Time Warner Cable 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

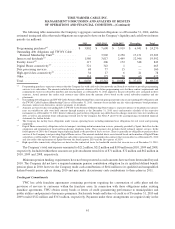

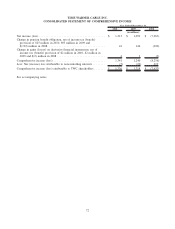

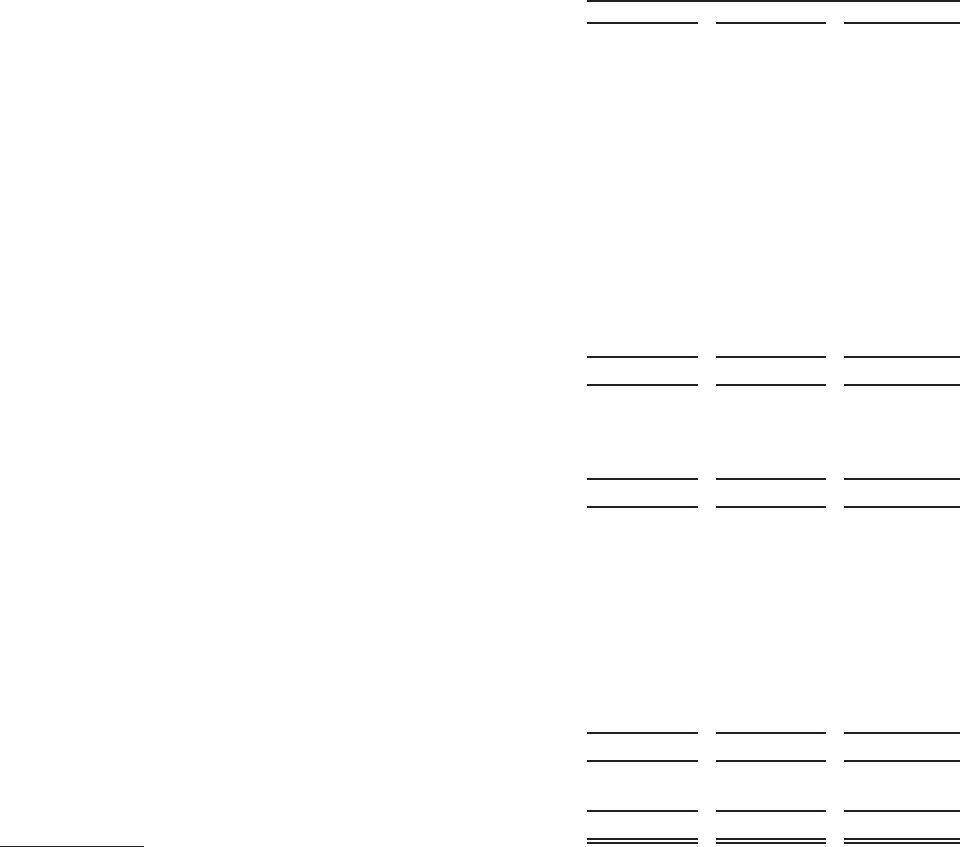

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

2010 2009 2008

Year Ended December 31,

(in millions)

OPERATING ACTIVITIES

Net income (loss) ......................................... $ 1,313 $ 1,092 $ (7,963)

Adjustments for noncash and nonoperating items:

Depreciation . .......................................... 2,961 2,836 2,826

Amortization. .......................................... 168 249 262

Impairment of cable franchise rights . ......................... — — 14,822

Pretax (gain) loss on asset sales ............................. — (12) 49

Loss from equity investments, net of cash distributions . . . ......... 132 64 378

Deferred income taxes .................................... 687 676 (4,960)

Equity-based compensation . ............................... 109 97 78

Changes in operating assets and liabilities, net of acquisitions and dispositions:

Receivables . .......................................... (50) 2 20

Accounts payable and other liabilities ......................... (177) 161 48

Other changes .......................................... 75 14 (260)

Cash provided by operating activities . . ......................... 5,218 5,179 5,300

INVESTING ACTIVITIES

Acquisitions and investments, net of cash acquired and distributions received . . 48 (88) (685)

Capital expenditures . . . .................................... (2,930) (3,231) (3,522)

Other investing activities .................................... 10 12 67

Cash used by investing activities .............................. (2,872) (3,307) (4,140)

FINANCING ACTIVITIES

Borrowings (repayments), net

(a)

............................... (1,261) 1,261 (206)

Borrowings

(b)

............................................ 1,872 12,037 7,182

Repayments

(b)

........................................... (8) (8,677) (2,817)

Debt issuance costs ........................................ (25) (34) (97)

Proceeds from exercise of stock options ......................... 113 4 —

Dividends paid . .......................................... (576) — —

Repurchases of common stock . ............................... (472) — —

Payment of special cash dividend.............................. — (10,856) —

Other financing activities.................................... 10 (8) (5)

Cash provided (used) by financing activities . . .................... (347) (6,273) 4,057

Increase (decrease) in cash and equivalents . . . .................... 1,999 (4,401) 5,217

Cash and equivalents at beginning of period . . .................... 1,048 5,449 232

Cash and equivalents at end of period . ......................... $ 3,047 $ 1,048 $ 5,449

(a)

Borrowings (repayments), net, reflects borrowings under the Company’s commercial paper program with original maturities of three months or

less, net of repayments of such borrowings.

(b)

Amounts represent borrowings and repayments related to debt instruments with original maturities greater than three months.

See accompanying notes.

70