Time Warner Cable 2010 Annual Report Download - page 92

Download and view the complete annual report

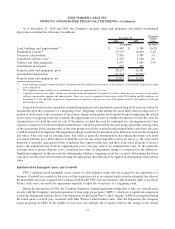

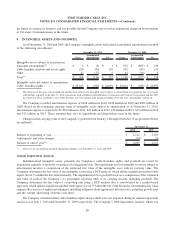

Please find page 92 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.With respect to vendor advertising arrangements being negotiated simultaneously with the same cable network,

TWC assesses whether each piece of the arrangements is at fair value. The factors that are considered in determining the

individual fair value of the programming vary from arrangement to arrangement and include:

• existence of a “most-favored-nation” clause or comparable assurances as to fair market value with respect to programming;

• comparison to fees under a prior contract; and

• comparison to fees paid for similar networks

In determining the fair value of the advertising arrangement, the Company considers advertising rates paid by other

advertisers on the Company’s systems with similar terms.

Sales of Multiple Products or Services

If the Company enters into sales contracts for the sale of multiple products or services, then the Company evaluates

whether it has fair value evidence for each deliverable in the transaction. For example, the Company sells video, high-

speed data and voice services to subscribers in a bundled package at a rate lower than if the subscriber purchases each

product on an individual basis. Subscription revenues received from such subscribers are allocated to each product in a

pro-rata manner based on the fair value of each of the respective services.

Purchases of Multiple Products or Services

The Company’s policy for cost recognition in instances where multiple products or services are purchased

contemporaneously from the same counterparty is consistent with the Company’s policy for the sale of multiple

deliverables to a customer. Specifically, if the Company enters into a contract for the purchase of multiple products or

services, the Company evaluates whether it has fair value evidence for each product or service being purchased. If the

Company has fair value evidence for each product or service being purchased, it accounts for each separately, based on the

relevant cost recognition accounting policies.

Gross Versus Net Revenue Recognition

In the normal course of business, the Company acts as or uses an intermediary or agent in executing transactions with

third parties. The accounting issue presented by these arrangements is whether the Company should report revenue based

on the gross amount billed to the ultimate customer or on the net amount received from the customer after commissions

and other payments to third parties. To the extent revenues are recorded on a gross basis, any commissions or other

payments to third parties are recorded as expense so that the net amount (gross revenues less expense) is reflected in

Operating Income (Loss). Accordingly, the impact on Operating Income (Loss) is the same whether the Company records

revenue on a gross or net basis.

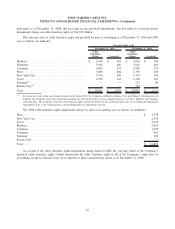

For example, TWC is assessed franchise fees by franchising authorities, which are passed on to the customer. The

accounting issue presented by these arrangements is whether TWC should report revenues based on the gross amount

billed to the ultimate customer or on the net amount received from the customer after payments to franchising authorities.

The Company has determined that these amounts should be reported on a gross basis. TWC’s policy is that, in instances

where the fees are being assessed directly to the Company, amounts paid to the governmental authorities and amounts

received from the customers are recorded on a gross basis. That is, amounts paid to the governmental authorities are

recorded as costs of revenues and amounts received from the customer are recorded as Subscription revenues. The amount

of such fees recorded on a gross basis related to video and voice services was $585 million in 2010, $544 million in 2009

and $524 million in 2008.

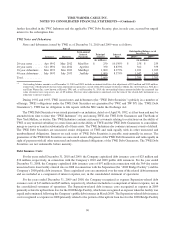

Derivative Financial Instruments

The Company recognizes all derivative financial instruments in the consolidated balance sheet as either assets or

liabilities at fair value. Derivative financial instruments are specifically designated, if certain conditions are met, as (a) a

80

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)