Time Warner Cable 2010 Annual Report Download - page 91

Download and view the complete annual report

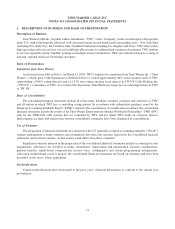

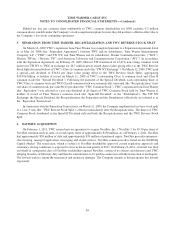

Please find page 91 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimates. When the programming contract terms are finalized, an adjustment to programming expense is recorded, if

necessary, to reflect the terms of the new contract. Management also makes estimates in the recognition of programming

expense related to other items, such as the accounting for free periods and credits from service interruptions, as well as the

allocation of consideration exchanged between the parties in multiple-element transactions. Additionally, judgments are

also required by management when the Company purchases multiple services from the same programming vendor. In

these scenarios, the total consideration provided to the programming vendor is allocated to the various services received

based upon their respective fair values. Because multiple services from the same programming vendor may be received

over different contractual periods and may have different contractual rates, the allocation of consideration to the

individual services will have an impact on the timing of the Company’s expense recognition.

Launch fees received by the Company from programming vendors are recognized as a reduction of expense on a

straight-line basis over the life of the related programming arrangement. Amounts received from programming vendors

representing the reimbursement of marketing costs are recognized as a reduction of marketing expenses as the marketing

services are provided.

Advertising costs are expensed upon the first exhibition of related advertisements. Marketing expense (including

advertising), net of certain reimbursements from programmers, was $629 million in 2010, $563 million in 2009 and

$569 million in 2008.

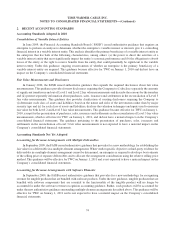

Multiple-element Transactions

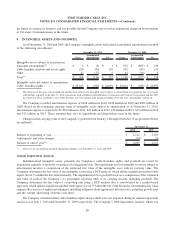

Multiple-element transactions involve situations where judgment must be exercised in determining the fair value of

the different elements in a bundled transaction. As the term is used here, multiple-element arrangements can involve:

• Contemporaneous purchases and sales (e.g., the Company sells advertising services to a customer and at the

same time purchases programming services);

• Sales of multiple products and/or services (e.g., the Company sells video, high-speed data and voice services to

a customer); and/or

• Purchases of multiple products and/or services, or the settlement of an outstanding item contemporaneous with

the purchase of a product or service (e.g., the Company settles a dispute on an existing programming contract at

the same time that it enters into a new programming contract with the same programming vendor).

Contemporaneous Purchases and Sales

In the normal course of business, TWC enters into multiple-element transactions where the Company is simultaneously

both a customer and a vendor with the same counterparty. For example, when negotiating the terms of programming

purchase contracts with cable networks, TWC may at the same time negotiate for the sale of advertising to the same cable

network. Arrangements, although negotiated contemporaneously, may be documented in one or more contracts.

The Company’s accounting policy for each transaction negotiated contemporaneously is to record each element of the

transaction based on the respective estimated fair values of the products or services purchased and the products or services

sold. The judgments made in determining fair value in such transactions impact the amount of revenues, expenses and net

income recognized over the respective terms of the transactions, as well as the respective periods in which they are

recognized.

In determining the fair value of the respective elements, TWC refers to quoted market prices (where available),

historical transactions or comparable cash transactions. The most frequent transactions of this type that the Company

encounters involve funds received from its vendors. The Company records cash consideration received from a vendor as a

reduction in the price of the vendor’s product unless (i) the consideration is for the reimbursement of a specific,

incremental, identifiable cost incurred, in which case the Company would record the cash consideration received as a

reduction in such cost or (ii) the Company is providing an identifiable benefit in exchange for the consideration, in which

case the Company recognizes revenue for this element.

79

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)