate, merge or convey or transfer substantially all of their assets. The TWC Indenture also contains customary

events of default. The TWC Debt Securities are unsecured senior obligations of the Company and rank equally with its

other unsecured and unsubordinated obligations. Interest on each series of TWC Debt Securities is payable semi-annually

in arrears. The guarantees of the TWC Debt Securities are unsecured senior obligations of the TWC Debt Guarantors and

rank equally in right of payment with all other unsecured and unsubordinated obligations of the TWC Debt Guarantors.

The TWC Debt Securities may be redeemed in whole or in part at any time at the Company’s option at a redemption

price equal to the greater of (i) all of the principal amount of the TWC Debt Securities being redeemed and (ii) the sum of

the present values of the remaining scheduled payments on such TWC Debt Securities discounted to the redemption date

on a semi-annual basis at a government treasury rate plus a designated number of basis points for each of the securities as

89

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)